Market News

Trade Setup for Sept 12: NIFTY50 remains range-bound amid volatility

.png)

4 min read | Updated on September 12, 2024, 07:40 IST

SUMMARY

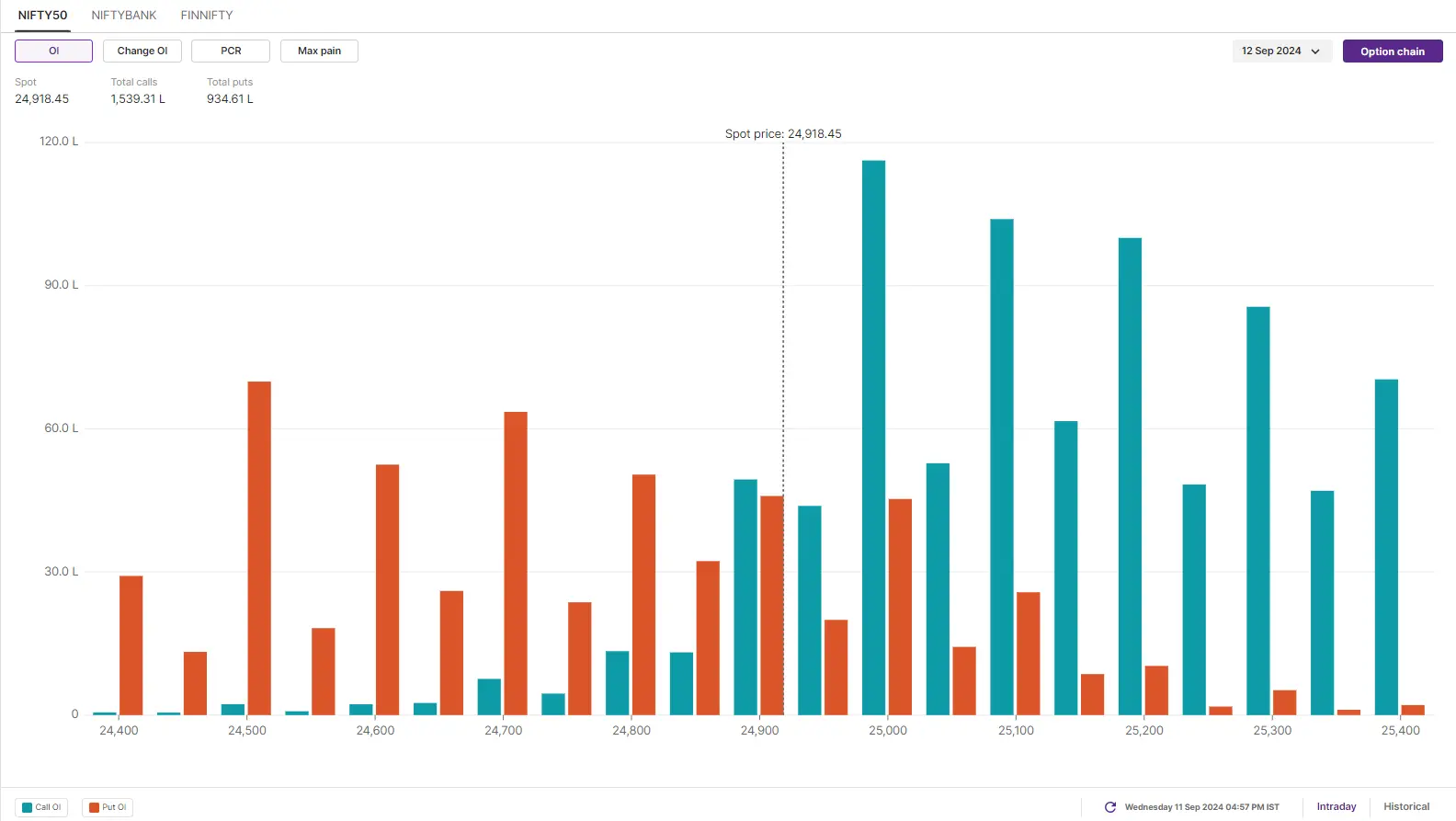

According to options data, the NIFTY50 index saw strong call writing at 25,000 and 25,200 strikes, indicating resistance around these levels. Traders should closely watch the price action near the 25,100 strike. A breakout above this level, followed by a close, could trigger a short-covering rally.

Stock list

After a flat start, the NIFTY50 index attempted to reclaim the 25,100 zone in the first half but faced renewed selling pressure.

Asian markets update at 7 am

After a positive handover from Wall Street, GIFT NIFTY is up 0.5%, signaling a strong start for Indian equities today. Other Asian markets are also trading in the green, with Japan's Nikkei 225 surging 2.7% and Hong Kong's Hang Seng index rising 0.5%.

U.S. market update

- Dow Jones: 40,861 (▲0.3%)

- S&P 500: 5,554 (▲1.0%)

- Nasdaq Composite: 17,395(▲2.1%)

U.S. indices reversed earlier losses to end Wednesday's session near the day's high as investors digested the latest inflation data. A sharp 8% surge in Nvidia shares led a rally in technology stocks, helping the broader market recover.

Earlier in the session, all three major indices fell over 1% after core CPI for August, which excludes food and energy costs, rose 0.3% month-on-month—slightly above the expected 0.2%. However, the annual inflation rate eased to 2.5%, below expectations and down from 2.9% in July, offering some relief to the market.

NIFTY50

- September Futures: 24,938 (▼0.5%)

- Open Interest: 5,32,540 (▲0.4%)

After a flat start, the NIFTY50 index attempted to reclaim the 25,100 zone in the first half but faced renewed selling pressure. The index slipped over 200 points from the day’s high, closing below 25,000 mark in the red.

On the daily chart, the index remains within the range of 6th September’s candle, between 25,160 and 24,800. The rise in volatility has caused sharp swings within this range, and until a breakout occurs on a closing basis, the index is likely to remain range-bound, experiencing bouts of volatility. A break above or below this range will offer clear directional signals for traders.

Meanwhile, the open interest data reflects the shift in momentum due to increased volatility. The call base moved to the 25,000 and 25,200 strikes, suggesting immediate resistance, while the put base at the 24,500 and 24,700 strikes suggests support around these levels.

BANK NIFTY

- September Futures: 51,124 (▼0.4%)

- Open Interest: 1,64,235 (▲5.0%)

BANK NIFTY extended its consolidation between the 50-day and 20-day moving averages for the second consecutive day, trading in a narrow range during the weekly expiry of its options contracts. The index formed a negative candle on the daily chart, closing near the previous day’s low.

Similar to NIFTY50, the banking index is also trading within the range of 6th September candle and is experiencing sharp volatility. The index has further contracted its range between the 50-day and 20-day moving averages, signaling continued consolidation.

On the 15-minute chart, BANK NIFTY remained within the range highlighted in our previous day’s blog, displaying significant volatility. For the upcoming sessions, traders should monitor the range between 51,400 and 51,000. A strong breakout from this range,either intraday or on a closing basis, could trigger a strong directional move.

FII-DII activity

Stock scanner

Short build-up: Tata Motors, ONGC, Aarti Industries, Mahanagar Gas, Samvardhana Motherson and Hindustan Petroleum

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Balrampur Chini Mills, Bandhan Bank, Chambal Fertilisers, Hindustan Copper and RBL Bank

Added under F&O ban: Aarti Industries

Out of F&O ban: Biocon

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story