Market News

Trade Setup for Nov 5: Is 24,500 a key resistance for NIFTY50?

.png)

4 min read | Updated on November 05, 2024, 07:28 IST

SUMMARY

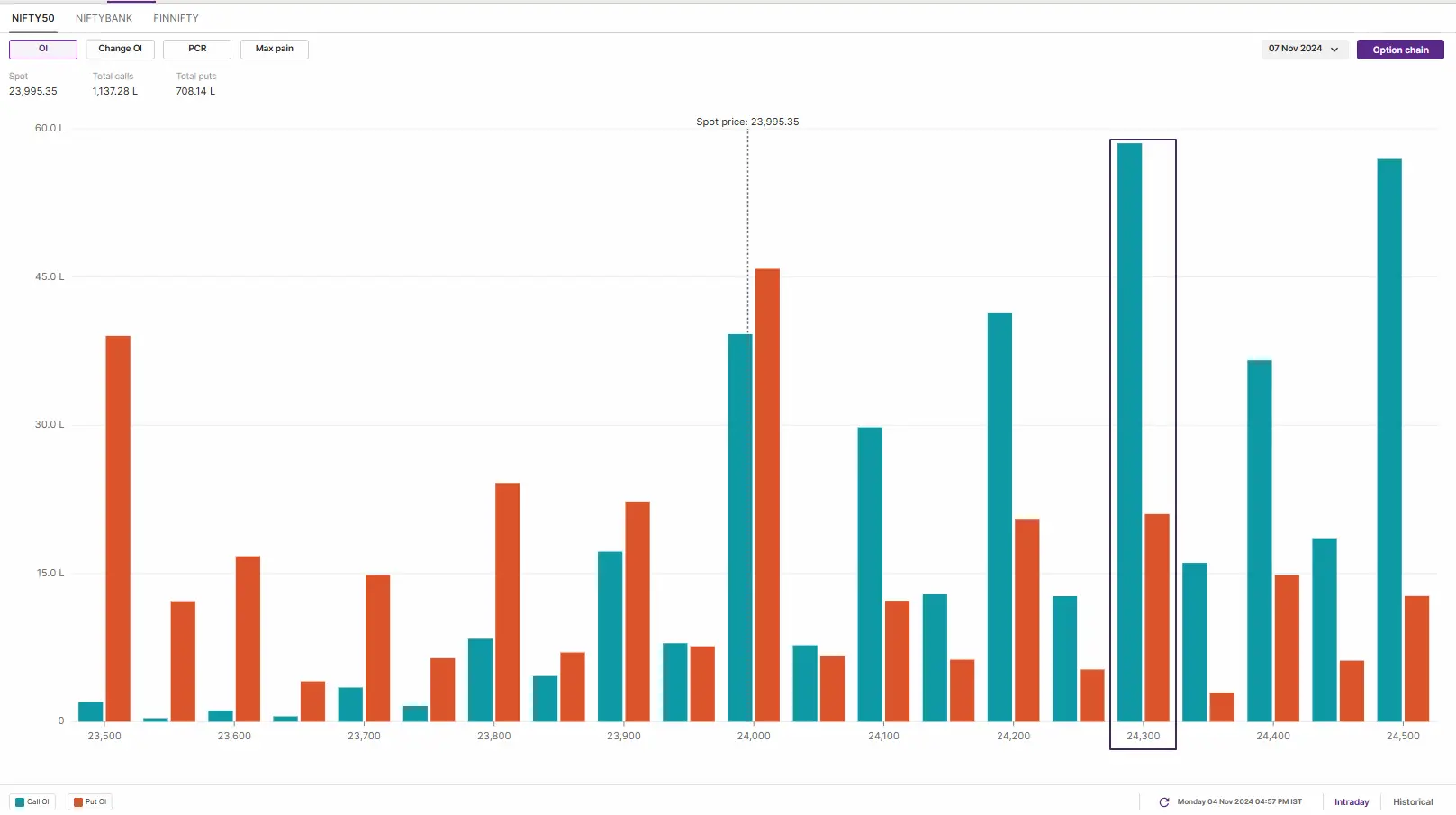

As per the weekly options data, the NIFTY50 index saw significant call build-up at 24,300 and 24,500 strikes, indicating that the index may face resistance around these strikes.

The NIFTY50 index started the November series on a negative note and ended the Monday’s session below the psychologically crucial 24,000 mark.

Asian markets update

The GIFT NIFTY is trading flat, indicating a subdued start for the NIFTY50 today. Meanwhile, the other Asian indices are trading in the green. Japan’s Nikkei 225 is up 1.3%, while Hong Kong’s Hang Seng index rose 0.1%.

U.S. market update

- Dow Jones: 41,794 (▼0.6%)

- S&P 500: 5,712 (▼0.2%)

- Nasdaq Composite: 18,179 (▼0.3%)

U.S. indices ended the volatile and the choppy session in the red ahead of the outcome of the Presidential election and Federal Reserve’s policy. The Street is currently pricing in a 0.25% rate cut on Thursday despite the weaker jobs report of October.

NIFTY50

- November Futures: 24,114 (▼1.1%)

- Open Interest: 4,45,977 (▲5.1%)

The NIFTY50 index started the November series on a negative note and ended the Monday’s session below the psychologically crucial 24,000 mark. It was a broad-based sell-off across the sectors with Energy and Oil & Gas stocks declining the most.

On the daily chart, the index formed a bearish candle and protected the crucial August month low on the closing basis. In our yesterday’s blog, we highlighted that the index is broadly consolidating between 23,900 and 24,500 zone and a break of this zone will provide further directional clues. In the coming sessions, traders should keep an eye on the November 4th low. A break below this level could further dampen sentiment. On the other hand, a close above 24,500 could see the bulls stage a pullback.

Meanwhile, the open interest data for the 7 November expiry saw highest call base at 24,300 and 24,500 strikes, suggesting resistance for the index around these levels. On the flip side, the put base was seen at 24,000 and 23,500 strikes, hinting that index may found support around these levels.

BANK NIFTY

- November Futures: 51,552 (▼0.7%)

- Open Interest: 1,81,342 (▲43.8%)

The BANK NIFTY index also came under selling pressure and formed a bearish candle on the daily chart. The index ended the Monday’s session below the low of previous two sessions, indicating weakness.

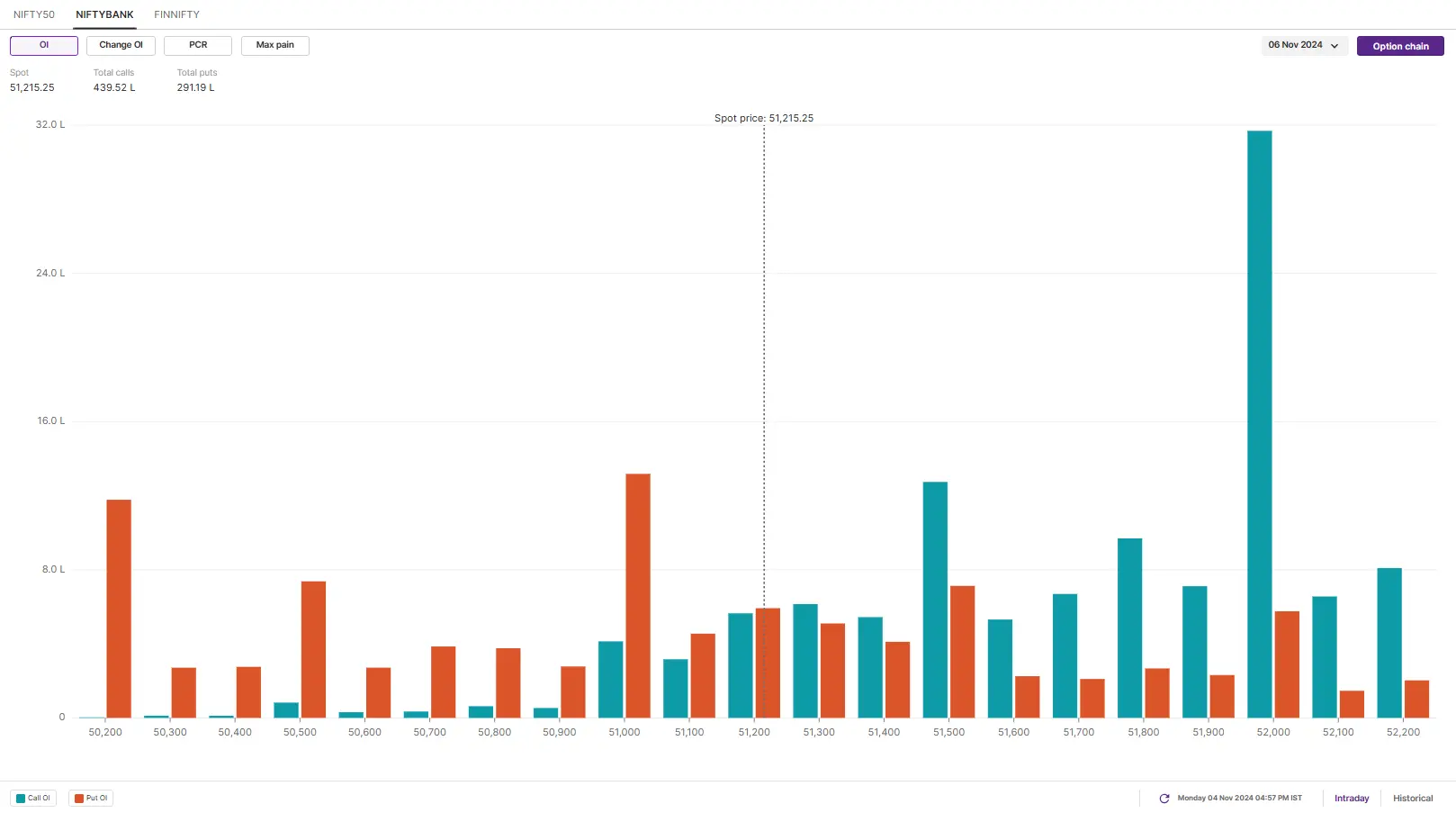

The technical structure of the BANK NIFTY remains range-bound broadly between the range of 52,800 and 49,700. However, the index ended the day near its crucial support of 51,000 and protected the level on closing basis. If the index slips below this level then it may slip back into the consolidation zone highlighted in the image below.

The open interest data for the 6 November expiry saw significant call base at 52,000 strike, indicating the index may face resistance around this level. On the flip side, the put base was seen at 51,000 and 50,200 strikes, suggesting support for the index around these strikes.

FII-DII activity

Stock scanner

Short build-up: Hero Motocorp, PVR Inox, Manappuram Finance, Mahanagar Gas and BHEL

Under F&O ban: NIL

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story