Market News

Trade Setup for Nov 28: NIFTY50 sustains 21 EMA, extends consolidation around 24,300

.png)

4 min read | Updated on November 28, 2024, 07:20 IST

SUMMARY

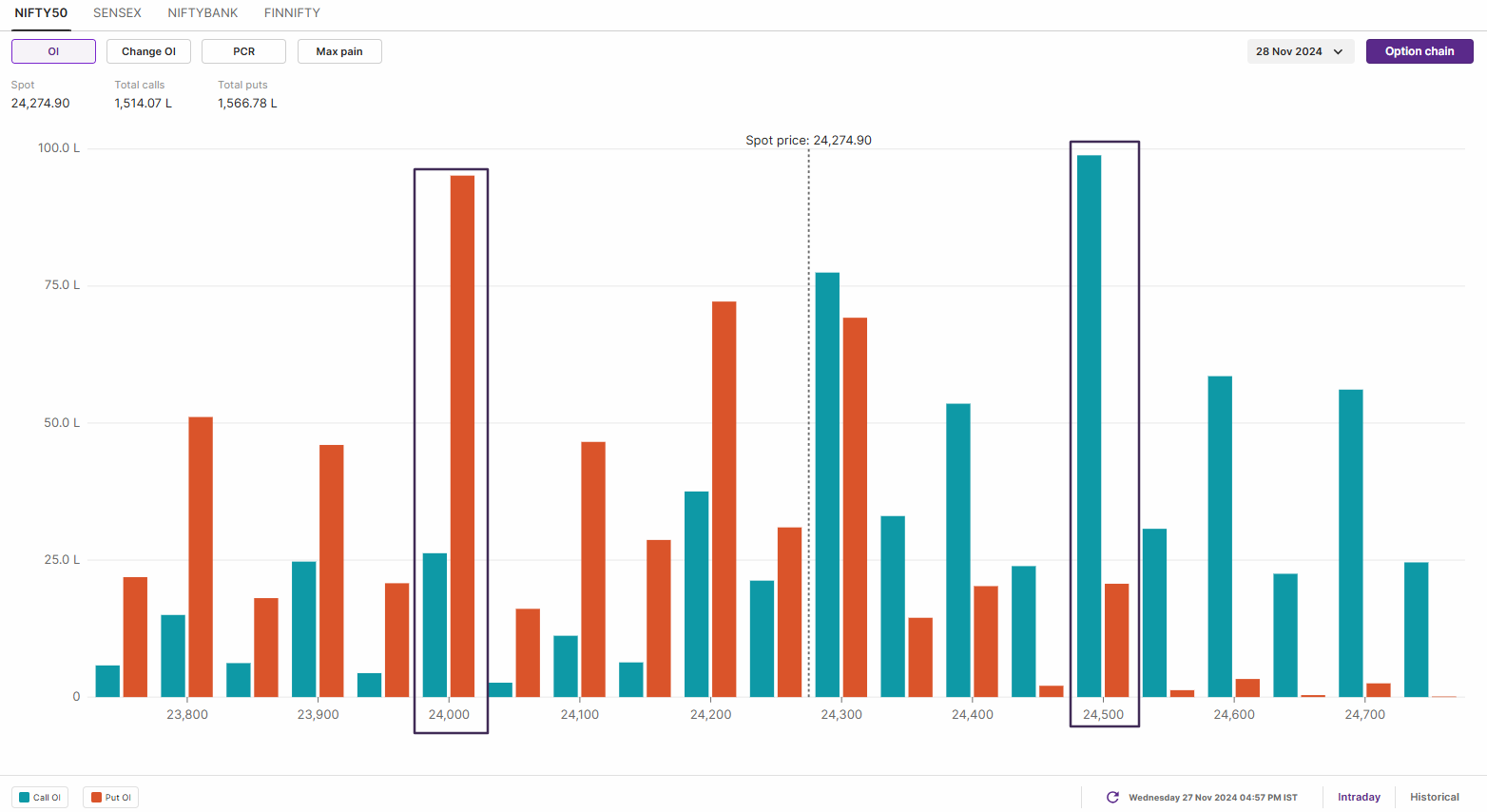

According to the options data for NIFTY50’s monthly expiry, the index exhibits a strong call open interest (OI) base at the 24,500 strike and a robust put OI base at the 24,000 strike. This indicates a significant resistance and support zone, respectively. Unless the index decisively breaks out of this range, the trend is likely to remain range-bound, with the 24,300 level serving as the immediate pivot point.

Stock list

The SENSEX opened on a positive note but continued its range-bound movement for the third consecutive session around the crucial 80,000 mark.

Asian markets @ 7 am

- GIFT NIFTY: 24,315 (+0.07)

- Nikkei 225: 38,077 (-0.15%)

- Hang Seng: 19,558 (-0.23%)

U.S. market update

- Dow Jones: 44,722 (▼0.3%)

- S&P 500: 5,998 (▼0.3%)

- Nasdaq Composite: 19,060 (▼0.6%)

U.S. indices ended the Wednesday’s session on negative note after the latest reading of the inflation data remained flat in October. The Personal Expenditures Index (PCE) rose 2.3%, an increase from 2.1% from September. Additionally, the core PCE rose 0.3% on a month-on-month basis, which was in line with the Wall Street’s expectations.

However, the mood in the broader markets remained muted ahead of the Thanksgiving holiday, which will see markets shut on Thursday and close early on Friday.

NIFTY50

- November Futures: 24,299 (▲0.3%)

- Open Interest: 2,48,576 (▼22.2%)

After a flat start, the NIFTY50 index consolidated around the 24,300 zone and extended the consolidation for third day in a row. Once again, the index formed a doji candlestick pattern on the daily chart, as seen previously on November 25, signaling indecision and a lack of clear directional bias.

From a technical perspective, the daily chart shows a sideways to bullish structure, with the index trading between its 21-day and 50-day Exponential Moving Average (EMA) for the past three sessions. A decisive break above or below these moving averages on a closing basis will provide clearer directional cues for positional traders.

On the 15-minute chart, traders focusing on today's expiry should monitor a key 200-point area. Over the past three days, the index has traded between 24,350 and 24,150, and a strong breach of this area is likely to dictate the next directional move.

The open interest data for the 28 November expiry has highest call base at 24,500 and put base at 24,000 strikes, marking these levels as crucial resistance and support levels. Additionally, the index also has significant call and put base at 24,300 strikes, indicating range-boond movement around this zone.

SENSEX:

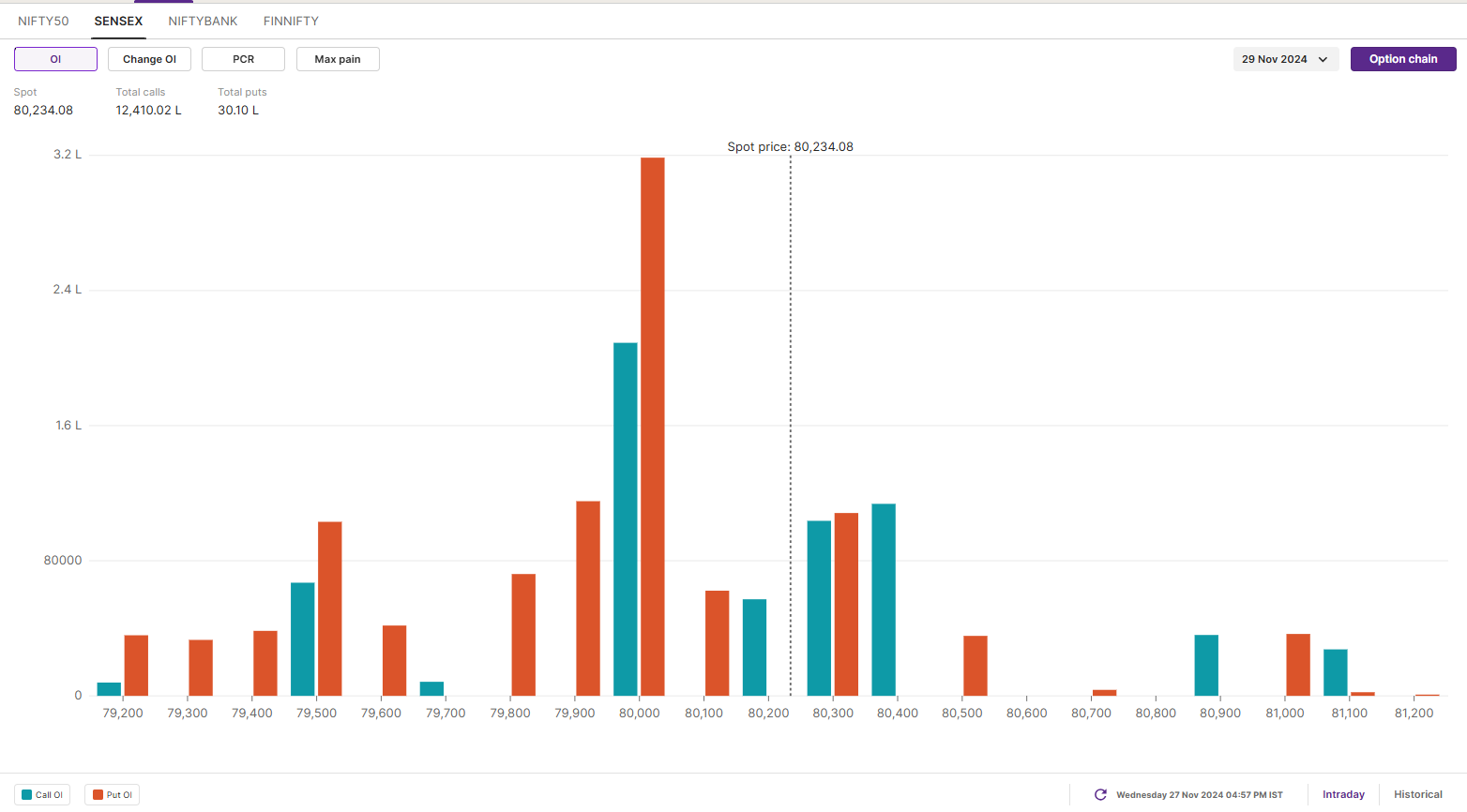

- Max call OI: 82,000

- Max put OI: 78,000

The SENSEX opened on a positive note but continued its range-bound movement for the third consecutive session around the crucial 80,000 mark. During the session, the index reclaimed the 50-day Exponential Moving Average (EMA) on the daily chart and formed a doji candlestick pattern, reflecting market indecision.

From a technical standpoint, a daily close above the 50-day EMA is typically viewed as a bullish signal. However, for stronger confirmation, traders should closely monitor the high of the doji pattern. A close above this level would reaffirm bullish momentum, potentially propelling the index towards the 81,600 zone. Conversely, a rejection from the current level and a close below the doji pattern would indicate weakness, signaling a potential downside move.

The open interest (OI) data for the 29 November expiry indicates minimal changes, with the 80,000 strike holding the highest call and put OI for the SENSEX. This suggests that the market perceives this level as a significant pivot point. However, given the index's consolidation in this range over the past three sessions, traders are advised to closely monitor changes in OI at key strikes. A noticeable shift in OI could provide valuable clues about potential directional movement as expiry approaches.

FII-DII activity

Stock scanner

- Long build-up: Adani Ports, Exide Industries and NTPC

- Short build-up: Granules India, IPCA Laboratories and Godrej Properties

- Under F&O ban: NIL

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story