Market News

Trade Setup for Nov 18: NIFTY50 ends below 200 EMA, 23,800 turns resistance

.png)

4 min read | Updated on November 18, 2024, 07:46 IST

SUMMARY

The NIFTY50 index formed a bearish marubozu candle last week, indicating that the broader trend of the index continuous remains weak. The index has immediate resistance around 23,800, while the next support is visible around 23,200 which coincides with its 50 weekly exponential moving average.

Stock list

The technical structure of NIFTY50 as per the daily chart looks weak as the index surrendered the crucial support zone of 23,800 on closing basis on 13 November.

Asian markets @ 7 am

- GIFT NIFTY: 23,505.50 (+0.26%)

- Nikkei 225: 38,367.19 (-0.71%)

- Hang Seng: 19,579.09 (+0.79%)

U.S. market update

- Dow Jones: 43,444 (▼0.7%)

- S&P 500: 5,870 (▼1.3%)

- Nasdaq Composite: 18,680 (▼2.2%)

U.S. indices ended Friday's session in the red, erasing around a third of the previous week's gains. The decline followed comments from Federal Reserve Chairman Jerome Powell, statintg that the economy was not showing the urgency that would warrant an interest rate cut. His comments reinforced expectations of a prolonged higher interest rate environment and dampened market sentiment.

Adding to the pressure, Friday's retail sales data came in stronger than expected, rising 0.4% versus consensus estimates of 0.3%. September retail sales were also revised up to 0.8% from the previously reported 0.4%, highlighting robust consumer spending and the underlying strength of the economy.

NIFTY50

- November Futures: 23,658 (▼1.1%)

- Open Interest: 4,80,488 (▲2.7%)

The NIFTY50 index ended the losing streak to the sixth day in a row and ended the Thursday’s session tad below the psychologically crucial 200 exponential moving average (EMA). The index formed a doji candle stick pattern on the daily chart, refecting pause and indecision at current levels.

The technical structure of the index as per the daily chart looks weak as the index surrendered the crucial support zone of 23,800 on closing basis on 13 November. In the upcoming sessions, the index has immediate support around 23,100 zone, which coincides with the high of June 2023 general election.

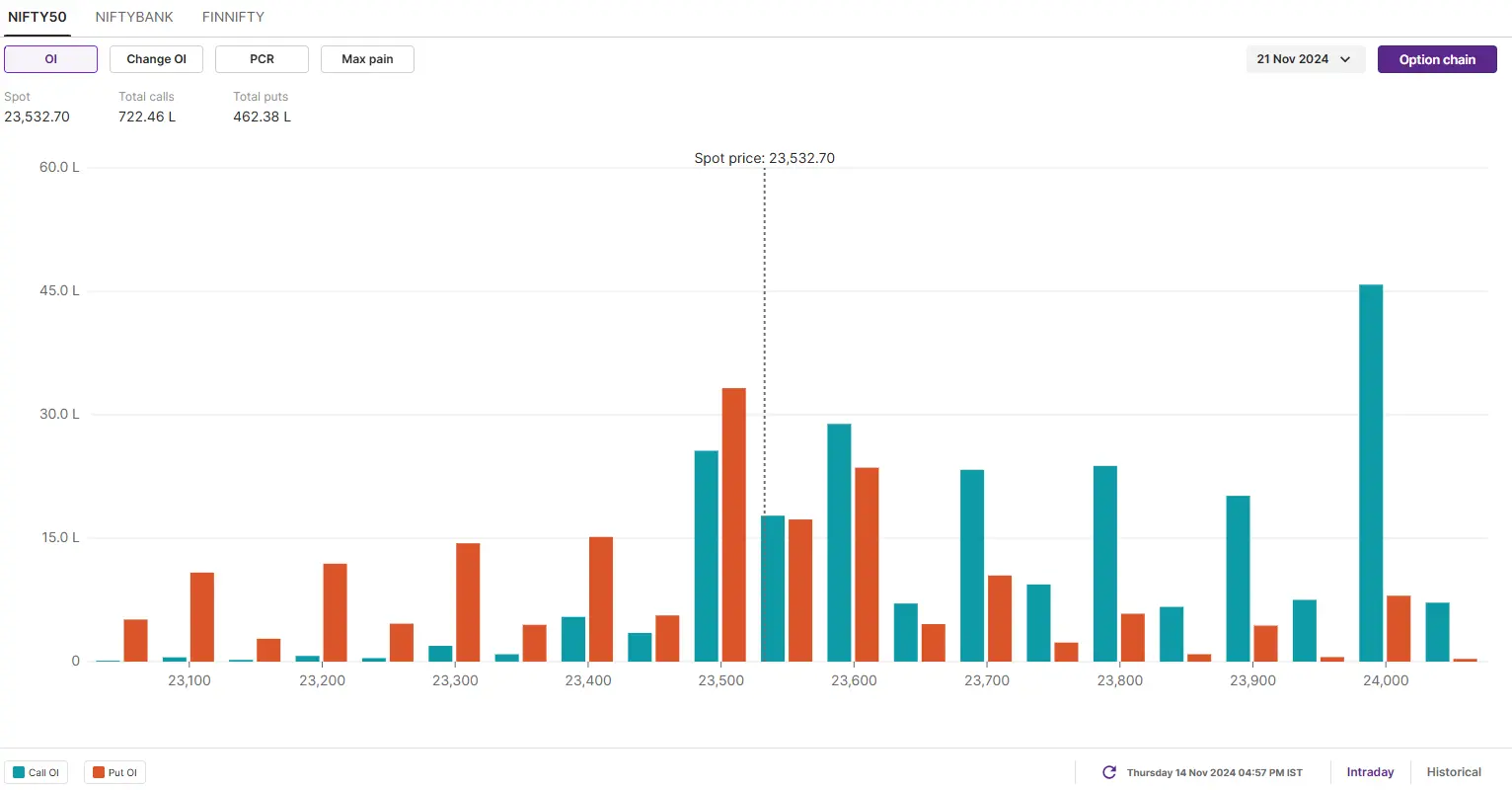

The options data for the 21 October expiry has highest call open interest (OI) at 24,000 strike, indicating that the index may face resistance around this level. Meanwhile, the put base was seen at 23,500 strike, with relatively low volume. Tarders can closely monitor the change in open interest today and plan the strategies accordingly.

SENSEX

- Max call OI: 80,000

- Max put OI: 77,500

- (Expiry: 22 October)

The SENSEX extended the losing streak for the third consecutive day and ended near its 200 EMA on the daily chart. Similar to NIFTY50, the SENSEX also formed a doji candlestick pattern on the daily chart, reflecting indecision among investors at current levels.

As per the daily chart, the technical structure of the SENSEX remains weak with index trading below 21 and 50 exponential moving average (EMA). The index took support around its 200 EMA on Thursday, ending the day in the red. Traders can monitor the price action of the index around its psychologically crucial support. If the index slips below this crucial support zone, then it may extend the weakness upto 76,800 zone. Additionally, the resistance for the index remains at 21 EMA.

The open interest data for 22 November expiry remains scattered with highest call and put open interest placed at 77,500 and 78,500 strikes. For further trading clues, traders should monitor the change in open interest and plan strategies accordingly.

FII-DII activity

Stock scanner

Short build-up: PI Industries, Tata Consumers and MDC

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India and Hindustan Copper

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story