Market News

Trade setup for March 25: NIFTY50 reclaims 200 EMA, next stop 23,800?

.png)

4 min read | Updated on March 25, 2025, 07:26 IST

SUMMARY

The benchmark indices extended their gains for a sixth consecutive session on Monday amid strong buying by the FIIs and positive global market cues. The NIFTY50 and SENSEX have comfortably closed above their respective 200 EMA levels indicating a sustained bullish momentum in the markets. However, OI data shows that 23,800 and 79,000 remain key resistance for the current month's expiry.

Stock list

NIFTY50 index continued its rally for the sixth consecutive session and comfortably closed above short, medium and long-term moving averages. | Image: Shutterstock

Asian markets @ 7 am

- GIFT NIFTY: 23,750 (+0.23%)

- Nikkei 225: 37,894 (+0.76%)

- Hang Seng: 23,703 (-0.85%)

U.S. market update

- Dow Jones: 42,583 (▲1.4%)

- S&P 500: 5,767 (▲1.7%)

- Nasdaq Composite: 18,188 (▲2.2%)

U.S. indices started the Monday’s session on a positive note after reports suggested that the impact of President Donald Trump’s tariffs will be narrower than expected. Meanwhile, shares of Tesla rebounded over 10%, registering its best day in 2025. The stock was under pressure in 2025 and slipped over 36% in 2025 amid rising consumer boycotts and subdued demand globally.

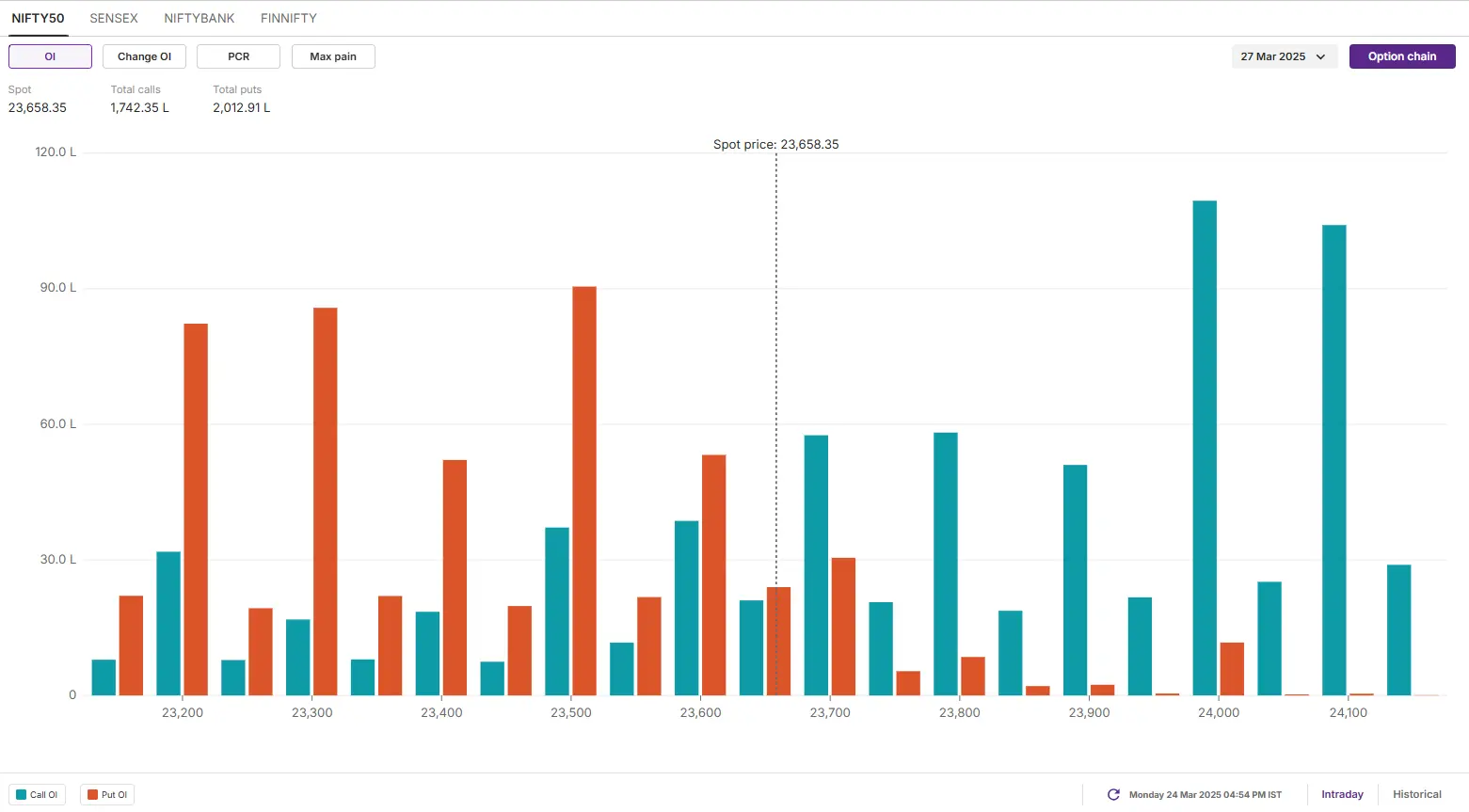

NIFTY50

- Max Call OI: 24,100

- Max Put OI: 23,500

- (10 Strikes from ATM, Expiry: 27 March)

NIFTY50 index continued its rally for the sixth consecutive session and comfortably closed above short, medium and long-term moving averages. The rally was largely aided by strong FII buying for the third consecutive session and buying banking stocks.

Meanwhile, the technical structure for the index continues to remain bullish with the index reclaiming, 20 EMA, 50 EMA and 200 EMA on a closing basis. Market participants and experts believe that 23,80, the swing high of February 2025 may act as immediate resistance. Conversely, 50 EMA around the 23,000 could act as near-term support.

On the open interest (OI) front, there was significant put OI addition at the 23,500 strike level, which also holds the highest open interest for the 27th March expiry. This indicates that this zone may act as immediate support zone for the index. On the call side, the 24,000 level holds the highest open interest indicating a strong resistance at these levels for current expiry.

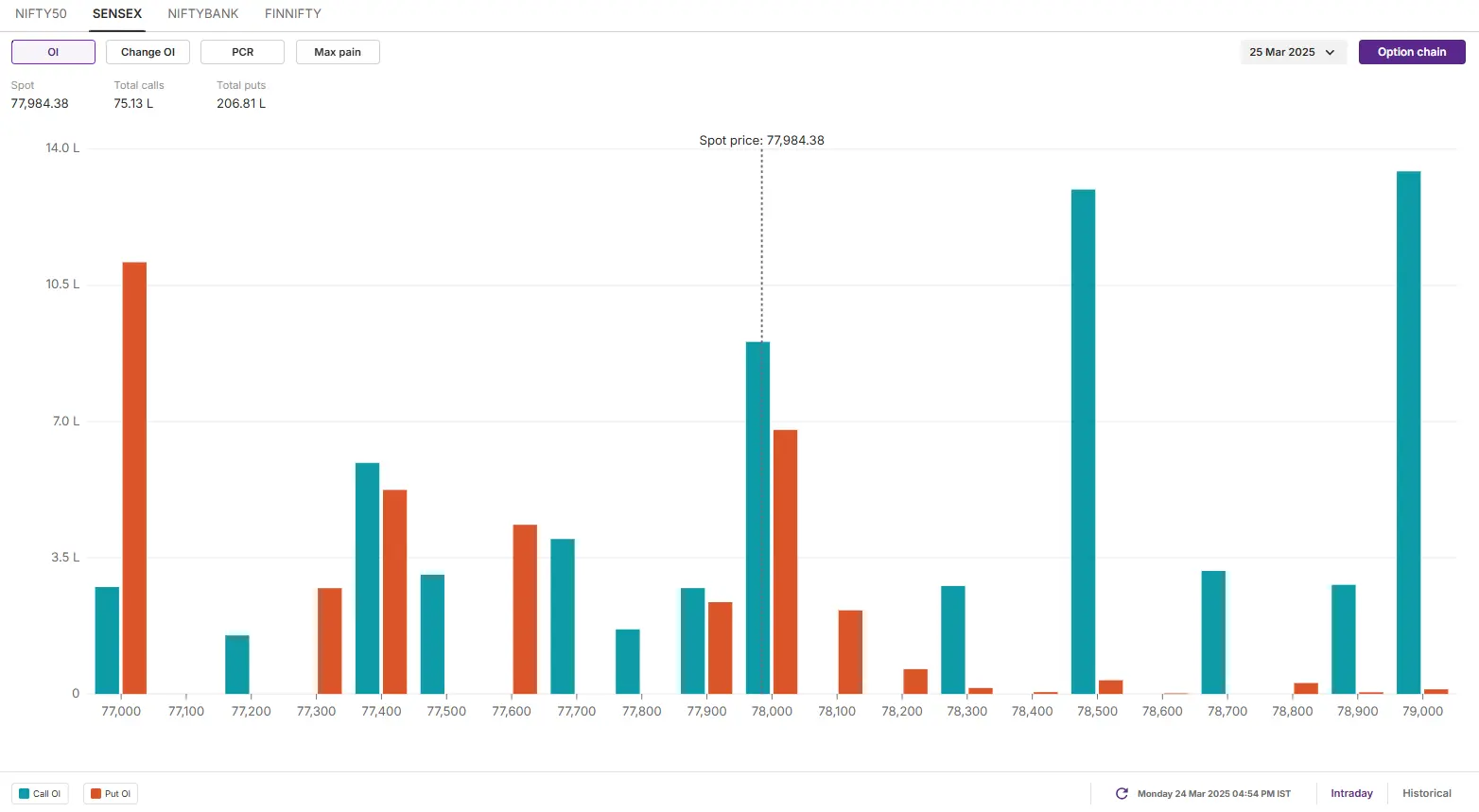

SENSEX

- Max call OI: 79,000

- Max put OI: 77,000

- (10 Strikes from ATM, Expiry: 25 March)

Similar to the NIFTY50, SENSEX now trades above short, medium and long-term moving averages as it closed above 200 EMA on Monday after rising for the sixth consecutive session. The rally was largely driven by positive global and domestic cues, which included stock-specific announcements on capex, order wins and more, in addition to the change in stance by the FIIs.

On technical charts, the SENSEX has closed above the falling trendline connecting swing highs of September and December and the crucial 200-day EMA. Experts believe some consolidation in the range of 77,000 and 79,000 after a sharp 7% rally from the lower levels.

The open interest (OI) data of today’s expiry shows the highest open interest on the call side at 79,000 strike price, which could remain as strong resistance for the current expiry of 25th March. On the put side, the highest OI stood at 77,000 strike. In addition, the 77,500 strike price puts also saw significant OI addition, indicating immediate support for the current month's expiry.

FII-DII activity

Stock scanner

- Long build-up: Titagarh Wagons, Manappuram Finance, NTPC, Dixon Technologies and Eicher Motors

- Short build-up: BSE and Jindal Stainless

- Top traded futures contracts: HDFC Bank, Reliance Industries, ICICI Bank, State Bank of India and Bajaj Finance

- Top traded options contracts: HAL 4,100 CE, BSE 4,900 CE, Bajaj Finance 9,000 CE, Reliance 1,300 CE and HDFC Bank 1,800 CE

- Under F&O ban: IndusInd Bank

- Out of F&O ban: Hindustan Copper and Polycab

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story