Market News

Trade setup for Jan 29: NIFTY50 rebounds from day’s low, faces resistance around 23,100

.png)

4 min read | Updated on January 29, 2025, 07:20 IST

SUMMARY

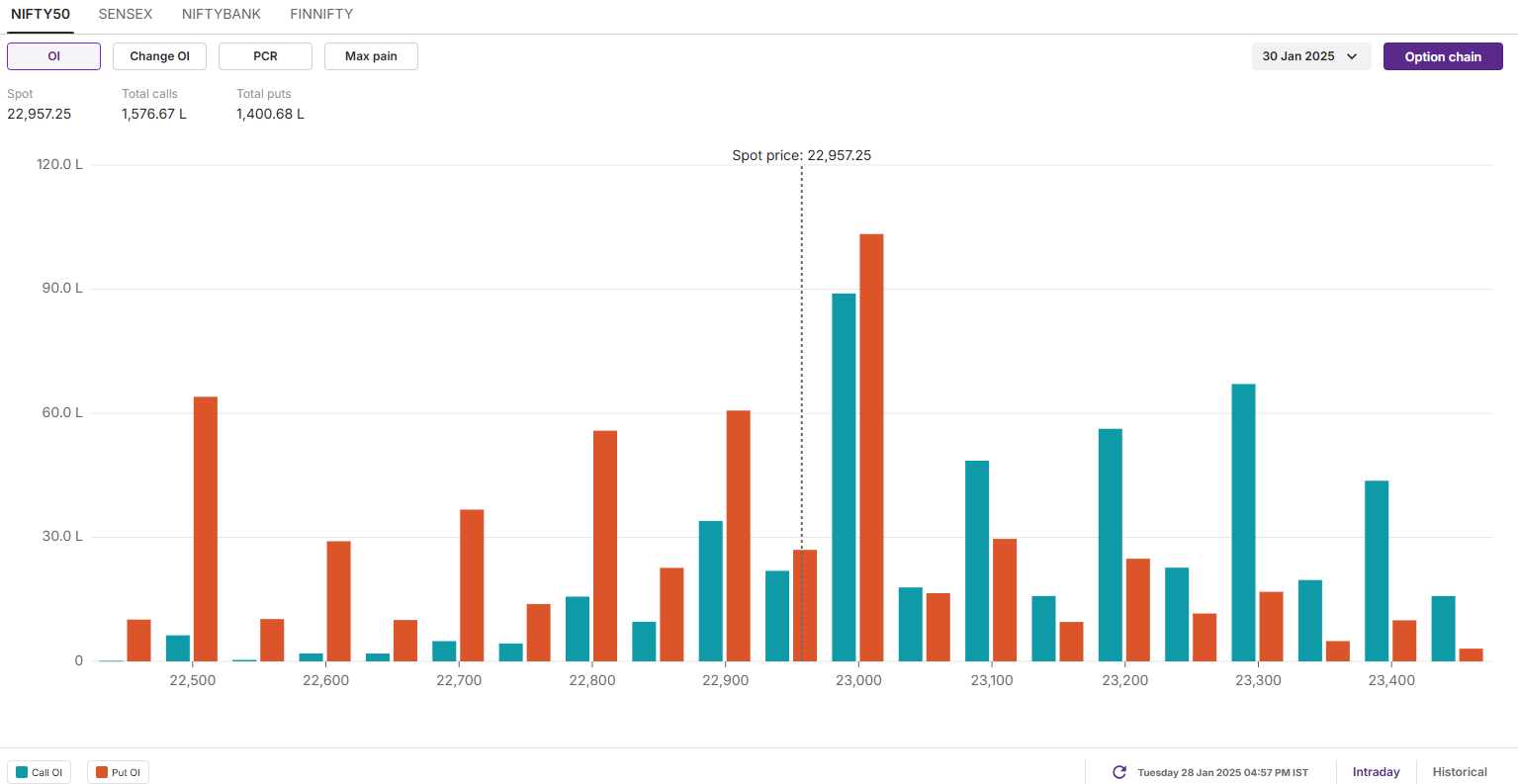

The options data for the monthly expiry saw significant call and put open interest build-up at 23,000 put and call options, signalling options market expecting consolidation around this zone.

Stock list

The NIFTY 50 index rebounded on January 28, recovering a portion of the previous day's losses to close 0.6% higher. | Image: Shutterstock

Asian markets @ 7 am

- GIFT NIFTY: 23,025 (+0.22%)

- Nikkei 225: 39,180 (+0.42%)

- Hang Seng: 20,225 (+0.14%)

U.S. market update

- Dow Jones: 44,850 (▲0.3%)

- S&P 500: 6,067 (▲0.9%)

- Nasdaq Composite: 19,733 (▲2.0%)

U.S. stocks closed higher on Tuesday, with the S&P 500 and Nasdaq Composite rebounding strongly from the previous session’s losses. The recovery came after the rise of Chinese AI startup DeepSeek sent ripples across Wall Street, reigniting investor interest in the tech sector.

Nvidia (NVDA) emerged as the day’s standout performer, surging nearly 9% after suffering a record $589 billion wipeout in market cap during the prior session. The rebound underscored renewed confidence in the chipmaker's long-term growth prospects amid the AI boom.

NIFTY50

- January Futures: 22,977 (▲0.6%)

- Open interest: 3,58,780 (▼24.0%)

The NIFTY 50 index rebounded on January 28, recovering a portion of the previous day's losses to close 0.6% higher. However, the index faced resistance at the critical 23,000 mark, as investors remained cautious ahead of the Budget announcement.

As per the daily chart, the index has immediate resistance around the 23,350 zone. Meanwhile, the immediate support for the index is between the 22,750 and 22,800 zones. A breach below this zone might intensify selling pressure, potentially dragging the index down to 22,600.

Meanwhile, the open interest data for the 30 January expiry saw significant call and put build-up at 23,000 strike, suggesting range-bound activity around this zone. On the other hand, minor call and put open interest build-up was also seen at 23,300 and 22,500 strikes.

BANK NIFTY

- January Futures: 90,035 (▲1.6%)

- Open interest: 3,58,780 (▼28.0%)

The BANK NIFTY index started Tuesday's session on a positive note as India's central bank, RBI announced measures to inject liquidity into the banking system. This includes bond purchases, including bond purchases and dollar/rupee swaps worth ₹1.5 lakh crore.

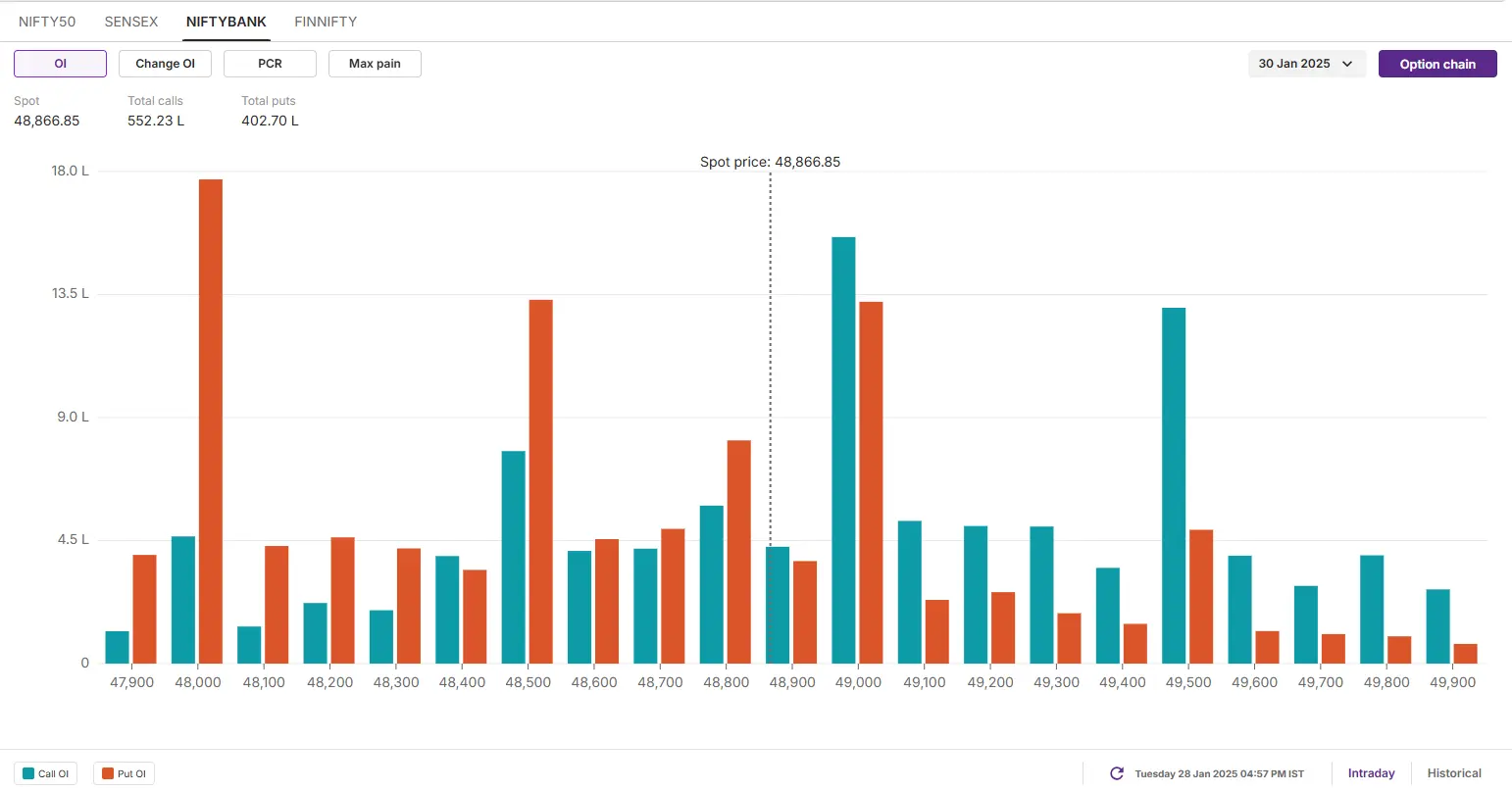

Meanwhile, the technical structure of the banking index as per the hourly chart remains range-bound between 49,600 and 48,000. The index is consolidating within this range for the past eleven trading sessions. For the upcoming sessions, traders monitor these levels as a close above these levels will provide further directional clues.

The open interest data for the 30 January expiry saw a significant put base at 48,000 strike, suggesting support for the index around this level. On the flip side, the call base was seen at 49,500, indicating resistance around this zone. Additionally, the index also witnessed significant accumulation of call and put base at 49,000 strike, signalling range-bound activity.

FII-DII activity

Stock scanner

- Long build-up: Bank of India, Cipla, Balkrishna Industries, Jubilant FoodWorks and TVS Motor

- Short build-up: CG Power, Federal Bank, Petronet LNG, BSE and JSW Energy

- Under F&O ban: Nil

- Out of F&O ban: IndiaMART InterMESH, Manappuram Finance, Mahanagar Gas and Punjab National Bank To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story