Market News

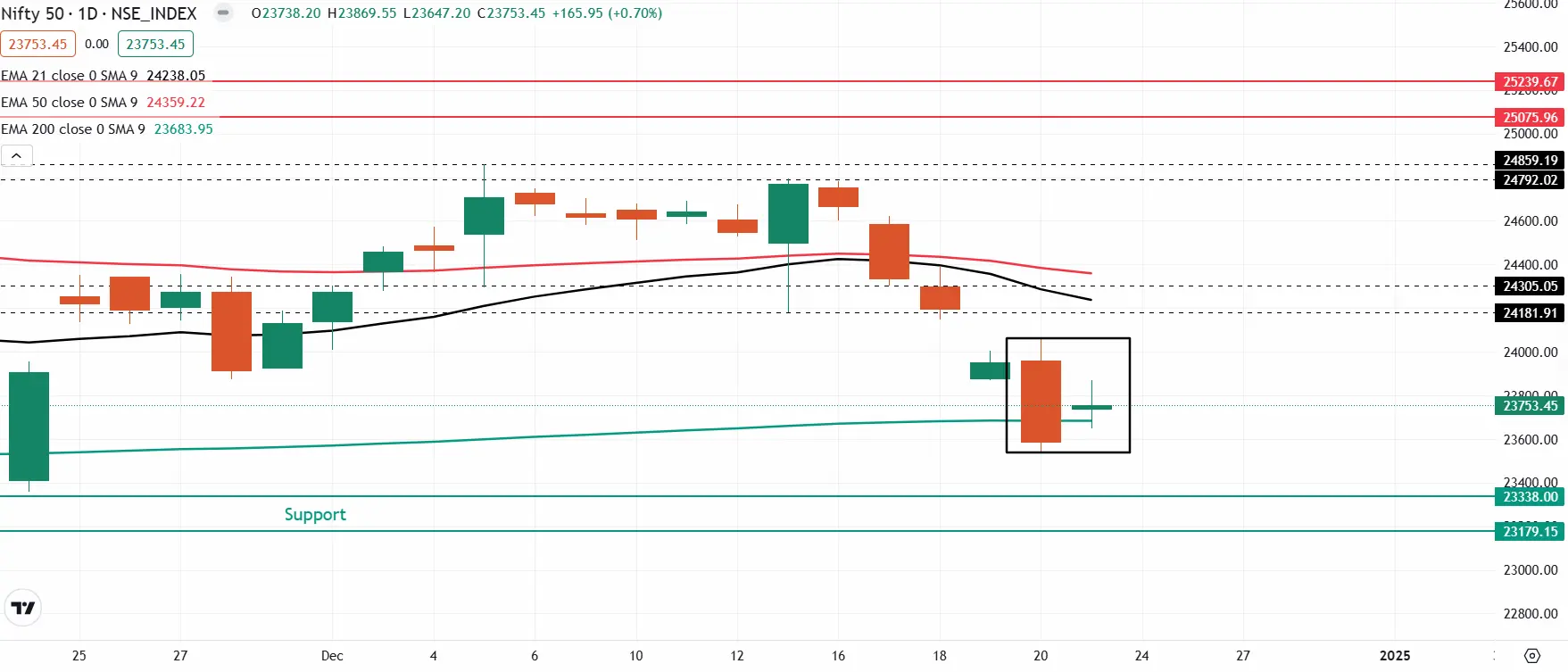

Trade Setup for Dec 24: NIFTY50 rebounds from 200 EMA, inside candle reflects pause in momentum

.png)

4 min read | Updated on December 24, 2024, 07:18 IST

SUMMARY

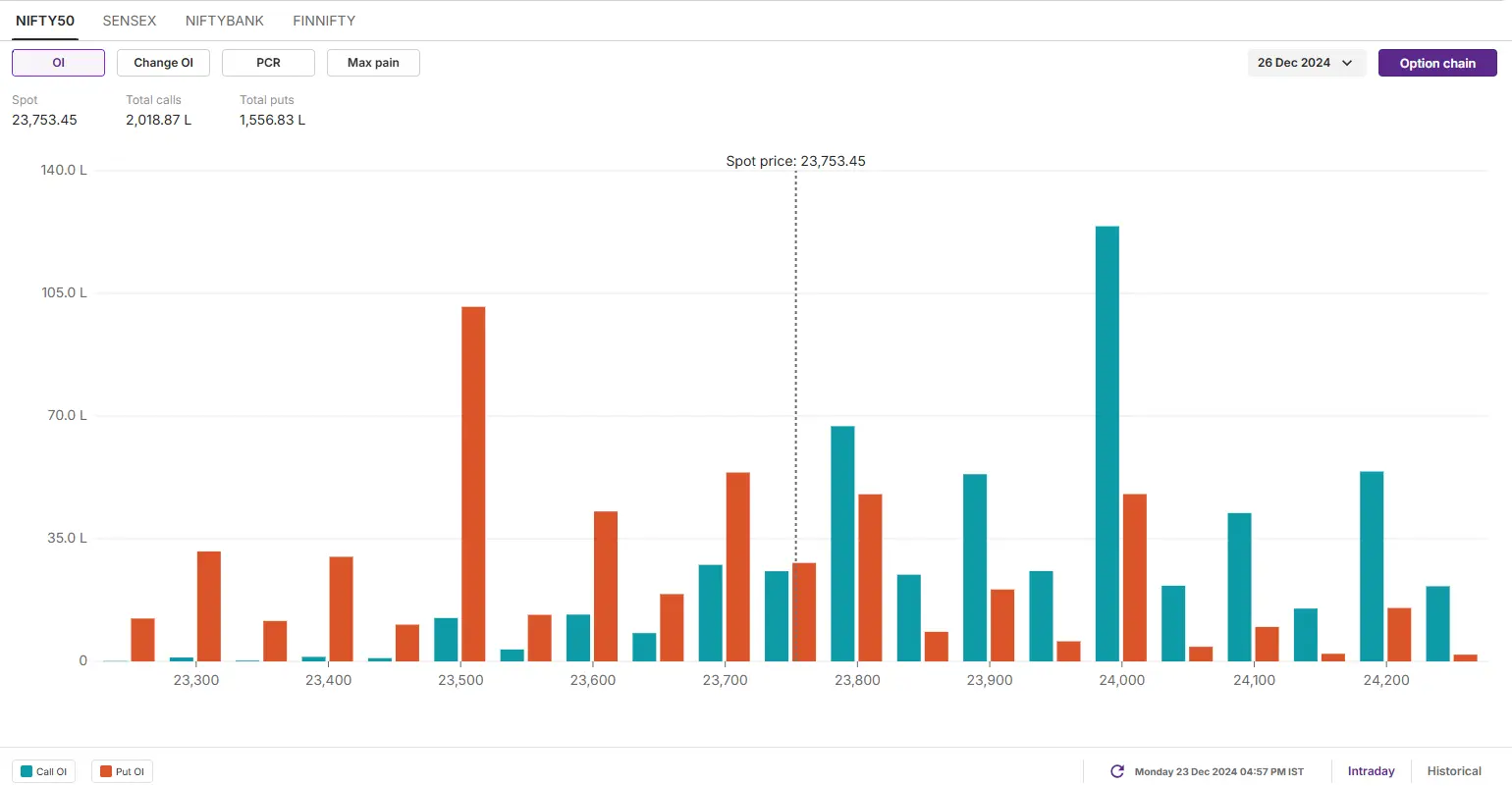

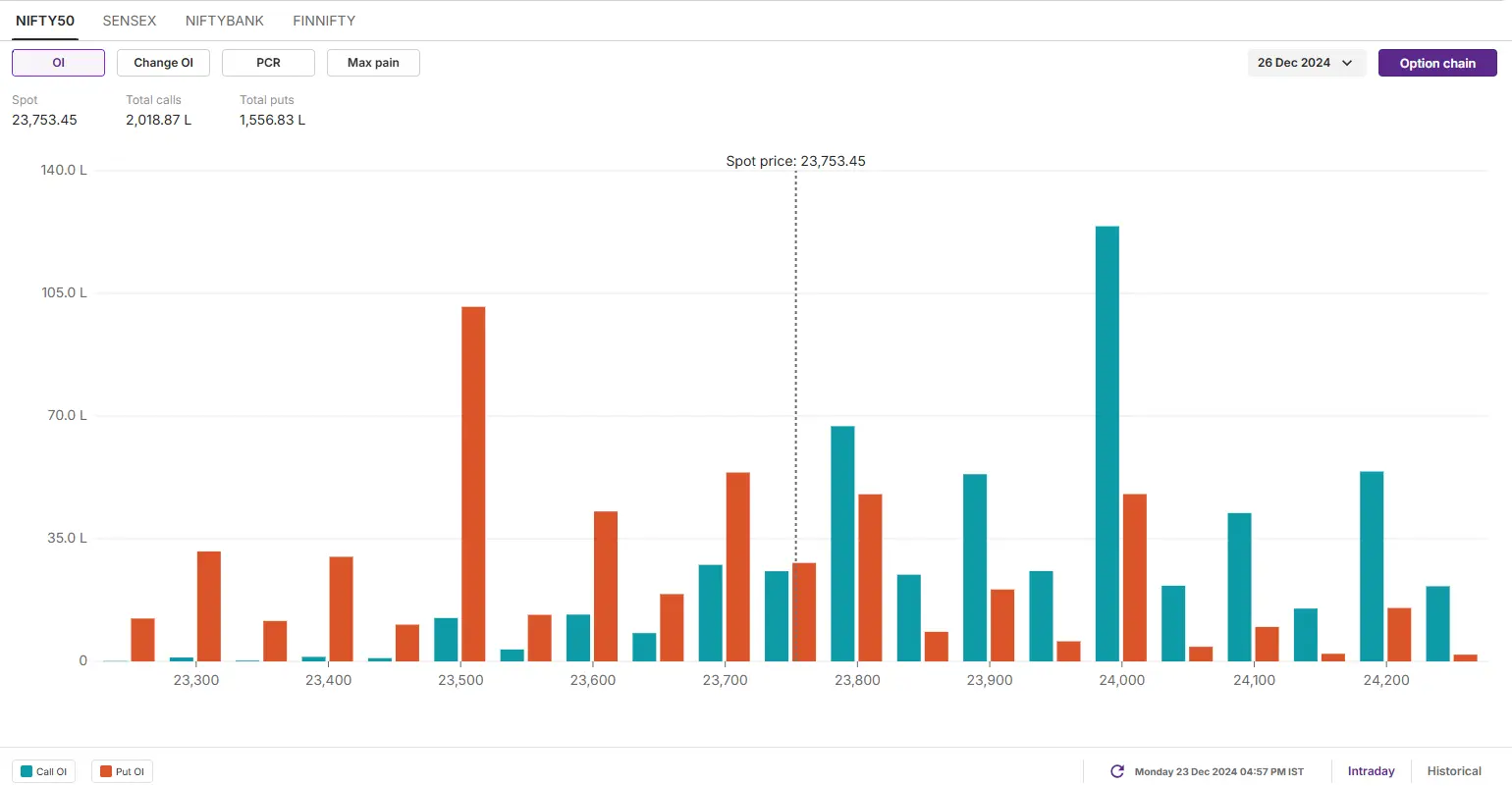

As per the options data of monthly expiry, the immediate resistance for the NIFTY50 index is around 24,800, while support is visible around the 24,500 zone. A break of this range on a closing basis will provide further directional closure.

Stock list

The NIFTY50 index started the week on a positive note and snapped its five-day losing streak.

Asian markets @ 7 am

- GIFT NIFTY: 23,759 (+0.09%)

- Nikkei 225: 39,064 (-0.25%)

- Hang Seng: 19,911 (+0.14%)

U.S. market update

- Dow Jones: 42,906 (▲0.1%)

- S&P 500: 5,974 (▲0.7%)

- Nasdaq Composite: 19,764 (▲0.9%)

U.S. indices extended the gains for the second day in a row, led by semiconductor stocks. Shares of Nvidia and Broadcom surged in the range of 3% to 5%, while the other technology stocks like Meta and Tesla also lifted the broader market sentiment in the holiday-shortened week.

NIFTY50

- December Futures: 23,625 (▼1.05%)

- Open interest: 3,68,717 (▼2.2%)

The NIFTY50 index started the week on a positive note and snapped its five-day losing streak. After a positive start, the index sustained its opening gains and closed above its 200 day exponential moving average (EMA).

However, the index formed a doji candlestick pattern cum inside candle on the daily chart, reflecting indecision. For the upcoming sessions, traders can monitor the high and the low of 20 December’s candle. A close above or below these levels will provide further directional clues to the traders.

The open interest data for the 26 December expiry has significant call OI at 24,000 strikes, indicating that the index will face resistance around this zone. Conversely, the put base was seen at 24,500 strikes, suggesting support for the index around this zone.

SENSEX

- Max call OI: 79,000

- Max put OI: 78,500

- (Expiry: 27 Dec)

The SENSEX also snapped its five-day losing streak and formed a similar doji candlestick pattern on the daily chart. The index traded within the range of previous session and also formed formed a inside candle on the daily chart.

From the technical standpoint, the short-term trend of the index remains sideways to bearish as the index is currently placed at its 200 EMA. For positional traders, the high and the low of Friday's candle becomes extremely crucial. If the index recalims or surrenders the high or the low of the 20 December’s candle, then it may provide further directional clues. Unless the index breaks this range, then the trend may remain range-bound.

Meanwhile, the open interest (OI) data for the 27 December expiry saw significant call options OI at 79,000 strike, pointing at resistance for the index around this zone. On the other hand, the put base and consolidation was seen at 78,000 and 78,500 strikes, suggesting range-bound movements around these levels.

FII-DII activity

Stock scanner

- Long build-up: Jubilant FoodWorks, Union Bank and Paytm

- Short build-up: Can Fin Homes,CDSL, Zomato, KPIT Technologies, Cyient and JSW Energy

- Under F&O ban: Bandhan Bank, Granules India, Hindustan Copper, Manappuram Finance, and RBL Bank

- Out of F&O ban: Steel Authority of India

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story