Market News

Trade Setup for August 22: NIFTY50 sustains bullish momentum, will it fill the second bearish gap?

.png)

5 min read | Updated on August 22, 2024, 08:41 IST

SUMMARY

For today's expiry, the crucial range for the NIFTY50 index is between 24,850 and 24,450. Traders can plan range-bound strategies until the index moves within this range. However, a breach of this area will provide directional clues.

Stock list

The NIFTY50 extended its winning streak for the fifth consecutive day and closed above the previous day's high on Wednesday, indicating further bullishness.

Asian markets update at 7 am

The GIFT NIFTY is up 0.2%, indicating another positive start for the NIFTY50 today. Other Asian markets are also trading in the green. Japan's Nikkei 225 is up 1%, while Hong Kong's Hang Seng Index is up 0.4%.

U.S. market update

- Dow Jones: 40,890 (▲0.1%)

- S&P 500: 5,620 (▲0.4%)

- Nasdaq Composite: 17,918 (▲0.5%)

U.S. indices advanced on Wednesday after a summary of Federal Reserve’s July meeting last month reinforced the hope of lower rates in the coming days. The minutes said that several of the 19 Fed officials saw a plausible case for cutting rates by 0.25% at the July meeting or suggested support for the decision.

Additionally, the vast majority officials indicated that it would be appropriate to ease the policy at their next meeting in September, if inflation data continued to come in as expected. Currently, traders are pricing in a 100% chance of a rate cut in September as per CME FedWatch tool.

NIFTY50

- August Futures: 24,798 (▲0.3%)

- Open Interest: 4,28,732 (▼0.5%)

The NIFTY50 extended its winning streak for the fifth consecutive day and closed above the previous day's high, indicating further bullishness. The index has also formed a bullish candle on the daily chart and shows no signs of reversing or pausing.

On the daily chart, the index is approaching the second bearish gap between 24,850 and 24,950, which was formed on the 2nd of August after the NIFTY50 breached the 25,000 level. Traders may want to monitor the price action around this area, as a close above it will signal further bullishness. However, traders should also be wary of profit-taking scenarios as the index approaches the 25,000 level.

The crucial range for the NIFTY50 index on the 15 minute time frame is in the 24,850 - 24,450 zone. Traders can plan range-bound strategies until the index moves within this range. However, a breach of this area will provide directional clues.

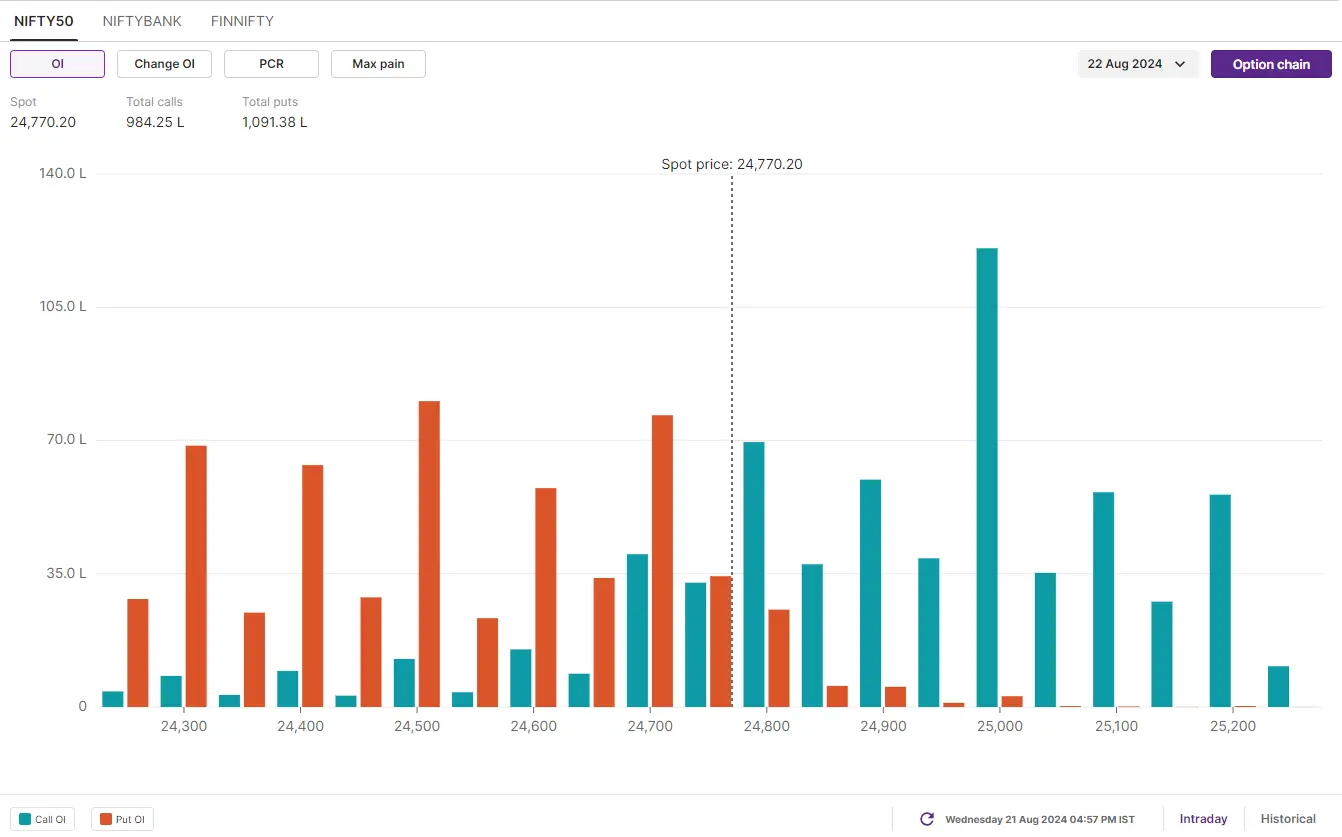

The positioning of the open interest for today’s expiry has significant put options base at 24,700 and 24,500 strikes. This suggests support for the index around these levels.

Meanwhile, the index may face resistance around the 24,800 and 25,000 strikes due to the significant accumulation of call options at these strikes.

BANK NIFTY

- August Futures: 50,806 (▼0.1%)

- Open Interest:1,81,327 (▼1.9%)

The BANK NIFTY index ended the volatile week on a negative note, but protected the 50,500 level on a closing basis. The index slipped back into the consolidation zone of the 5 August range and saw sharp swings to both sides within a narrow range.

As shown in the chart below, the index has protected the 49,500 zone on two occasions and has formed a base around that zone. In addition, the index has attempted to break out of the consolidation of the 5 August candle more than four times. Traders may want to keep a close eye on the closing price today. A close above the previous day's high and 50,800 will result in a strong directional up move. Conversely, a close below the 50,000 level will indicate weakness.

The initial open interest build-up of the monthly expiry of BANK NIFTY has significant call open interest at 51,000 and 52,000 strikes. The index may encounter resistance around these areas. On the flip side, the put open interest is placed at 50,500 and 50,000 strikes, pointing support for the index around these levels.

FII-DII activity

Stock scanner

Short build-up: N/A

Out of F&O ban: Bandhan Bank, Manappuram Finance, RBL Bank and Steel Authority of India (SAIL)

Added under F&O ban: N/A

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Balrampur Chini, Birlasoft, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, India Cements, LIC Housing Finance, National Aluminium, Piramal Enterprises and Sun TV

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story