Market News

Trade setup for 6 August: All eyes on 50-DMA as NIFTY50 breaks below Budget day low and 20-DMA

.png)

4 min read | Updated on August 06, 2024, 08:57 IST

SUMMARY

With the volatility index climbing to nearly 20, up by 42%, traders should exercise caution due to the potential for sharp intraday spikes. The next critical support zone for the NIFTY50 index is between 23,700 and 23,800. A close below this range could signal further weakness, while a rebound would make the price action around 24,000, a key level to watch.

Stock list

The NIFTTY50 index fell almost 3% on concerns about a possible U.S. recession, disappointing jobs data and weak manufacturing figures.

Asian markets update at 7 am

The GIFT NIFTY is up 0.7%, signalling a promising start for Indian equities today. This upward trend is in line with the positive start seen in other Asian markets. In particular, Japan's Nikkei 225 has rebounded sharply, gaining over 8% after falling over 12% yesterday. Meanwhile, Hong Kong's Hang Seng Index is also performing well with a 1% gain.

U.S. market update

- Dow Jones: 38,703 (▼2.6%)

- S&P 500: 5,186 (▼3.0%)

- Nasdaq Composite: 16,200 (▼3.4%)

U.S. stocks fell sharply on Monday as worries over the health of U.S. economy sparked a global sell-off. This comes after the release of Friday’s jobs report which was lower-than the estimates. Investors remained concerned whether the Federal Reserve is behind in cutting interest rates, which may lead to a economic slowdown.

Meanwhile, as per the CME Fedwatch Tool, markets are pricing in a 0.5% rate cut by the U.S. Fed in its September meeting.

NIFTY50

- August Futures: 24,102 (▼2.5%)

- Open Interest: 5,86,565 (▼3.6%)

The NIFTTY50 index fell almost 3% on concerns about a possible U.S. recession, disappointing jobs data and weak manufacturing figures. Additionally, rising geopolitical tensions and currency concerns related to Yen also contributed to the decline.

After a second consecutive gap-down start, the index gave up key support at the 20-day moving average (DMA) and the Budget day low (around 24,000) on a closing basis. This indicates near-term weakness for the NIFTY50. The next important support for the index is at the 50 DMA (around 23,800). A close below 23,800 on the daily chart will signal further weakness. However, should the index protect the 50 DMA on a closing basis, the rebound could take the NIFTY50 towards the 24,200 level.

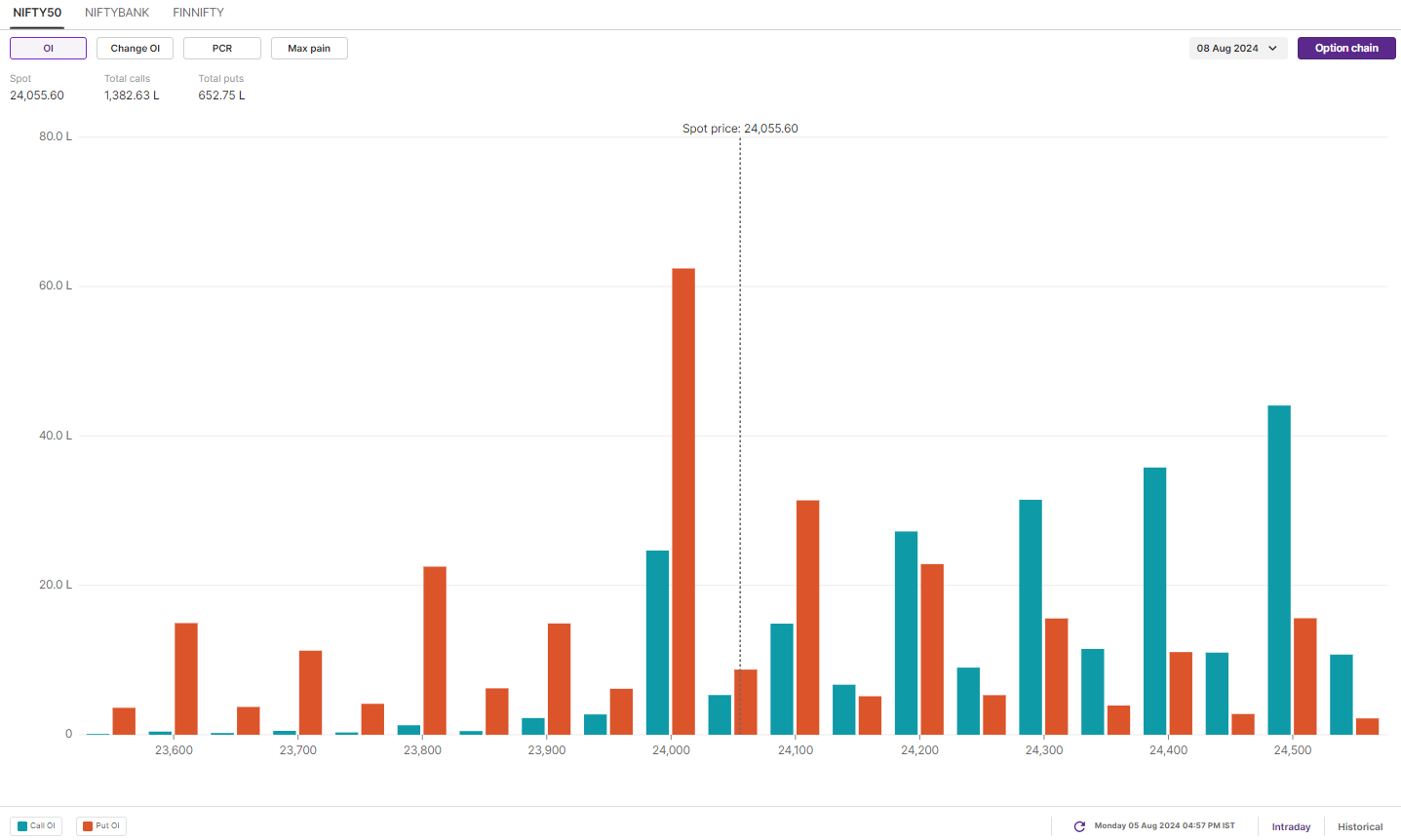

The open interest build-up for the 8 August expiry has call options based around the 25,000 and 24,800 strikes. Conversely, the put build-up was seen at the 24,000 and 23,500 strikes. Apart from the put base at 24,000, the overall open interest is skewed towards the call writers, indicating multiple resistance for the index above 24,500. Traders should closely monitor the change in open interest at 24,000 for further directional clues.

BANK NIFTY

- August Futures: 50,215 (▼2.4%)

- Open Interest: 1,97,934 (▲13.5%)

The BANK NIFTY started Monday's session on a negative note and closed below its 50-day moving average (DMA) amid sell-off in the broader market, indicating further weakness.

As you can see on the chart below, the BANK NIFTY has now immediate support at 100 DMA, which is around 49,500. Until the index closes below this level, it may remain range-bound, with immediate resistance around 51,800, which coincides with its 20 DMA.

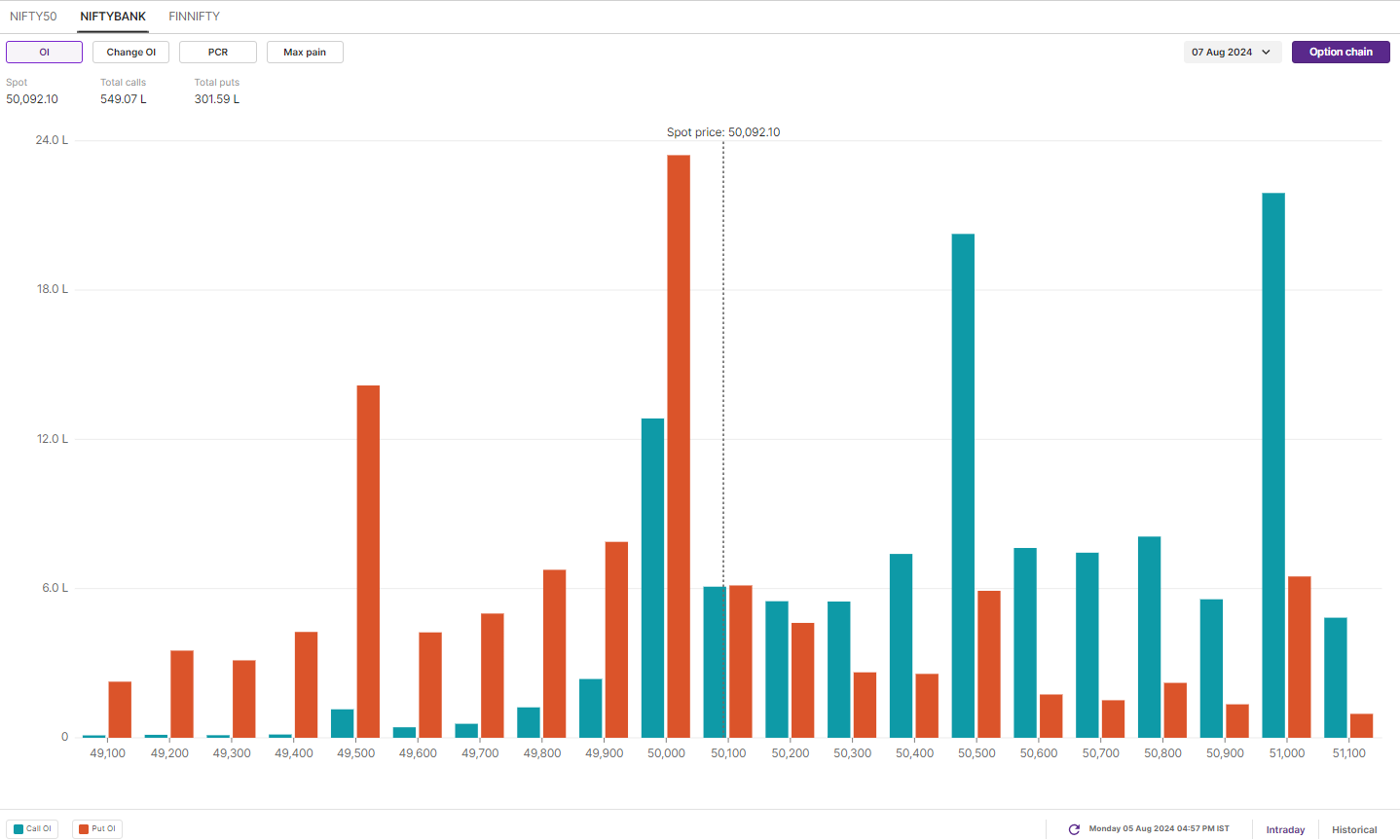

The open interest analysis for 7 August expiry has highest call base at 52,000 and 51,500 strikes, pointing resistance for BANK NIFTY around these levels. On the other hand, the put options base is established at 50,000 and 49,000 strike, hinting at support for the index around these levels.

FII-DII activity

Stock scanner

Long build-up: N/A

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story