Market News

Trade setup for July 11: NIFTY50 forms bearish candle, 24,000 key support on expiry?

.png)

5 min read | Updated on July 11, 2024, 07:45 IST

SUMMARY

Immediate resistance for the NIFTY50 index for today's expiry is around 24,450, while key support is around 24,200. The index may trade sideways until it breaks out of this range.

Stock list

After a flat start, the NIFTY50 index saw profit-booking at higher levels, forming a bearish candlestick on the daily chart.

Asian markets update at 7 am

The GIFT NIFTY is trading higher, indicating a positive start for Indian equities today. Following positive global cues, other Asian markets are also trading in the green. Japan's Nikkei 225 is up 1%, while Hong Kong's Hang Seng Index rose 1.4%.

U.S. market update

- Dow Jones: 39,721 (▲1.0%)

- S&P 500: 5,633 (▲1.0%)

- Nasdaq Composite: 18,647 (▲1.1%)

U.S. equities soared to fresh all-time highs, with the S&P 500 and Nasdaq Composite closing higher for the seventh consecutive session. The sharp rise in the indices was led by broad-based buying across sectors, with technology stocks leading the way. This comes ahead of the release of the Consumer Price Index (CPI) figures later today.

Wall Street also looked to Washington for more optimism. Fed Chairman Jerome Powell's two days of testimony before Senate and House committees suggested that the Fed was moving closer to a decision to cut interest rates. He also insisted that he was not ready to declare that inflation had been beaten.

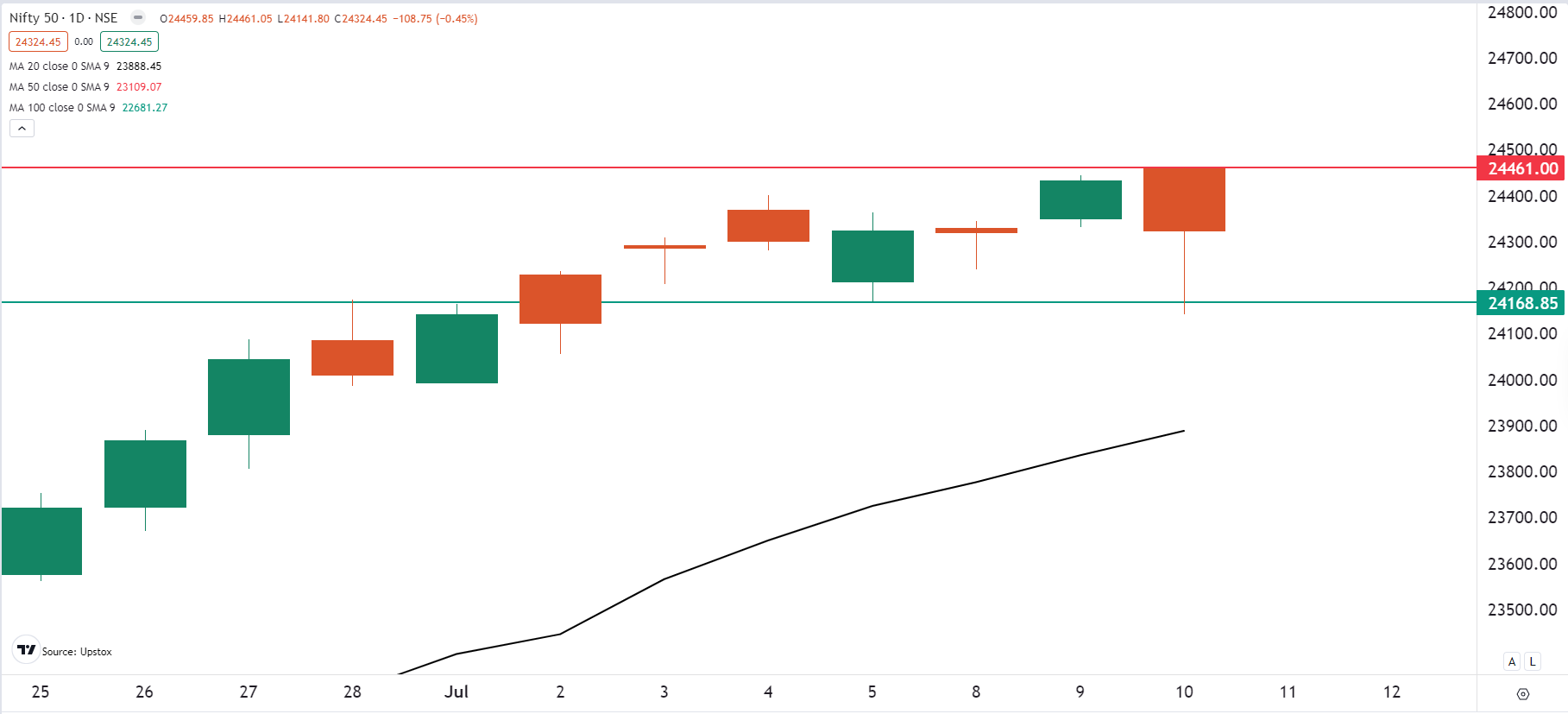

NIFTY50

- July Futures: 24,355 (▼0.5%)

- Open Interest: 5,62,720 (▼2.8%)

After a flat start, the NIFTY50 index saw profit-booking at higher levels, forming a bearish candlestick on the daily chart. The index fell over 1% from its opening levels amid a sharp sell-off in the mid- and small-cap indices. However, the index recovered most of its losses in the second half of the day to end the day down 0.4%.

The NIFTY50 index formed a hanging man candlestick pattern, which also has engulfed previous day’s candle. This pattern is also known as bearish reversal pattern and is formed after an uptrend. The pattern is confirmed if the close of the subsequent day is lower than the bearish reversal candle.

For today’s expiry, the NIFTY50 index faces immediate resistance around 24,450 zone, with support near 24,200. The index may remain sideways until it breaks out of this range. Traders will gain clear directional clues once the index moves beyond these levels.

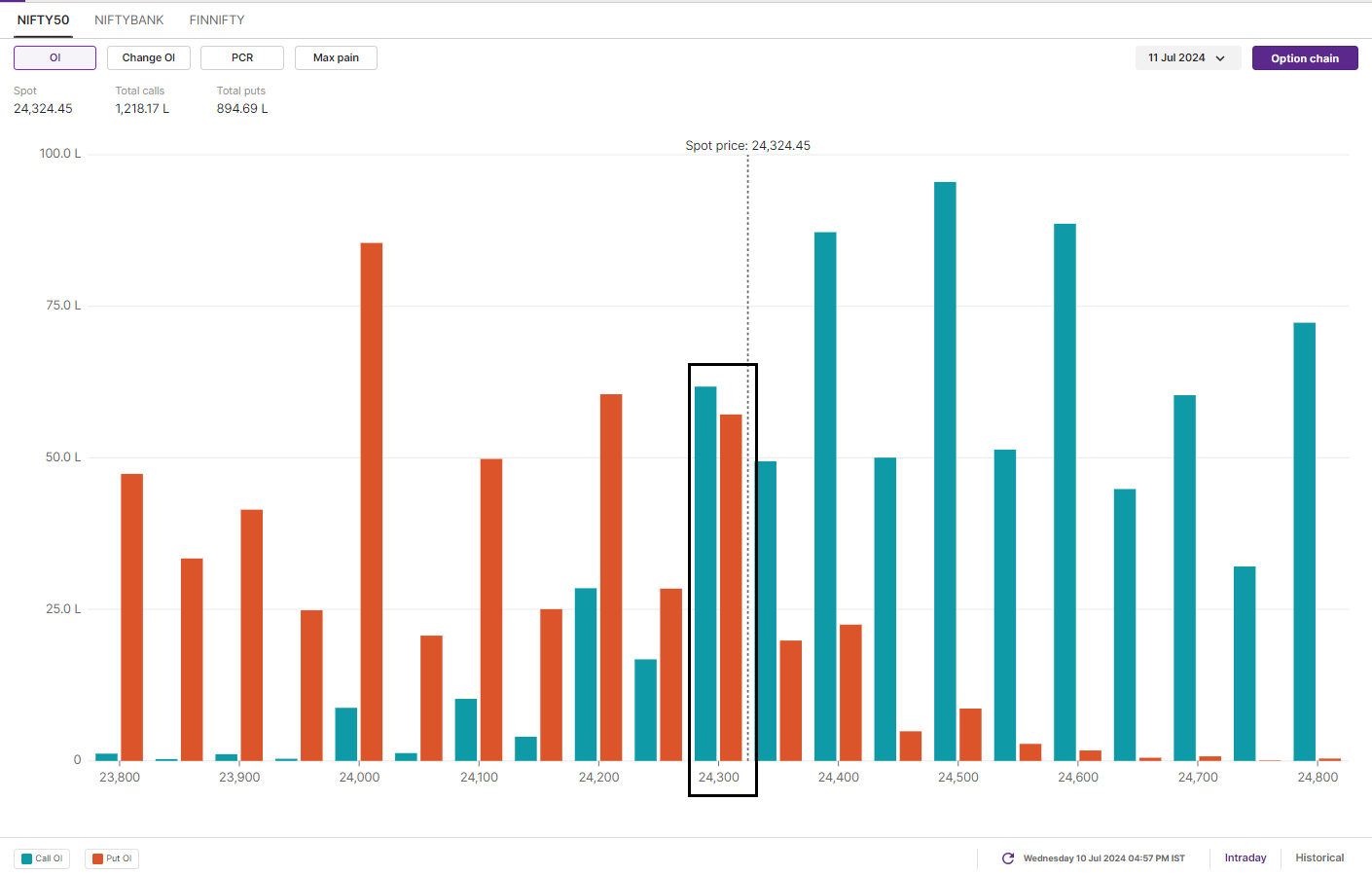

The open interest build-up on NIFTY50 for today’s expiry saw highest call build-up at 24,500 strike, pointing it as resistance for the index. On the flip side, the put base was formed at 24,000 strike, indicating support around this zone. Based on the open interest data, traders are expecting NIFTY50 index to trade between 24,000 and 24,500.

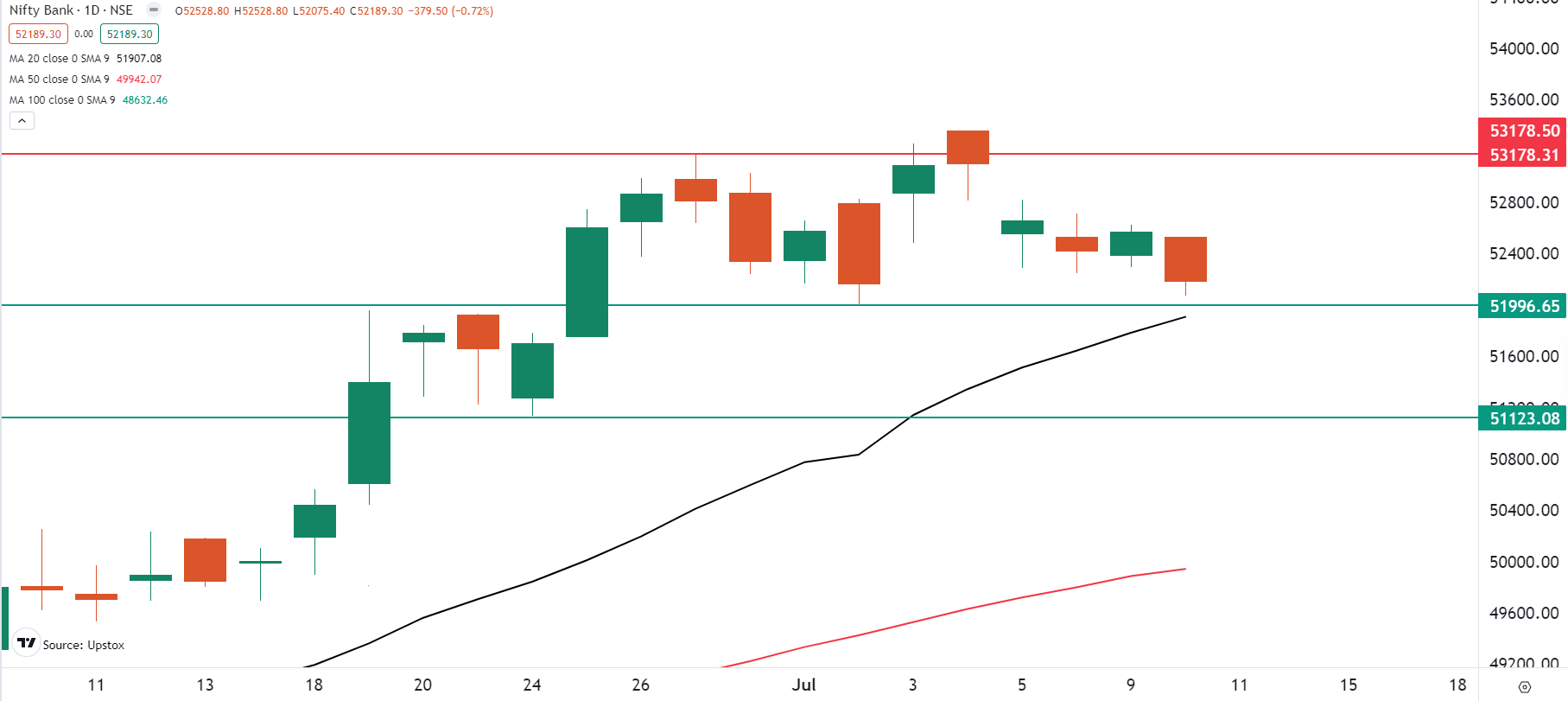

BANK NIFTY

- July Futures: 52,318 (▼0.5%)

- Open Interest: 1,56,473 (▼8.9%)

The BANK NIFTY also came under selling pressure along with the broader markets, closing below the lows of the previous three sessions. The index formed a bearish candle on the daily chart, indicating weakness.

As shown on yesterday's 15-minute chart, the BANK NIFTY traded within 52,800 and 52,000, protecting the 52,000 level on the weekly options expiry..

For the upcoming sessions, BANK NIFTY has immediate support around 52,000 mark and has formed a bearish candle near its crucial support zone. Traders should monitor the price action around 52,000 ,as the break of this level will indicates further weakness. Conversely, if index rebounds, negates the bearish candle and closes around 52,500, it may become range-bound.

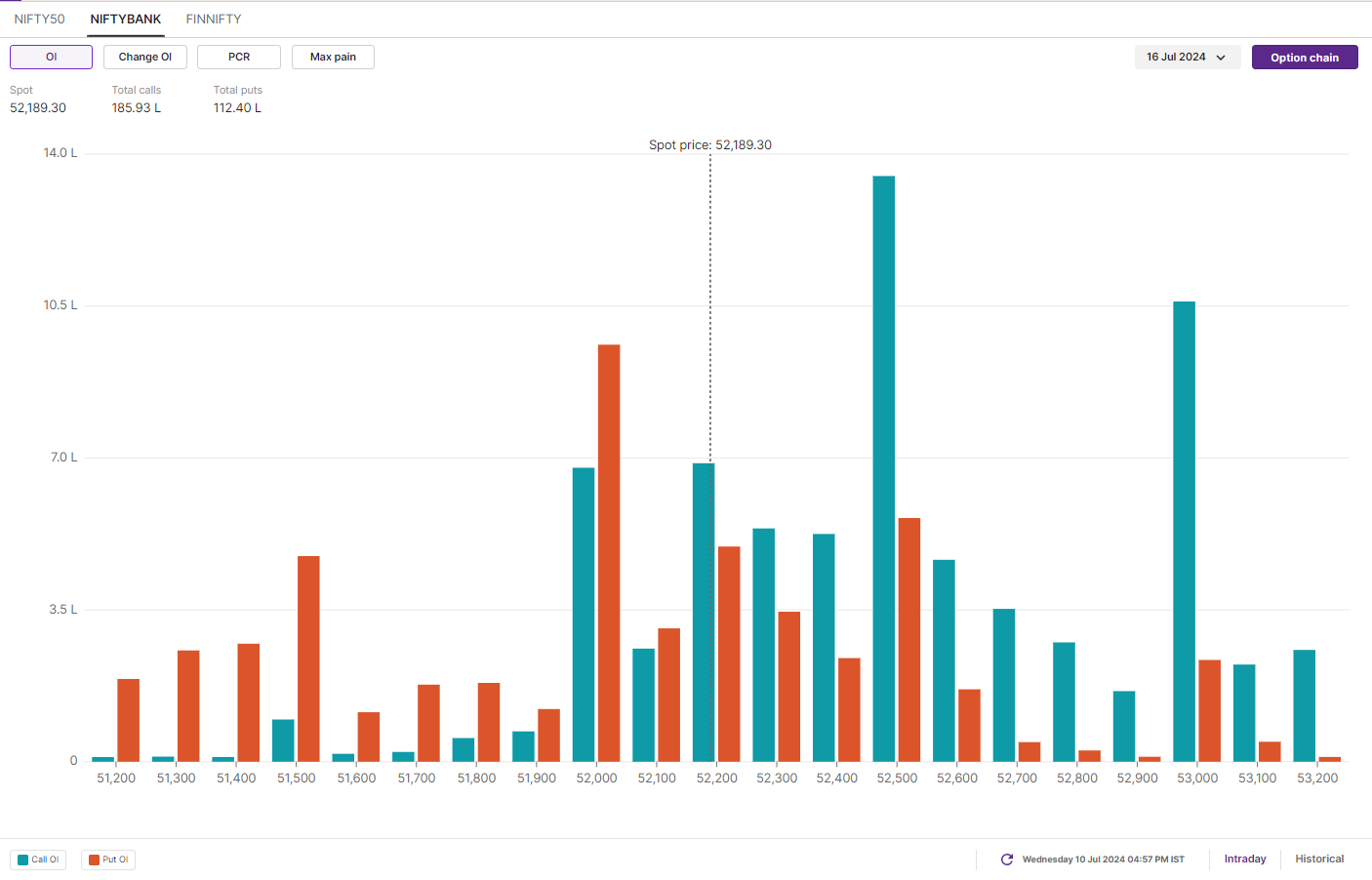

The initial open interest build-up for the 16 July expiry has maximum call build-up at 52,500 and 53,000 strikes. These levels will act as resistance zone for the BANK NIFTY. Meanwhile, the put base is concentrated at 52,000 and 51,000 strikes, which will act as immediate support for the index.

FII-DII activity

Stock scanner

Under F&O Ban: Aditya Birla Fashion and Retail, Balrampur Chini Mills, Bandhan Bank, Chambal Fertilisers, Gujarat Narmada Valley Fertilisers & Chemicals, RBL Bank, Indian Energy Exchange, India Cements, Indus Towers and Piramal Enterprises

Out of F&O Ban: N/A

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story