Market News

Trade setup for 1 August: NIFTY50 eyes 25,000 as US Fed hints at September rate cut

.png)

5 min read | Updated on August 01, 2024, 08:51 IST

SUMMARY

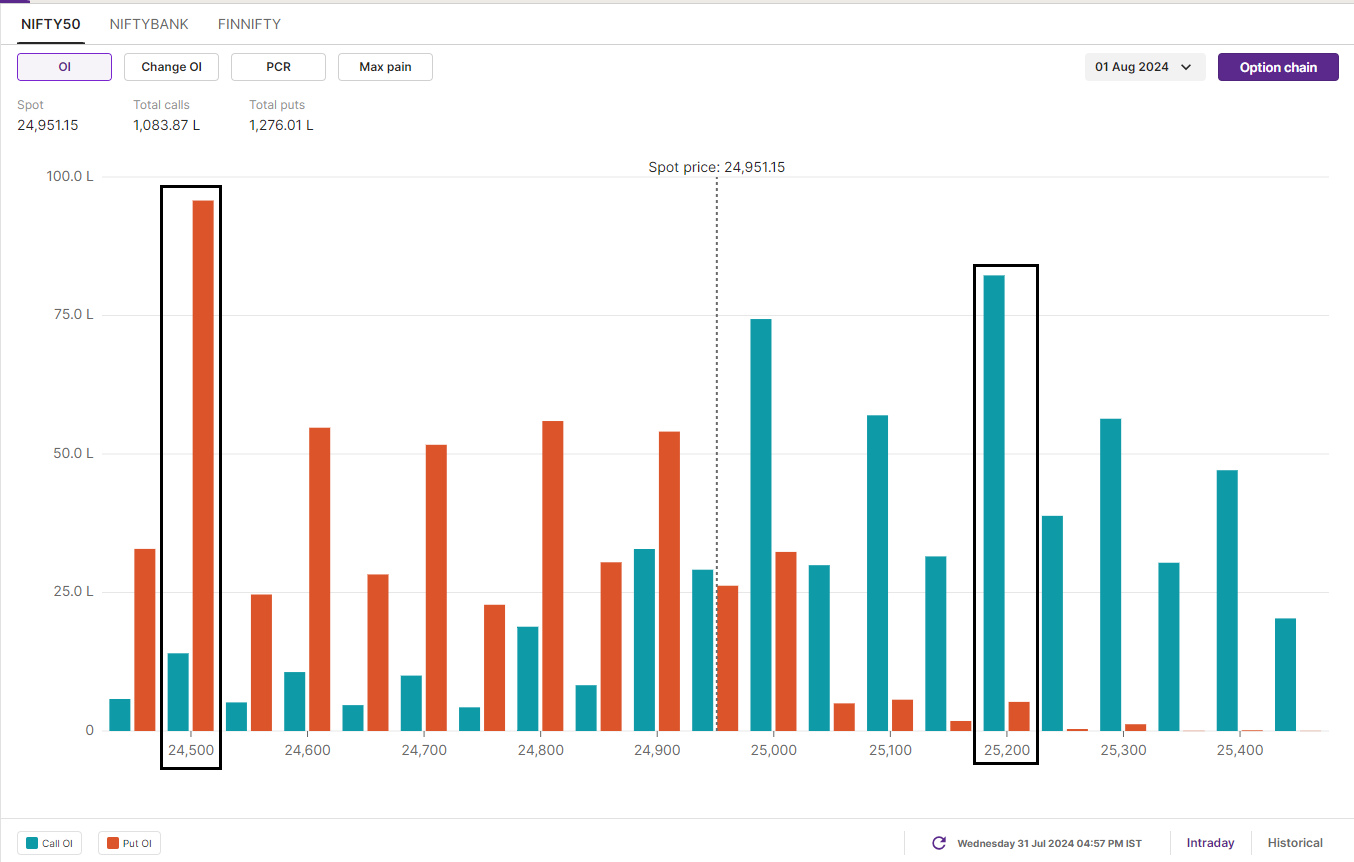

According to open interest data, NIFTY50 has immediate support in the 24,700 to 24,800 zone for today's expiry. Significant open interest additions at the 25,200 call strike indicate resistance around this level.

Stock list

Despite mixed cues from the global market, the NIFTY50 started the Wednesday’s session on a positive note and closed at record high levels.

Asian markets update at 7 am

The GIFT NIFTY is up 0.2%, indicating a positive and a gap-up start above the 25,000 mark for the NIFTY50 today. In contrast, the other Asian markets are trading lower. Japan’s Nikkei 225 has dropped by more than 2%, and Hong Kong’s Hang Seng index slipped by 0.2%.

U.S. market update

- Dow Jones: 40,842 (▲0.2%)

- S&P 500: 5,522 (▲1.5%)

- Nasdaq Composite: 17,599 (▲2.6%)

US equities rallied on Wednesday as markets digested the Federal Reserve's latest decision to keep interest rates on hold. Fed Chairman Jerome Powell stated in his press conference that a rate cut in September could be on the table. He said that the committee's broad view is that the economy is moving closer to the point where it will be appropriate to lower our federal funds rate.

Meanwhile, technology stocks staged a comeback on Wednesday, buoyed by a return of optimism in the semiconductor sector. Shares of Nvidia jumped 12% as better-than-expected results from rival Advanced Micro Devices (AMD) stoked optimism. In addition, Meta Platforms surged 4% in after-hours trading as the company's Q2 revenue and earnings per share beat Street estimates.

NIFTY50

- August Futures: 25,013 (▲0.4%)

- Open Interest: 6,16,312 (▲5.4%)

Despite mixed cues from the global market, the NIFTY50 started the Wednesday’s session on a positive note and closed at record high levels. The index traded remained range-bound and tarded with a positive breadth whole day, aided by broad-based buying across sectors.

On the daily chart, the NIFTY50 index formed a positive candle and closed near the psychologically crucial 25,000 level. As highlighted in our previous blogs, the broader trend of NIFTY50 remains bullish as long as it stays above 24,700 on the daily chart. Unless the index slips below 24,800, traders may utilise the dip to add to their positions with the ongoing trend.

As shown in the chart below, the NIFTY50 index was forming a symmetrical triangle pattern on the 30-minute time frame. This pattern typically indicates a period of consolidation before a breakout. A breakout above the trendline suggests a continuation of the ongoing trend, while a breakdown below could signal a reversal. Before initiating any strategy, traders should monitor the initial price action around the pattern to confirm the breakout or breakdown.

Open interest (OI) data for today's expiry highlights the maximum put base at 24,500 and 24,400 strikes, making these levels a key support zone for the index. On the other hand, the significant call OI base was placed at the 25,200 and 25,500 strikes. This suggests that the market may encounter resistance around these zones.

BANK NIFTY

- August Futures: 51,815 (▲0.1%)

- Open Interest: 1,61,048 (▲24.9%)

The BANK NIFTY consolidated its gains for the second day in a row, forming another inside candle on the daily chart. The index tarded within a narrow range of approximately 400 points on the monthly expiry of its futures and options contract, remaining in the contractionary phase.

As shown in the chart below, the index has been consolidating between its 20-day and 50-day moving averages (DMAs) for the past five trading sessions. The formation of consecutive inside bar candles suggests that the index may soon expand its range and provide a directional move in the upcoming sessions. In this scenario, traders should wait and monitor for a break of either the 20 or 50 DMA on a closing basis to gain further directional insights.

Meanwhile, the initial open interest (OI) build-up for the 7 August expiry is scattered and does not provide significant clues. Currently, the index has the highest call and put open interest base at 51,500 strike. Traders should wait for the fresh open interest build-up around the weekly close of the index to gain clear insights of the positioning.

FII-DII activity

Stock scanner

Short build-up: IndiaMART InterMESH and Birlasoft

Under F&O ban: Granules India and India Cements

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story