Market News

Stock Market Weekly Recap: SENSEX, NIFTY close flat in Diwali week on profit taking in bluechips, FII outflows

.png)

4 min read | Updated on November 01, 2024, 16:37 IST

SUMMARY

In the week, SENSEX slipped by 13 points while NIFTY edged up 24 points to end its four-week slide. Sustained inflows from DIIs and a decline in oil prices restricted losses in key indices.

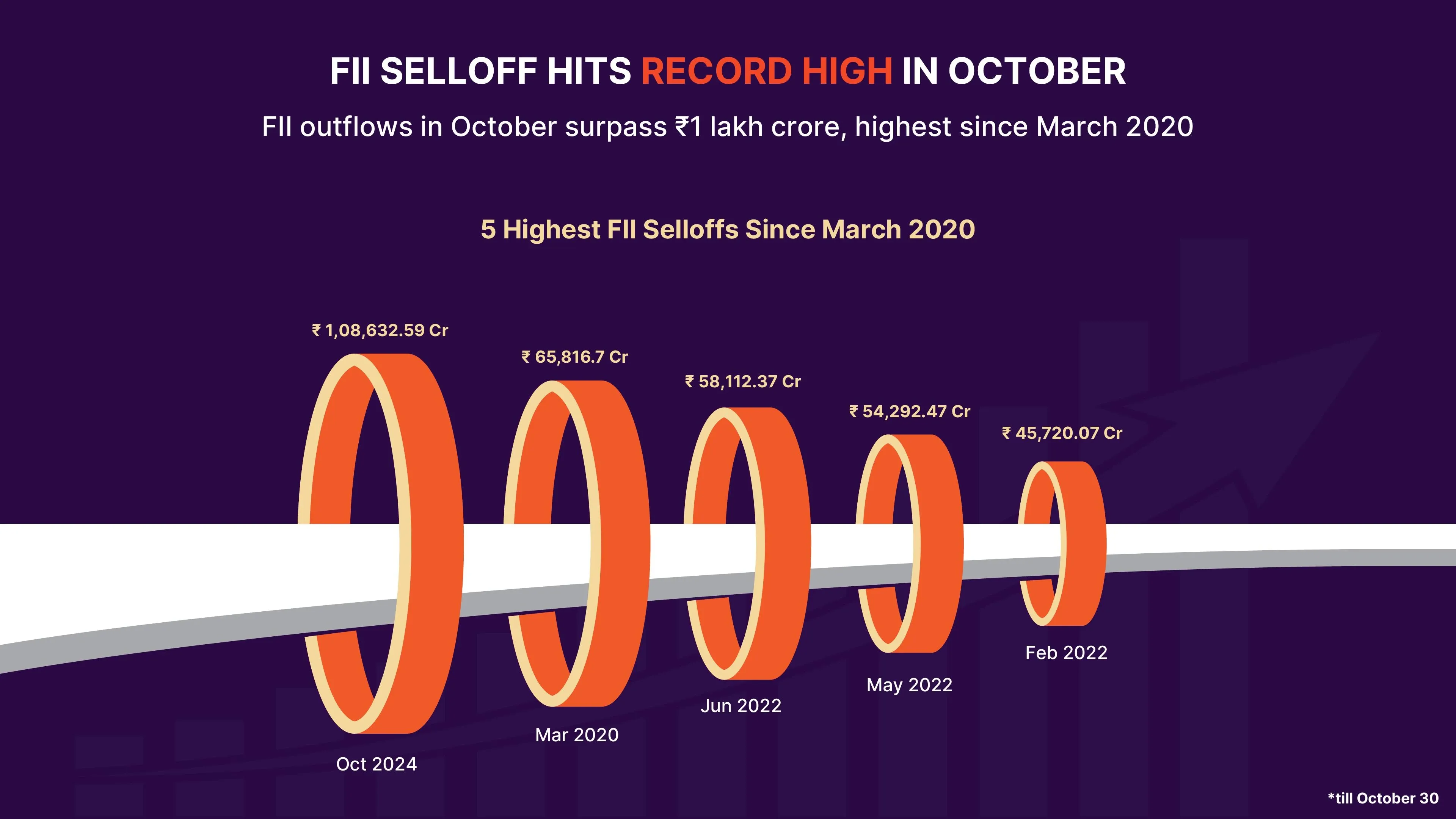

- FII outflows surpassed ₹1 lakh crore in October, the highest since March 2020.

- NIFTY, SENSEX tanked more than 6% in October.

- PSU Bank and Media indices rallied around 7% this week.

- Waaree Energies shares extended gains this week, rising 80% compared to IPO price.

Hi folks! We are back with a quick recap of all the actions on the D-Street this week marked by Diwali festivities.

Benchmark indices SENSEX and NIFTY closed flat in the Diwali week due to profit taking in bluechips and record FII outflows.

In the week, SENSEX slipped by 13 points while NIFTY edged up 24 points to end its four-week slide. Sustained inflows from DIIs and a decline in oil prices restricted losses in key indices.

However, the recovery was short-lived as stock indices dropped on Wednesday and Thursday due to concerns over sluggish corporate commentary and potential earnings cuts. Weaker than expected results by Maruti Suzuki triggered selling in auto stocks. SENSEX dropped 980 points in the two days on persistent FII selling. NIFTY tanked 270 points to retreat to 24,200 level. SENSEX closed at 79,389.06 while NIFTY settled at 24,205.35 on Thursday.

SENSEX dropped a whopping 4,910 points, or 6.19%, in October month due to FIIs’ flight from Indian markets. NIFTY tanked 1,605 points, or 6.63%, in October.

FII outflows surpass ₹1 lakh crore, highest since March 2020

Weaker than expected financial performance in the second quarter of FY 2024-25 and rich valuations of corporates have triggered selling by foreign institutional investors (FIIs) in Indian equities. FIIs withdrew more than ₹1 lakh crore in October, marking the highest outflows in a month since Covid period in March 2020.

Domestic investors, however, have come to the rescue putting in more than ₹1 lakh crore to beat FIIs in total ownership holding charts of Indian corporates.

Broader markets buck trend, PSU Bank, Media shares rally up to 7%

Broader markets bucked the trend with NIFTY midcap indices gaining up to 2% and NIFTY smallcap rising up to 6%. Among sectoral indices, PSU Bank and Media rallied around 7% this week. The Realty index gained 3%. On the other hand, auto, consumer durables and IT shares declined.

Tech Mahindra, HCL Tech drop after weak US earnings

HCL tech fell the most on Thursday by 3.61%. Tech Mahindra dropped 3.58%, TCS by 2.68%, Infosys by 2.17% and Wipro by 2.15%. NIFTY IT index dropped 4% this week.

L&T rises 6% after better than expected Q2 results

Larsen & Toubro shares rallied around 6% on Thursday after the company reported a 5% growth in consolidated profit after tax for the September quarter. Revenue rose by 21% to ₹62,655.85 crore.

Waaree Energies gains for 4th day; gains 80% from IPO price

Solar panel producer Waaree Energies soared more than 12% on Thursday to hit a record high of ₹2,758.70 per share on NSE. The stock extended gains to the fourth straight day. After a bumper debut of 70% premium, the stock has zoomed over 80% against the issue price of ₹1,503 per share.

Cipla shares rally 10% after USFDA action

Pharma major Cipla rose by nearly 10% on Thursday, recovering its earlier losses after the US FDA classified its Goa manufacturing facility as “Voluntary Action Indicated” (VAI). The status would pave the way for the launch of Abraxane generic and other niche products.

What lies ahead?

As aggressive selling by FIIs due to a shift to China has hit Indian equities’ appeal, better corporate earnings and fair valuations would restrict the outflows. Earnings by Dr Reddy’s, Tata Steel, Mahindra & Mahindra, and SBI next week would dictate the trend.

About The Author

Next Story