Market News

Stock market crash: Mid, small-cap indices down 21% from record highs, SENSEX, NIFTY50 down 12%; what lies ahead?

4 min read | Updated on February 17, 2025, 12:03 IST

SUMMARY

Data-wise, the S&P BSE Midcap index is currently down 20% from its record high of 49,701.15 touched on September 24, 2024, while the BSE SmallCap index is down 21% from its record peak of 57,827.69, touched on December 12, 2024. (as of Friday, February 14 close). Meanwhile, the benchmarks, SENSEX and NIFTY50, are down 12% from their all-time high levels.

FII sold Indian equities worth over ₹78,000 crore in January 2025.

Worries over high valuations and subdued corporate earnings, coupled with geopolitical tensions and the exodus of FIIs from the Indian market, the strengthening of the US dollar, and trade uncertainties after Donald Trump took charge as the US President, are the key factors behind the sell-off in the Indian market.

Data-wise, the S&P BSE Midcap index is currently down 20% from its record high of 49,701.15 touched on September 24, 2024, while the BSE SmallCap index is down 21% from its record peak of 57,827.69, touched on December 12, 2024. (as of Friday, February 14 close).

Meanwhile, the benchmarks, SENSEX and NIFTY50, are down 12% from their all-time high levels.

According to a recent note by Tata Mutual Fund, India’s outperformance has reduced due to earning downgrades in FY25 and the China stimulus. It also added that the corporate earnings downgrade risk has increased.

FII sold Indian equities worth over ₹78,000 crore in January 2025, and so far in February, the outflow stands at ₹21,272 crore, driven by global tensions after the US imposed tariffs on imports.

With these, the total outflow by FPIs has reached ₹1 lakh crore in 2025 so far, data with the depositories showed.

These developments reignited fears of a potential global trade war, prompting FPIs to re-evaluate their exposure to emerging markets, including India, Srivastava added.

The Tata MF report added that FIIs remained net sellers across almost all sectors in January, except for sectors such as chemicals, media, and telecom.

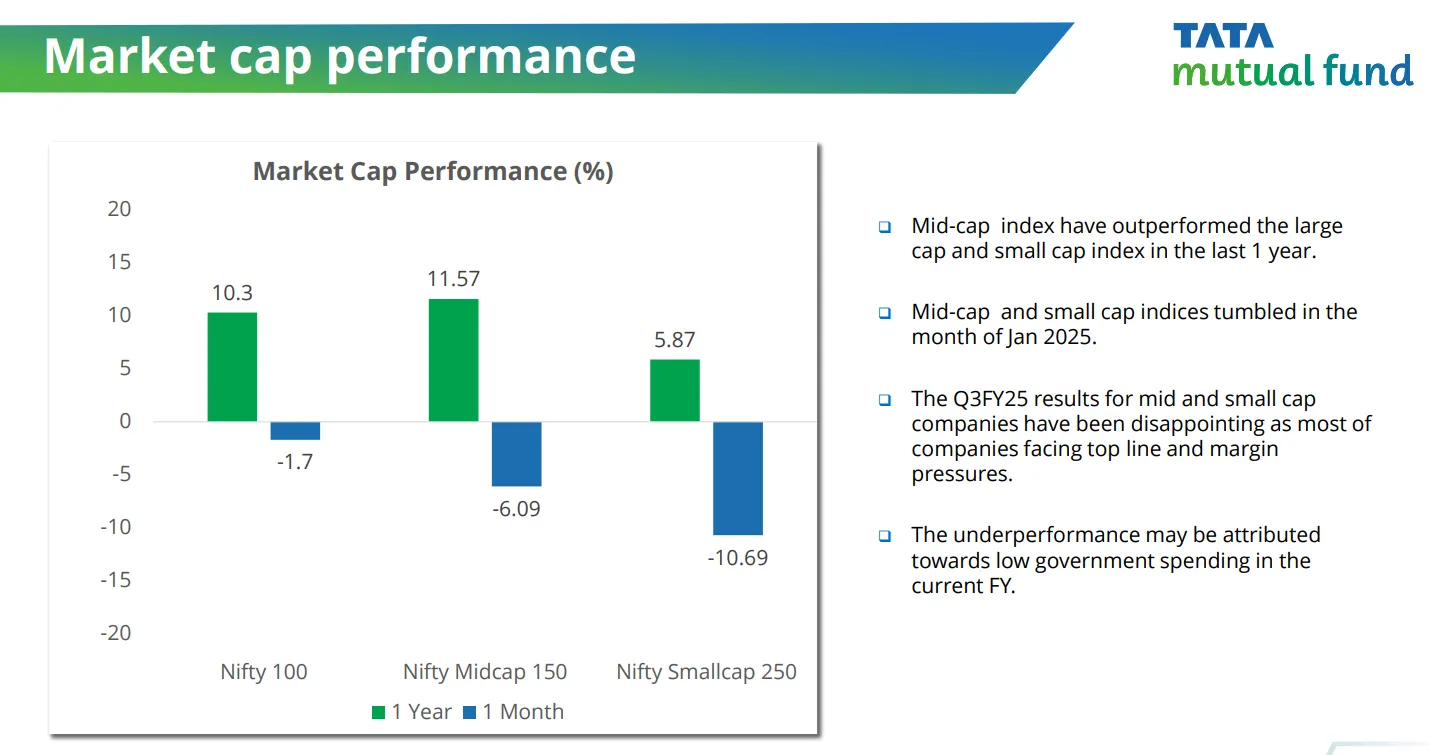

Broader market indices performance

Mid-cap and small-cap indices tumbled in January 2025. The Q3FY25 results for mid- and small-cap companies have been disappointing as most companies are facing top-line and margin pressures.

The underperformance may be attributed to low government spending in the current fiscal year.

What experts say

Experts suggest investors should adopt active and cautious exposure to mid- and small-caps to capitalise on investment cycle-led economic growth. They note that the risk-reward is more in favour of large caps.

-

Banks upgrade cycle likely in FY26. The Pharma/Healthcare upgrade cycle is still underway;

-

Sectors with topline risk (e.g. IT, FMCG) have stabilised; margins are to be supported by lower input costs or easing attrition and wage pressure, the Tata MF report added.

-

Capital goods/Manufacturing led the positive earning upgrade cycle last 12 months. Execution and margin risks will weigh on valuations in CY25. Sentiments weakened as the GOI focus shifted from capital expenditure to a consumption-driven approach.

-

Slowing urban consumption could get lifted post-tax cuts in the Budget. In contrast, rural consumption is picking up from a low base, albeit gradually.

The biggest risk to the market is global trade policies and commodity prices, including crude oil, they note.

Shridatta Bhandwaldar, Head of Equities at Canara Robeco Mutual Fund, says, "Given the current market dynamics, we have moderated our cautious stance. For investors with a one-to-two-year horizon, large caps offer fair valuations, while mid- and small caps require a longer-term view."

The fund manager further says that their portfolio remains barbell, with overweight positions in consumer discretionary, telecom, aviation, hospitals, hotels, and select retail on the consumption side, and industrials and auto on the cyclical side.

The IT sector remains equal weight. "Overall, while near-term challenges persist, the market offers opportunities for incremental allocation, especially in large caps, as earnings recovery unfolds over the next 18 months," Bhandwaldar adds.

About The Author

Next Story