Market News

NIFTY50 consolidates with second doji, finds footing at 24,500

.png)

2 min read | Updated on July 16, 2024, 19:11 IST

SUMMARY

Based on open interest data, the index saw significant call and put open interest at the 26,600 strike - indicating range-bound activity with immediate support around the 24,500 level.

Stock list

NIFTY50 consolidates with second doji, finds footing at 24,500

Markets extended the winning momentum to the third day in a row and ended yet another range-bound session in the green. The NIFTY50 index gained 0.1% and ended the session at 24,613, while the SENSEX closed the session flat at 80,716.

Sectorally, Realty (+1.6%), FMCG (+0.9%) and IT (+0.5%) advanced the most, while Media (-1.0%), Pharma (-0.4%) and PSU Banks (-0.2%) witnessed profit booking.

After forming a doji candlestick pattern on 16 July, the NIFTY50 closed above the indecision pattern, signalling strength. However, the index has once again formed a doji pattern, reflecting investor indecision ahead of the Union Budget announcement next week.

Currently, the index is consolidating around the 23,600 mark after the breakout on 12 July. Immediate support is around 24,450. As long as the index stays above this level, the trend may remain positive.

-

Top gainer and loser in NIFTY50: Coal India (+3.0%) and Shriram Finance (-2.1%)

-

Broader markets traded in a narrow range, with both the NIFTY Midcap 100 index and the NIFTY Smallcap 100 index ending the day flat.

-

Top gainer and loser in NIFTY Midcap 100: Ponawalla Fincorp (+3.6%) and Oil India (-3.2%)

-

Top gainer and loser in NIFTY Smallcap 100: Natco Pharma (+5.9%) and IRCON (-3.2%)

Key highlights of the day

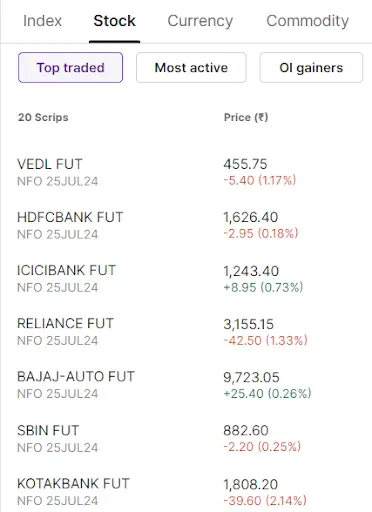

Top traded futures contracts

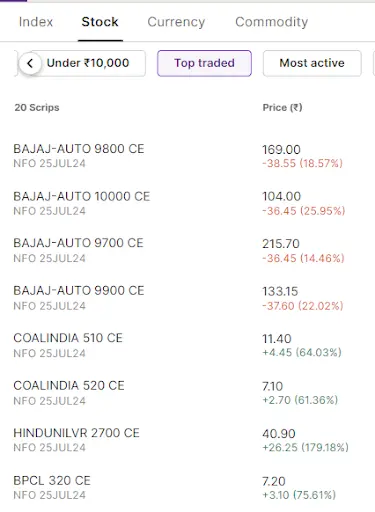

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Oil India, Alkem Laboratories, Ultratech Cement, L&T Finance and Cummins India

📈Open=Low (Bull power): Poonawalla Fincorp, Prestige, Coal India, Bharat Petroleum and Delhivery

🏗️Fresh 52 week-high: Hindustan Unilever, Godrej Properties, Marico, Oracle Financial Services Software and Indraprastha Gas

⚠️Fresh 52 week-low: N/A

See you on Friday!

About The Author

Next Story