Market News

NIFTY50 achieves 14th straight win, powered by banking sector

.png)

2 min read | Updated on September 03, 2024, 17:31 IST

SUMMARY

The BANK NIFTY regained its 50-day moving average and captured the 51,500 level on a closing basis. Ahead of its weekly expiry on September 4th, the index saw significant put build-up at the 51,500 and 51,000 levels, making them immediate support zones for the index.

NIFTY50 achieves 14th straight win, powered by banking sector

The markets extended their winning streak for the 14th consecutive day, closing near the opening levels. A rebound in banking stocks, coupled with gains in the FMCG sector, helped the NIFTY50 index maintain its gains above the 25,000 mark.

The NIFTY50 experienced weakness due to declines in the Metals, Real Estate, and Oil & Gas sectors, each of which fell by 0.5%.

After a flat start, the NIFTY50 index traded in a tight range of around 100 points and remained lacklustre. For the upcoming sessions, the index has immediate support at the 25,000 and 25,100 levels, while resistance remains at the 25,350 level. Traders are advised to monitor the price action around these levels. A close below or above these levels will provide directional clues.

-

Top gainer and loser in NIFTY50: SBI Life (+1.7%) and Bajaj Finance (-1.3%)

-

The broader markets outperformed their benchmark peers, with the NIFTY Mid Cap 100 index gaining 0.2% and the NIFTY Small Cap 100 index gaining 0.4%.

-

Top gainer and loser in NIFTY Midcap 100: Mazagon Dock Shipbuilders (+6.0%) and Zee Entertainment (-3.5%)

-

Top gainer and loser in NIFTY Smallcap 100: Raymond (+5.1%) and Renuka Sugars (-2.1%)

Key highlights of the day

🚢Shipyard companies were in the spotlight on expectations of significant naval defence orders. According to reports, the Defence Acquisition Council plans to propose deals worth ₹1.3 lakh crore, including seven naval warships worth ₹70,000 crore.

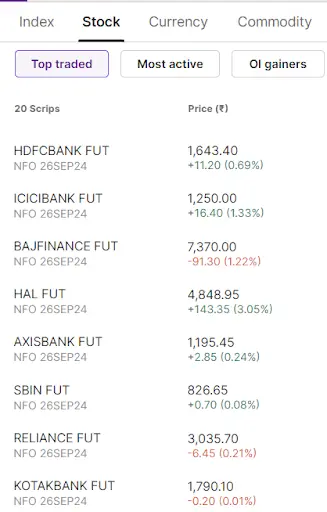

Top traded futures contracts

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Petronet LNG, Infosys, Bajaj Finance, Bharti Airtel, TVS Motor and IDFC First Bank

📈Open=Low (Bull power): Tata Chemicals, Nestle India, Jubilant FoodWorks, Grasim Industries and Lupin.

🏗️Fresh 52 week-high: Oracle Financial Services Software, Bajaj Holdings, Voltas, Kalyan Jewellers, SBI Life and Persistent Systems

⚠️Fresh 52-week-low: N/A

See you tomorrow!

About The Author

Next Story