Market News

Maruti Suzuki Q3 results: Check earnings preview and options strategy ahead of results

.png)

4 min read | Updated on January 29, 2025, 14:13 IST

SUMMARY

Ahead of its 27 February expiry, options market is implying a ±6.4% on Maruti Suzuki on either side. Meanwhile, from the technical point of view, shares of Maruti Suzuki are trading above all the key daily EMAs and is currently placed near the immediate resistance of ₹12,192.

Stock list

The carmaker's revenue from operations climbed to ₹38,492.1 crore for Q3 FY25

India’s leading passenger car manufacturer, Maruti Suzuki India, is set to announce its December quarter results on January 29, 2025. Analysts expect the company to deliver healthy earnings growth for Q3 FY25, driven by a strong product mix and solid volume growth.

Revenue for the quarter is projected to rise 14-16% year-on-year to ₹37,900–₹38,500 crore, while net profit is estimated to increase by 11-15% YoY to ₹3,490–₹3,600 crore, supported by robust festive season sales.

In comparison, Maruti Suzuki recorded standalone revenue of ₹33,309 crore in Q3 FY24 and ₹37,203 crore in Q2 FY25, with net profits of ₹3,130 crore and ₹3,069 crore, respectively. However, the EBITDA margin for Q3 FY25 is expected to shrink by 40-60 basis points due to elevated discounts offered during the quarter.

Ahead of the results, Maruti Suzuki shares are trading 0.72% higher at ₹12,210 per share on Wednesday, January 28. So far this month, Maruti Suzuki shares are trading 12.4% higher.

Technical View

Shares of Maruti Suzuki reclaimed its weekly 21 and 50 exponential moving averages during the week ending 17 January, indicating positive structure as per the weekly chart. Additionally, the technical structure of the daily chart remains positive as Maruti Suzuki is currently trading above all the key exponential moving averages like 21, 50 and 200.

Options outlook

Open interest data for the 27 February expiry shows a high concentration of call and put option at 12,000 strike, suggesting range-bound movement around this level. Additionally, significant call open interest was also seen at 12,500 and 13,000 strike, hinting at resistance for Maruti around these levels.

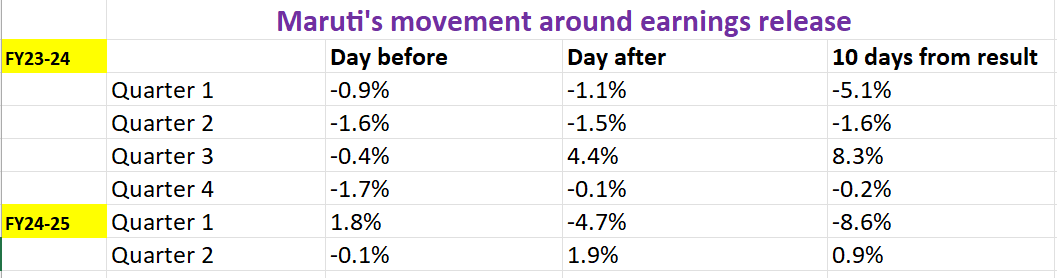

Maruti Suzuki's 27 February’s at-the-money ( ATM ) strike was 12,100, with both call and put options priced at ₹774. This implies an expected price movement of ±6.4%, leaning up to the 27 February’s expiry. To make more informed trading decisions, let's look at Maruti Suzuki’s historical price behaviour during previous earnings announcements.

Options strategy for Maruti Suzuki

Given the implied movement of ±6.4% from the options market ahead of the 29 February expiry, traders can consider using long and short Straddle strategies to capitalise on the anticipated volatility and potential price swings.

Put simply, a long straddle involves buying both an at-the-money (ATM) call and put option of Maruti Suzuki with the same strike price and expiry dates. This strategy benefits when the share price moves significantly more than ±6.4% in either direction.

A short straddle, on the other hand, involves selling an ATM call and put option with the same strike price and expiry dates. In this approach, strategy benefits shares of Maruti Suzuki remain relatively stable and move less than ±6.4% before the contracts expire.

Traders looking to implement bullish or bearish options strategies can explore directional spreads, a slightly more advanced approach. For a bullish outlook, they can consider a bull call spread, which involves purchasing a call option and simultaneously selling a higher strike call option with the same expiry. Similarly, for a bearish perspective, traders can opt for a bear put spread by buying a put option and selling a lower strike put option with the same expiry.

Interested in learning more about Straddles? Check out our UpLearn educational content for a deeper dive. If you're keen on exploring more historical earnings price data like the example above, join our community and get in touch—we'd be happy to share it with you!

About The Author