Market News

Market highlights | NIFTY50 index closes below September month low, surrenders 100 DMA

.png)

2 min read | Updated on October 22, 2024, 19:01 IST

SUMMARY

NIFTY50 index broke out of its 10-day consolidation, closing below the crucial 24,700 level, which marked September's key swing low. Additionally, it surrendered the 100-day moving average, signalling potential weakness and further downside risk ahead.

Stock list

NIFTY50 index closes below September month low, surrenders 100 DMA

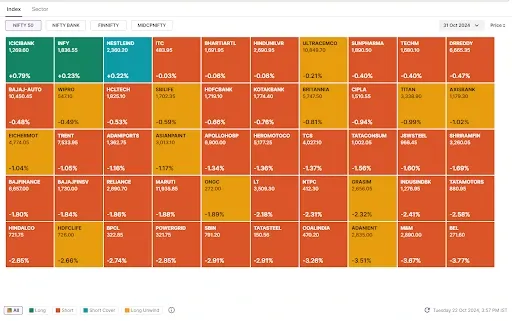

Markets extended the losing streak and declined nearly 2% from the day’s high amid broad based sell-off across sectors. The NIFTY50 index closed below the crucial swing low of 24,700, indicaiting weakness in the upcoming sessions.

It was a see of red across sectors with all the major sectoral indices ending the day in the red. PSU Banks (-4.1%) and Metals (-3.0%) declined the most.

On the daily chart, the NIFTY50 index closed below the crucial swing low of 24,700, which also coincides with the low of September month. Additionally, the index also surrendered its 100- day moving average on closing basis, indicating weakness in the upcoming sessions.

As per the open interest data, the NIFTY 50 index has immediate resistance around 25,000 and 24,800 strikes, while the support was seen at 24,000 level.

-

Top gainer and loser in NIFTY50: ICICI Bank (+0.7%) and Bharat Electronics (-3.7%)

-

Top gainer and loser in NIFTY Midcap 100: Hindustan Zinc (+2.2%) and Mazagon Dock Shipbuilders (-9.8%)

-

Top gainer and loser in NIFTY Smallcap 100: IndiaMART InterMESH (+0.6%) and Aditya Birla Real Estate (-9.4%)

Key highlights of the day

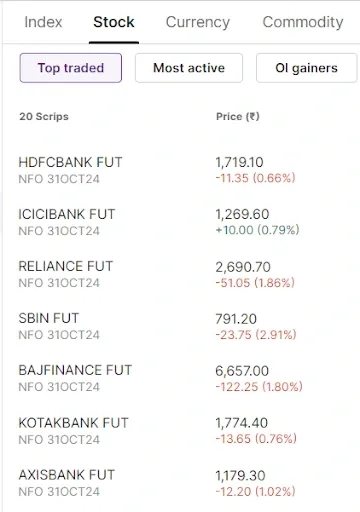

Top traded futures contracts

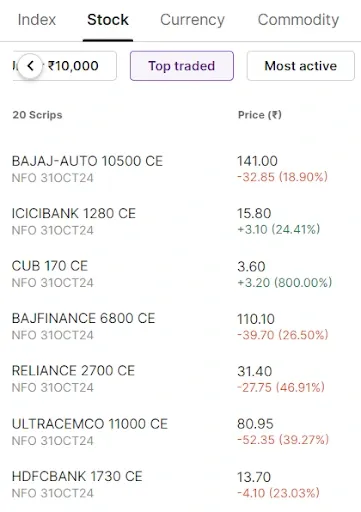

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Canara Bank, IREDA, Siemens, IRCTC and Tata Steel

📈Open=Low (Bull power): Tube Investments of India and Shree Cements

🏗️Fresh 52 week-high: Torrent Power

⚠️Fresh 52-week-low: IndusInd Bank and IDFC First Bank

See you tomorrow!

About The Author

Next Story