Market News

Market highlights| NIFTY50 breaks below 50-day moving average, closes below two week low

.png)

3 min read | Updated on October 04, 2024, 19:34 IST

SUMMARY

The options data for the NIFTY50’s 10 October expiry has significant call base at 26,000 strike. This indicates that the index may face resistance around this level during upcoming sessions.

NIFTY50 breaks below 50-day moving average, closes below two week low

Markets extended their downtrend and ended the day in the red for the fifth day in a row. The NIFTY50 index, on the back of geopolitical tensions, rising crude oil prices and selling by foreign investors, slipped below its key 50-day moving average and closed near the day's low.

Except for PSU Banks (+0.5%) and IT (+0.3%) all, the major sectoral indices ended the day in red and witnessed profit-booking.

The technical structure of the NIFTY50 has turned bearish, as it dropped below key support levels on the daily chart, forming a large bearish candlestick. The index ended the week below two-week low, signalling further downside potential.

Experts warn that the ongoing tensions between Israel and Iran and rising crude oil prices could increase market volatility. The next critical support zone lies between 24,700 and 24,800, while 25,600 will act as a resistance level in the coming sessions.

-

Top gainer and loser in NIFTY50: Infosys (+1.5%) and Mahindra & Mahindra (-3.5%)

-

Top gainer and loser in NIFTY Midcap 100: Oil India (+5.0%) and Mahindra and Mahindra Financial Services (-6.5%)

-

Top gainer and loser in NIFTY Smallcap 100: 360 One Wam (+4.9%) and Chambal Fertilisers (-5.9%)

Key highlights of the day

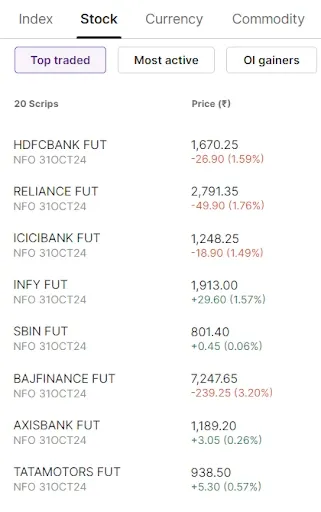

Top traded futures contracts

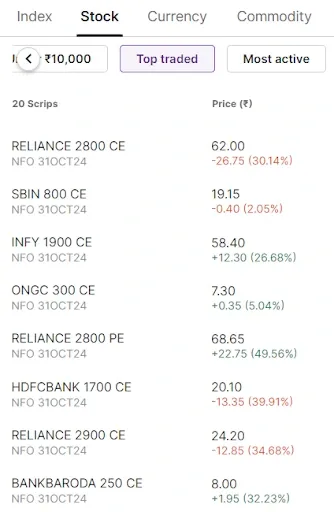

Top traded options contracts

4 trading insights from NIFTY 200🔍

📉Open=High (Bear power): Godrej Properties, Avenue Supermarts (DMART), Tube Investments of India, Colgate Palmolive and Ashok Leyland

📈Open=Low (Bull power): Tech Mahindra, Wipro and Titan

🏗️Fresh 52 week-high: Dr Lal Pathlabs, Info-Edge (Naukri) and JSW Steel

⚠️Fresh 52-week-low: Vodafone-Idea

See you on Monday!

About The Author

Next Story