Market News

Expiry day trade setup: Can NIFTY50 hold 200 EMA support on monthly expiry?

.png)

3 min read | Updated on March 27, 2025, 04:43 IST

SUMMARY

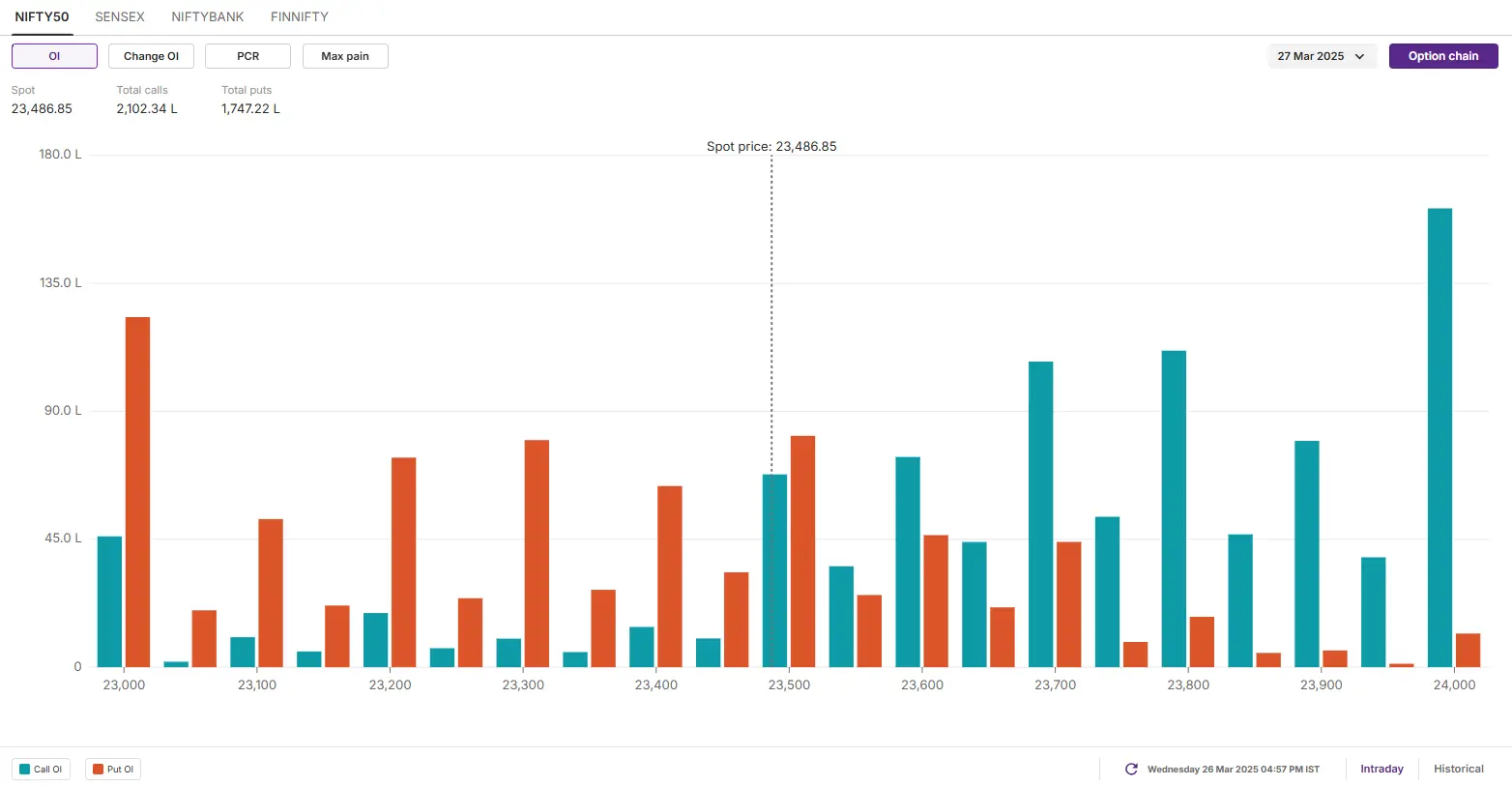

Options data for NIFTY50's monthly expiry shows significant call build-up at the 23,700 and 23,800 strikes, indicating potential resistance. Meanwhile, strong put build-up at the key 23,200 support suggests a crucial level for the index.

Stock Market: ज्यादातर एशियाई बाजारों में आज बिकवाली हो रही है।

Asian markets @ 7 am

- GIFT NIFTY: 23,500 (-0.13%)

- Nikkei 225: 37,578 (-1.18%)

- Hang Seng: 23,543 (+0.26%)

U.S. market update

- Dow Jones: 42,454 (-0.31%)

- S&P 500: 5,712 (-1.12%)

- Nasdaq Composite: 17,899 (-2.04%)

NIFTY50

- Max call OI: 23,700

- Max put OI: 23,300

- PCR: 1.03

- (5 strikes from ATM)

The NIFTY50 index saw profit-taking for the second consecutive day, snapping its seven-day winning streak. The index formed a bearish candle on the daily chart, closing below the doji candlestick pattern formed on the March 25th.

The index maintains a bullish structure on the daily chart, trading above key exponential moving averages (21, 50 and 200). These levels will act as immediate support. However, with the uncertainty surrounding the U.S. reciprocal tariffs to be announced on April 2nd, profit-taking has taken place near the 23,800 area - the February swing high - which now acts as immediate resistance.

Intraday range

On the 15-minute chart, the NIFTY50 index faces immediate resistance near 23,650 and support around 23,400. An open above or below these levels will provide traders further directional clues. Meanwhile, a drop below the key 23,200 support would signal weakness.

Options build-up

The open interest (OI) data for the March 27th expiry saw significant call build-up at 23,800 and 23,700 strikes, pointing to resistance for the index around this zone. On the other hand, the put base was observed at 23,300 and 23,200 strikes, suggesting support for the index around these levels. Additionally, 23,500 call and put options also witnessed significant OI build-up, indicating range-bound activity around this level.

Bearish outlook

Traders anticipating a break below the 23,400 zone can consider a long put strategy to capitalise on the bearish outlook. Buying an ATM put option with a 23,500 strike price would set the breakeven point at 23,429. This means the strategy will turn profitable if the NIFTY50 index declines by 0.2%.

Range-bound outlook

Traders anticipating a range-bound movement on the NIFTY50 with option build-up and base around 23,500 can plan an iron condor strategy. If you believe that the NIFTY50 index will remain stable and between the short put and short call strike prices, you’ll earn the maximum profit.

Conclusion

In simple terms, a long call strategy allows traders to take advantage of rising prices, while a long put takes advantage of falling prices. Options offer the flexibility to navigate different market conditions - bullish, bearish or range-bound. However, past performance isn't a guarantee of future results. Before implementing any strategy, it's important to assess the risks and have a clear plan for managing potential losses.

Disclaimer Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story