Market News

Budget day strategy: BANK NIFTY to break 11-day consolidation? Key levels to watch

.png)

4 min read | Updated on July 23, 2024, 07:33 IST

SUMMARY

Both NIFTY50 and BANK NIFTY have formed an indecision (doji) candle on the daily chart. With the volatility index rising above 15, traders should closely monitor the 20-day moving average of both indices. Additionally, a close above or below the doji will indicate the future direction of the trend.

Stock list

The BANK NIFTY extended its range-bound activity for the eleventh day and formed a doji candlestick pattern on the daily chart.

Asian markets update at 7 am

The GIFT NIFTY is up 0.1%, pointing to a flat-to-positive start for Indian equities today ahead of the Union Budget announcement. Meanwhile, other Asian markets are trading in positive territory. Japan's Nikkei 225 is up 0.5% and Hong Kong's Hang Seng Index advanced 0.2%.

U.S. market update

- Dow Jones: 40,415 (▲0.3%)

- S&P 500: 5,564 (▲1.0%)

- Nasdaq Composite: 18,007 (▲1.5%)

U.S. indices closed higher on Monday as technology stocks rebounded from their worst weekly loss since April. This comes ahead of the release of second quarter earnings from Alphabet (Google) and Tesla later today. Meanwhile, investors also digested the political news of President Joe Biden's withdrawal from the presidential race.

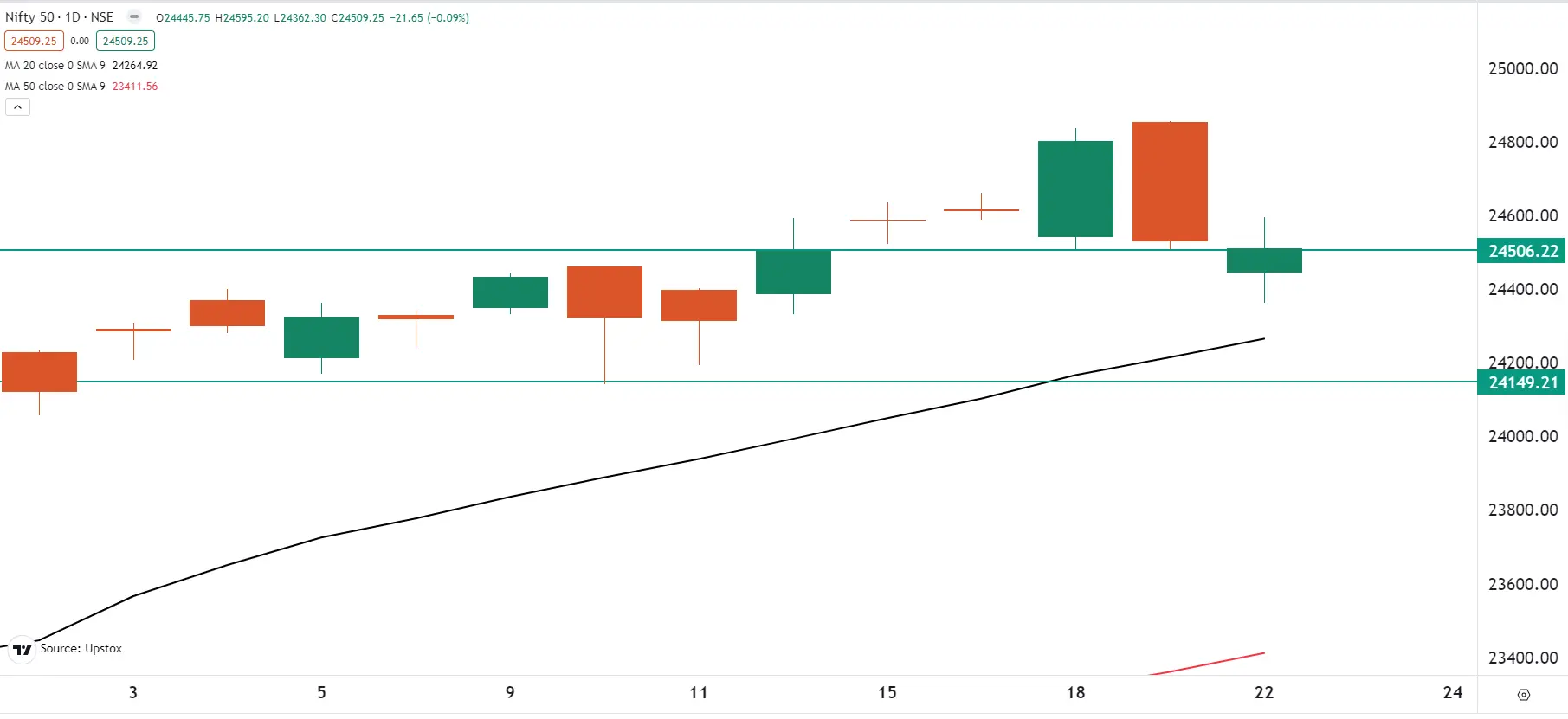

NIFTY50

- July Futures: 24,509 (▼0.0%)

- Open Interest: 5,30,384 (▼6.8%)

The NIFTY50 index started the day on a negative note and recovered all its losses in the first half of the session, ending the day flat. It fomed a doji candlestick pattern on the daily chart, reflecting indecision. However, the index protected the psychologically crucial 24,500 level on closing basis.

With the formation of doji candle, after a bearish reversal pattern signals increase in the volatility ahead of the Union Budget. The NIFTY50 index is currently consolidating between 24,800 and 24,200 zone. Until the index breaches these levels, the trend may remain sideways. A break of this range, both on intraday and closing basis will result in a directional move.

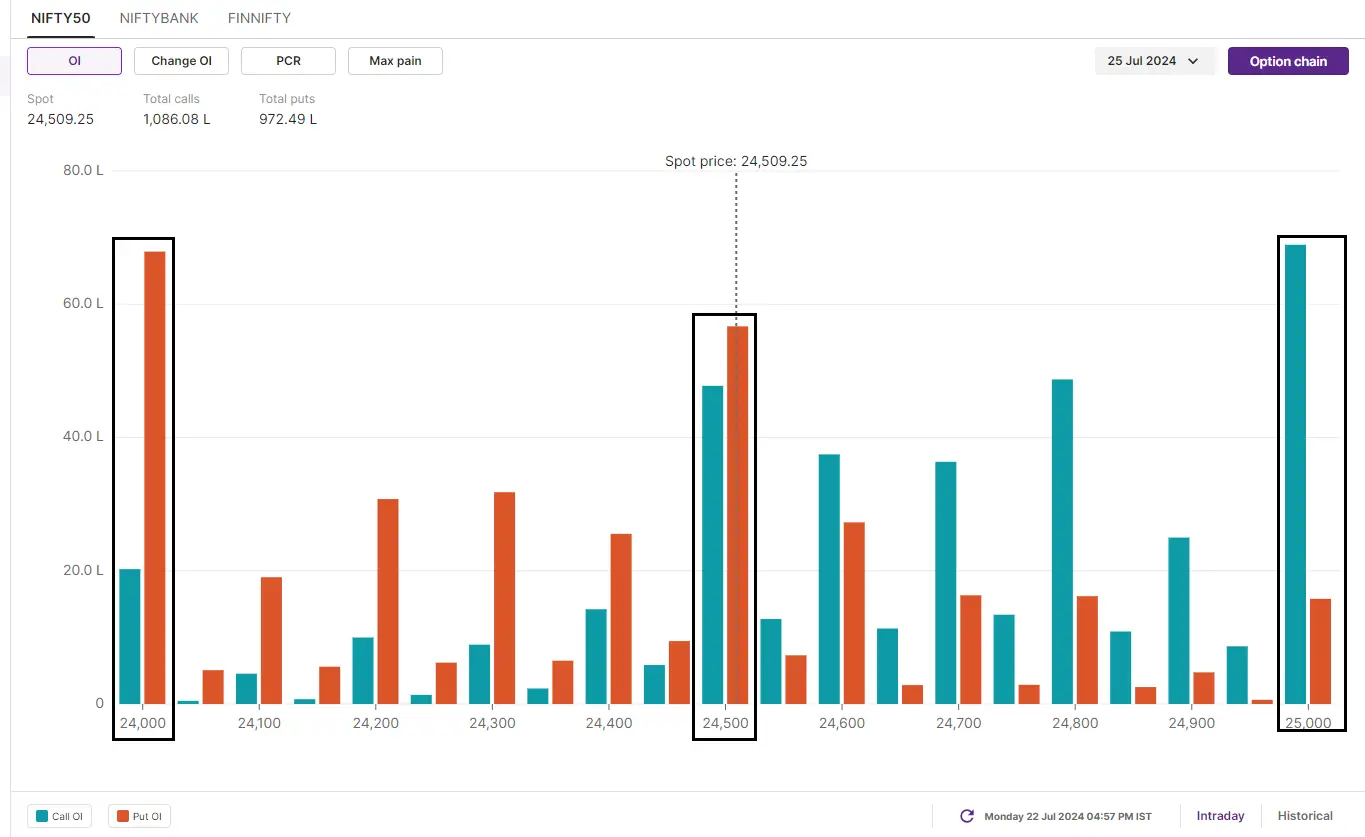

Meanwhile, the open interest for the 25 July expiry also indicates build-up of a range-bound position. The index has highest put base at 24,000 and call base at 25,000, pointing these as crucial levels before the 25 July expiry. Moreover, significant call and put base was also seen at 24,500 strike.

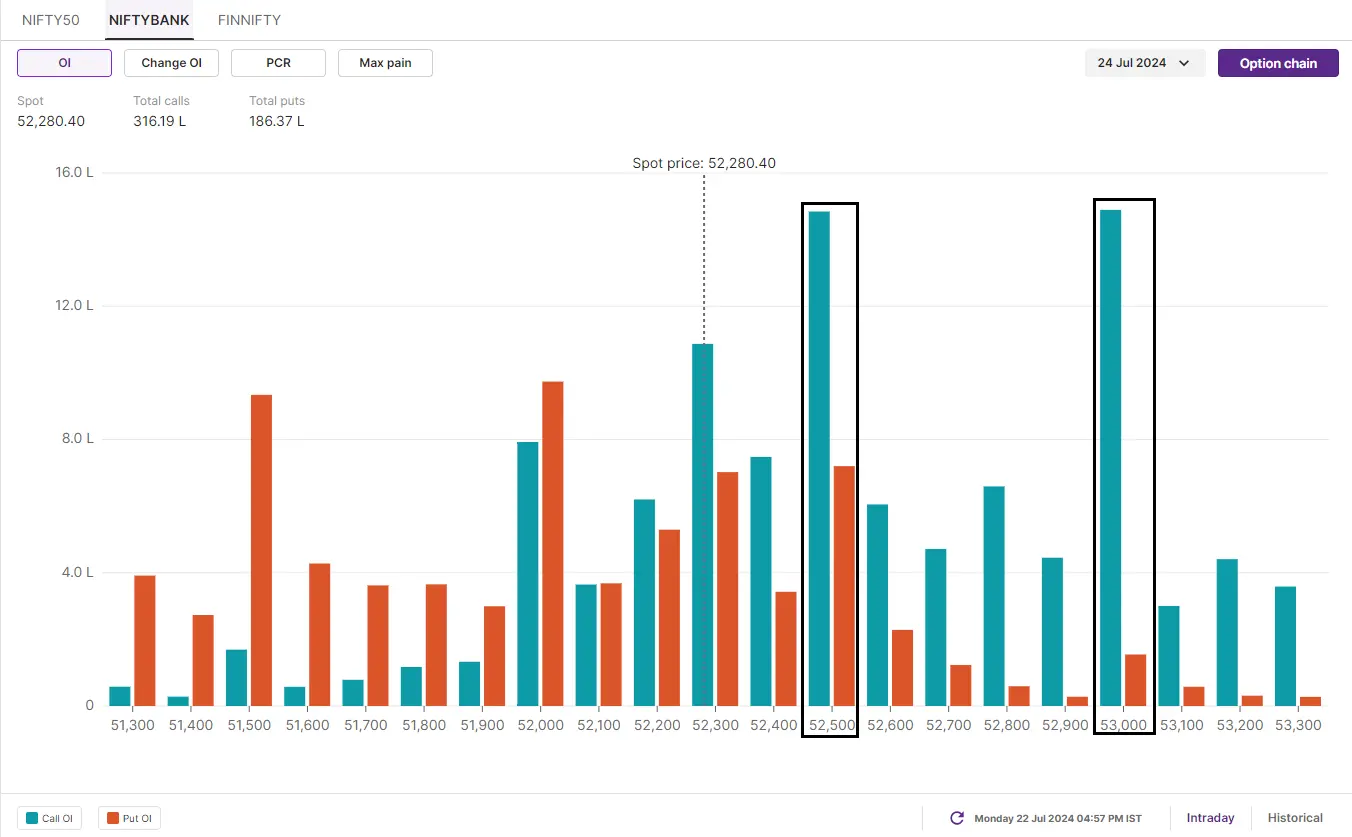

BANK NIFTY

- July Futures: 52,286 (▲0.0%)

- Open Interest: 1,19,775 (▼7.7%)

The BANK NIFTY extended its range-bound activity for the eleventh day and formed a doji candlestick pattern on the daily chart. Barring HDFC Bank, all major private sector banks came under selling pressure and ended the day in the red.

For the past eleven trading sessions, we have observed that the index has been trading between the 52,000 and 52,800 zones, failing to breach these levels on a closing basis. The formation of a doji candle indicates that investors are taking a wait-and-watch approach ahead of the Union Budget. Experts believe that the index may remain range-bound until it breaches this range. However, once the index breaks out of this range, a strong directional move is expected.

The BANK NIFTY's open interest of the 24 July expiry is heavily skewed in favour of the bears. The index has the highest call accumulation at the 53,000 and 52,500 strikes, suggesting that the index may face resistance in this area. On the other hand, puts have accumulated at the 52,000 and 51,500 strikes, suggesting support for the index in this area.

FII-DII activity

Stock scanner

Under F&O ban: Bandhan Bank, Chambal Fertilisers, Gujarat Narmada Valley Fertilisers & Chemicals, Hindustan Aeronautics, India Cements, Piramal Enterprises, Steel Authority of India

Out of F&O ban: Balrampur Chini Mills, GMR Infra, Hindustan Copper and Vedanta

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story