Market News

Q2FY25 pharma and healthcare preview: Diagnostics, pharma, and hospitals set to drive industry growth

.png)

4 min read | Updated on October 18, 2024, 13:24 IST

SUMMARY

The healthcare sector is expected to deliver strong Q2FY25 results, driven by pharma (Lupin, Sun Pharma), hospitals (Apollo, KIMS), diagnostics (Dr. Lal PathLabs), and retail pharmacy (Apollo).

Q2FY25 Pharma and Healthcare Preview: Diagnostics, Pharma, and Hospitals Set to Drive Industry Growth

The healthcare sector is gearing up for Q2FY25 results and is expected to maintain its positive trajectory, primarily driven by pharma, hospitals, diagnostics, and retail pharmacy businesses. Let’s take a deeper look at what to expect in the healthcare industry.

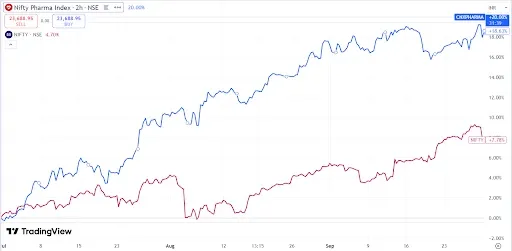

The Nifty Healthcare index jumped 17.80% and Nifty Pharma index jumped 18.63% in the July to September quarter, outperforming the benchmark NIFTY 50 (+8.08%).

Nifty Healthcare Index

Nifty Pharma Index

Top 5 Pharma Companies by market capitalisation

| S.No. | Name | CMP (in ₹) | Mcap in (₹ Crore) |

|---|---|---|---|

| 1 | Sun Pharma | 1,913 | 4,59,280 |

| 2 | Divi's Labs | 6,055 | 1,60,765 |

| 3 | Cipla | 1,552 | 1,25,358 |

| 4 | Torrent Pharma | 3,449 | 1,16,701 |

| 5 | Dr Reddy's Labs | 6,760 | 1,12,810 |

Top 5 Healthcare Companies by market capitalisation

| S.No. | Name | CMP (in ₹) | Mcap (in ₹ Crore) |

|---|---|---|---|

| 1 | Apollo Hospitals | 6,980 | 1,01,224 |

| 2 | Max Healthcare | 935 | 90,923 |

| 3 | Fortis Healthcare | 604 | 45,667 |

| 4 | Syngene International | 878 | 35,350 |

| 5 | Dr Lal Pathlabs | 3,345 | 27,980 |

(source: NSE, 18/10/2024)

Key Segments and What to Expect:

Pharma Sector

The pharma sector is anticipated to see healthy growth in sales and profitability, primarily driven by the Indian markets, while slightly offset by the US market. The US market may see a small dip in sales (compared to the previous quarter) due to the normalisation of sales from key products like gRevlimid (generic lenalidomide), a drug used to treat certain cancers.

The speciality segment is estimated to grow steadily, with companies like Lupin, Zydus, and Sun Pharma expected to benefit from this trend. However, competitive pressure remains, and players like Dr Reddy’s and Aurobindo may face challenges, as 50% and 47% of their revenues (respectively) come from the US market (according to Q1FY25).

Will the EBITDA Margins Grow?

EBITDA margins may expand due to lower input costs (decline in raw material prices) and growth in key markets like India. However, rising freight and R&D costs could limit EBITDA margin expansion.

Hospital Segment: Steady Growth with Margin Fluctuations

This segment is expected to grow fiercely, with an estimated YoY growth in the mid to high teens due to steady occupancy rates, an increase in ARPOB (Average Revenue Per Occupied Bed), and M&A (mergers and acquisitions) activity.

Key Insights:

- Max Healthcare has been active in M&A, with MD Abhay Soi recently stating that they see great opportunities in tier 2 and tier 3 cities for growth, aligning with their strategy to expand inorganically.

- Apollo Hospitals is expected to benefit from its decision to rationalise spending on Apollo 24/7 initiatives. Additionally, Apollo Hospitals is selling a 16.9% stake in its subsidiary Apollo Healthco to Advent International for Rs 2,475 crore (news in September 2024).

- KIMS is also expanding its footprint, having acquired Chalasani Hospitals (August 30, 2024) and leasing a new hospital facility in Kannur, Kerala (189-bed capacity), which should further support its growth.

Diagnostics

This segment is projected to grow steadily, with an estimated low teens YoY growth, supported by higher patient volumes and a stable competitive landscape. Companies like Dr Lal PathLabs and Thyrocare are expected to expand their reach.

Q1FY25 Concall Highlights:

- Dr. Lal PathLabs: Focuses on expanding lab infrastructure and enhancing technology capabilities. The NCLT Allahabad Bench sanctioned the Scheme of Amalgamation between two of its subsidiaries (September 6, 2024).

- Thyrocare: Focuses on customer success, network expansion, introducing new tests and health packages, and recently acquired Vimta Labs for ₹7 crore (August 30, 2024).

Margin Outlook

Despite stable growth, margins in the diagnostics sector may remain under pressure due to expansion-related costs. However, easing competition and seasonal factors may provide some relief.

Retail Pharmacy

The retail pharmacy business, led by companies like Medplus and Apollo, is expected to continue its double-digit growth trajectory. Store expansions with a focus on growth and margin improvements are expected to drive performance in this segment.

In summary, the healthcare sector is expected to post solid results in Q2FY25, with the pharma, hospital, diagnostics, and retail pharmacy segments all contributing to growth.

While companies like Lupin, Mankind, Sun Pharma, and Apollo Hospitals are poised for strong performance, others like Dr. Reddy’s and Max Healthcare may face more muted outcomes due to competitive pressures and rising costs.

A key challenge for the sector in Q2FY25 has been the sharp rise in freight costs and increased R&D expenses, which are expected to put pressure on margins.

About The Author

Next Story