Market News

Garden Reach vs Cochin Shipyard: A deep dive into financials and stock performance of these defence PSUs

.png)

5 min read | Updated on December 10, 2024, 17:58 IST

SUMMARY

India’s defence sector is booming, driven by the government’s policy support focused on modernising defence infra through indigenous procurements. With a strong order book, pricey valuation, and stellar share price return, Garden Reach Shipbuilders and Cochin Shipyard are under the spotlight. But as the saying goes “One cannot put foot on two boats”, here's the financial and operation evaluation of both companies.

Stock list

PSU defence stocks: Garden Reach Shipbuilders & Engineers vs Cochin Shipyard- Should investors stand on two boats?

Globally, India is among the top four countries in defence spending, next only to the USA, China and Russia. During the budget of 2024, the Ministry of Defence has allocated ₹6.21 lakh crore, the highest among the Ministries. Out of the total allocation, a share of 27.66% i.e. ₹1.72 lakh crore was allotted for capital expenditure (capex) for modernisation. Additionally, 75% of capex was marked for procurement through domestic industries.

Last week some defence stocks remained under the spotlight after the Defence Acquisition Council (DAC) approved five capital acquisition proposals worth ₹21,772 crore on December 3rd, which included the procurement of 31 new water jet fast attack crafts for the Indian Navy emphasising maritime security. Earlier in September 2024, the DAC had given the nod for 10 capital acquisition proposals worth nearly ₹1.45 trillion, through Acceptance of Necessity (AoN), with 99% of the total cost to be incurred on indigenous sources.

In another positive development for the sector, the Indian Navy Chief Admiral said that the Indian Navy is close to finalising three significant deals worth ₹1.25 lakh crore before the end of the current financial year, fuelling optimism around defence stocks. The high level of indigenisation procurements is expected to be an attractive opportunity for these players in the domestic defence ecosystem.

Garden Reach Shipbuilders & Engineers Ltd (GRSE) is a premier war-shipbuilding company in India under the administrative control of the Ministry of Defence, primarily catering to the shipbuilding requirements of the Indian Navy and the Indian Coast Guard. It also builds and repairs commercial and naval vessels.

Cochin Shipyard Ltd (CSL) is also a leading shipbuilding company owned by the Government of India. Engaged in shipbuilding and repair services, the company serves both domestic and international markets.

| Metrics | GRSE | Cochin Shipyard |

|---|---|---|

| Market Cap | ₹20,263 crore | ₹44,329 crore |

| EV/EBITDA Multiple | 29.6x | 32.4x |

| P/E Ratio | 52.6x | 50x |

| P/BV Ratio | 11x | 8.37x |

| ROE | 22.2% | 17.2% |

Currently, GRSE trades at a higher P/E multiple and P/BV multiple compared with Cochin Shipyard, reflecting premium valuation due to investors' willingness to pay more for GRSE. However, based on the EV/EBITDA multiple GRSE’s valuation is lower compared to Cochin Shipyard and has a higher ROE against Cochin Shipyard, indicating GRSE’s in generating a return to shareholders, justifying investors' optimism towards GRSE.

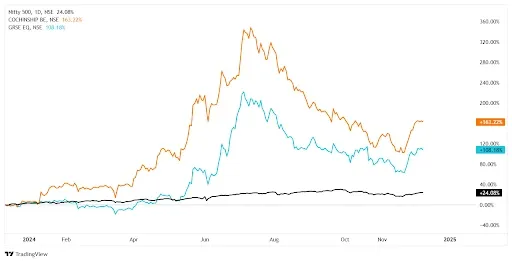

GRSE Vs Cochin Shipyard: Share price performance

In comparison with the broader market for the last 1 year period, GRSE (108.18%) and Cochin Shipyard (163.22%) have beaten markets with NIFTY 500 (24.08%) in terms of share price returns. Both these PSU defence stocks, GRSE (632%) and Cochin Shipyard (403%) have outperformed in the medium-term (3 years) to the benchmark NIFTY 500 (42%).

Comparisons - Financial performance

In H1FY25, GRSE posted revenue of ₹2,163 crore, a 31% year-on-year(YoY) increase, with an EBITDA of ₹274 crore (16% margin) and profit after tax of ₹185 crore (18% margin). Cochin Shipyard reported ₹1,806.8 crore in revenues, up 29% YoY, with an EBITDA of ₹558.8 crore (31% margin) and profit after tax ₹373.9 crore (20.7% margin). The topline growth of both companies Cochin Shipyard and GRSE followed a similar uptrend, However, Cochin Shipyard outperformed GRSE in profitability margins, highlighting differences in operational efficiencies.

The revenue visibility and growth are expected to be maintained going ahead. This is mainly due to the existing orders from the Indian Navy, coupled with orders for commercial vessels and specialised research vessels.

Order book

As of September 2024, Cochin Shipyard has a healthy order of ₹22,500 crore. Of this, 70% of orders are from defence and 21% are for commercial projects. In the case of GRSE, its order book is more than its market capitalisation, standing at ₹24,221.37 crore, across 12 projects.

Key financial indicators

GRSE also shows better efficiency in capital utilisation than Cochin Shipyard, with GRSE’s ROCE (Return on Capital Employed) of 27.4% versus Cochin Shipyard’s 21.6%, However, GRSE’s ROA (Return on Asset) is lower at 3.26% against Cochin’s 7.47%, indicating Cochin’s better management of assets.

From a financial stability perspective, both companies have negligible debt, with GRSE displaying almost no leverage with a net debt-to-equity ratio of 0.01 compared to Cochin’s 0.09. Additionally, GRSE’s interest coverage ratio stands higher at 47.9 times, indicating better debt servicing capability, whereas Cochin’s interest coverage ratio is also good at 41.9 times.

Conclusion

GRSE and Cochin Shipyard both have witnessed significant growth in the last few years supported by government policies emphasising on modernisation of defence infrastructure and promoting the indigenisation of defence procurement. Both companies also remain optimistic about revenue growth and order inflows.

The sector has an optimistic view, with high export potential not limited to the defence segment but also in commercial shipbuilding. However, sector-wide potential challenges like geo-political crisis could disrupt supply chains and impact order fulfilment.

Investments in the securities market are subject to market risk. Read all the related documents carefully before investing. The stock discussed in this article is only for educational purposes and not a buy or sell recommendation. Investors are advised to conduct their own analysis and risk due diligence before trading and investing in the stock market.

About The Author

Next Story