Market News

Suzlon Energy vs Inox Wind: Who dominates the Indian wind energy sector?

.png)

7 min read | Updated on November 28, 2024, 19:04 IST

SUMMARY

India's wind energy sector accounts for 10% of total power capacity, with major players like Suzlon Energy and Inox Wind. Suzlon showcases stronger profitability and efficiency, supported by robust margins, debt reduction and strategic initiatives. Inox Wind shows growth potential but struggles with consistent margins. Both companies are poised for expansion, benefiting from India's renewable energy goals.

Stock list

India aims to generate 50% of the electricity from green sources by 2030

India is on the way to grabbing every opportunity in the energy sector to serve its massive population and expand its potential to shift from limited traditional energy sources. In India, 10% of power is generated by wind energy from total installed utility power generation capacity.

As of August 2024, India's total installed wind energy capacity stood at 47.2 GW, making the country the fourth-largest wind market globally in terms of cumulative capacity.

India has set ambitious goals, including achieving net zero carbon emissions by 2070 and generating 50% of its electricity from renewable sources by 2030. With increased production and heightened awareness about environmental sustainability, India aims to reach 140 GW of wind capacity by 2030, supported by an expected compound annual growth rate (CAGR) of 8% until 2029.

To lead the wind energy sector in India, the major wind energy companies include Suzlon Energy, a market leader in wind turbine production, and Noida-based Inox Wind, which manufactures wind turbines and offers services like site acquisition and wind resource assessment.

Suzlon Energy Ltd

Suzlon is a leading global provider of renewable energy solutions and a vertically integrated manufacturer of wind turbine generators (WTGs). The company handles the design, development, and production of key components, including rotor blades, tubular towers, generators, control equipment, gears, and nacelles. Additionally, Suzlon manages the installation and offers operation and maintenance (O&M) services for all WTGs sold.

Beyond manufacturing, Suzlon provides comprehensive wind project planning and execution services. These include wind resource assessment, infrastructure development, power evacuation, technical planning, and project implementation. The company also delivers O&M services both in India and internationally, ensuring efficient performance and long-term sustainability of wind power projects.

The company boasts a market capitalisation of ₹86,021, and as of November 2024, the company has the highest-ever domestic order book of 5.1 GW and a strong pipeline. The company has an India manufacturing capacity of 3.15 GW, and a 20.9 GW Global installed Wind energy capacity.

Inox Wind Ltd

Inox Wind is part of the Inox Group. The company manufactures Wind Turbine Generators (WTGs) and is a wind energy solutions provider servicing IPPs, Utilities, PSUs, Corporations, and Retail Investors. Inox Wind Ltd is a fully integrated player in the wind energy market and provides end-to-end turnkey solutions.

The company trades with a market capitalisation of ₹24,348, and as of October 2024, the company has a robust order book of 3.3 GW with a large order pipeline. The company has a strong operational track record of +13 years and a manufacturing capacity of 2.5GW across 4 facilities.

Q2FY25 Highlights

In Q2 FY25, Suzlon Energy reported revenue of ₹2,103.38 crore, an increase of 47.98%. The net profit stood at ₹200.20 crore, marking a growth of 95.72 %. The net profit margin for September 2024 was 9.52 %, higher than 7.20 % in September 2023.

Inox Wind reported revenue of ₹732.24 crore, reflecting a YoY growth of 97.56%. The quarter's net profit was ₹92.89 crore, marking a significant turnaround from a loss. The net profit margin also improved to 12.69% in September 2024.

| Revenue (₹ crore) | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Inox Wind | 784.4 | 787 | 655.3 | 1011.5 | 1743.2 |

| YOY Growth | - | 0.33% | -16.73% | 54.36% | 72.34% |

| Suzlon Energy | 3000.5 | 3365.6 | 6665.1 | 5990.2 | 6496.8 |

| YOY Growth | - | 12.17% | 98.04% | -10.13% | 8.46% |

Suzlon Energy and Inox Wind have significantly grown their businesses over the last five years, with Inox Wind's revenue having tripled since FY21, while Suzlon's revenue has doubled in the last three years. Moving forward, their revenues are expected to grow further due to execution, and a strong order pipeline.

| Profit After Tax (₹ crore) | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Inox Wind | -279.4 | -307.1 | -482.6 | -670.7 | -50.7 |

| Suzlon Energy | -2691.4 | 100.3 | -166.2 | 2887.3 | 660.3 |

Suzlon Energy’s net profits surpassed revenue growth due to improved margins because of operational expansion. The company’s better-than-expected margin growth in the Wind Turbine Generators (WTG) segment, strong cash flow from its Operation and maintenance (O&M) services, and a rise in its order book show a positive outlook for future revenues. Meanwhile, Inox Wind looks like it is struggling to keep up on stable margins.

Stock price performance

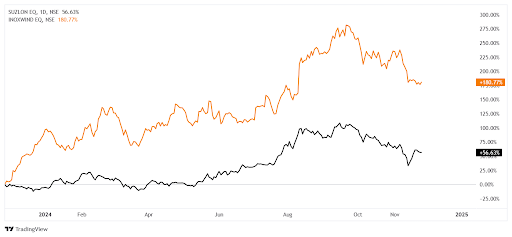

Suzlon Energy has delivered a 1-year gain of 56.63% and a remarkable 3-year return of 828.32%, with the recent correction seen in the market, the stock has corrected by 17.95% in the last 3 months. Inox Wind has similarly seen a 3-month correction of 17.95% but achieved a 1-year return of 180.81% and a strong 3-year performance of 500.74%.

Profitability and efficiency (ROE and ROCE)

| Parameters | Inox Wind | Suzlon Energy |

|---|---|---|

| Return on equity (%) | -3.00% | 16.80% |

| Return on capital employed (in %) | 10.30% | 20.80% |

Suzlon Energy's returns have stabilised after the company has repaid debt, in line with its profits. Inox Wind returns have been negative owing to the losses the business has been making.

Debt to Equity ratio

The debt-to-equity ratio (D/E ratio) depicts how much debt a company has compared to its assets. It is calculated by dividing a company's total debt by total shareholder equity. Note a higher debt-to-equity ratio states the company may have a more difficult time covering its liabilities. A negative D/E ratio means that the total value of the company's assets is less than the total amount of debt and other liabilities. This indicates financial instability and the potential for bankruptcy.

Suzlon Energy has significantly reduced its debt following a capital raise through the QIP in September 2023 and now has no net debt.

Inox's debt-to-equity ratio has risen to 1.91x in FY24. Nevertheless, the company has expressed confidence in achieving a completely debt-free status by the first half of fiscal year 2025.

Valuations

The most common and effective ratio for comparative analysis and valuation is the price-to-earnings (PE) ratio. The PE ratio tells us how much shareholders are paying for one rupee of earnings.

- The PE for Suzlon Energy is at 87.5x.

- For Inox Wind, the PE stood at 132x.

The industry PE is at 66.2x. Suzlon Energy and Inox Wind are both trading at a strong premium to their Industry PE, indicating the stocks might be overvalued at the moment.

Suzlon Energy: Future outlook

- The current manufacturing capacity is about 3.1 GW, expected to ramp up to 4.5 GW by the end of FY25.

- Management is focused on maintaining margins despite the increase in the WTG business, which typically has lower margins than services.

- The management confirmed that the 5.1 GW order book is expected to be completed in 18 to 24 months.

- Management anticipated supply commencement for NTPC orders by the end of Q2 FY25, with significant supplies expected from Q4 onwards.

- Management expresses confidence in achieving a higher commissioning rate in H2 FY25, overcoming past disruptions and leveraging strong order book visibility.

- The company is well-positioned to capitalise on emerging opportunities in the renewable energy sector, backed by a robust financial position and strategic initiatives.

Inox Wind: Future outlook

- Management anticipates EBITDA margins to improve from 15% to 17% for FY25, driven by the Cessation of royalty payments for 3-megawatt turbines starting FY26, contributing approximately ₹6 lakh per megawatt to profitability.

- Backward integration initiatives, including in-house manufacturing of critical components and cranes. Launch of larger turbine blades and a new 4X megawatt turbine.

- Competitive tariffs range from ₹3.3 to ₹4.37 per unit across various project types. Strong demand from the Commercial & Industrial (C&I) segment exceeds traditional tariff figures.

- Management remains cautious but optimistic about scaling operations to 2 gigawatts by FY27.

- Focused on prudent capital allocation and maintaining a strong cash position for future growth and potential dividend policies.

India's wind energy growth offers significant opportunities. Suzlon leads with profitability and order book strength, while Inox focuses on operational efficiency. Both are positioned to benefit from renewable energy transitions.

About The Author

Next Story