Market News

Five companies from the BSE IPO index giving consistent growth in profits for the past 4 quarters

.png)

6 min read | Updated on September 28, 2024, 12:46 IST

SUMMARY

The BSE IPO Index surged 35.16% on a YTD basis, surpassing the Sensex’s 18.25% rise. With 59 IPOs in 2023 and 47 premium listings in 2024, several companies posted strong returns, with seven achieving multibagger status.

NIFTY50 & SENSEX eye for positive weekly close on Friday

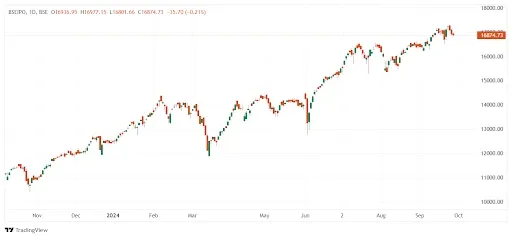

The BSE IPO Index has delivered a 35.16% return on a year-to-date (YTD) basis in 2024, with a yearly range between 10,391 and 17,281. In the first half of 2024, India saw the highest number of mainboard listed companies. The BSE IPO Index outperformed the BSE Sensex, which posted an 18.25% return on a YTD basis.

A total of 59 mainboard IPOs were launched in 2023, with the majority occurring in the second half 51 IPOs compared to just 9 in the first half. The Q4FY23 saw the highest concentration of IPOs, with 28 offerings, followed by 23 in Q3. Out of which 12 IPOs have negative returns as of today.

The year 2024 has been remarkable for IPO listings, with a total of 59 mainboard IPOs (NSE+BSE) listed during the year, of which 47 had premium listings. More than 25 IPOs have delivered returns exceeding 50%, with 7 of them achieving multibagger status.

| Company | Market Cap (₹ Cr) | LTP (₹) | YTD return | Q2FY24 (₹ Cr) | Q3FY24 (₹ Cr) | Q4FY24 (₹ Cr) | Q1FY25 (₹ Cr) | CAGR |

|---|---|---|---|---|---|---|---|---|

| IREDA | 60,649 | 232 | 118.48% | 285 | 336 | 337 | 384 | 10% |

| DOMS Industries | 15,840 | 2,685 | 109.07% | 38 | 39 | 47 | 54 | 12% |

| India Shelter Finance Corporation | 8,057 | 752 | 32.05% | 60 | 62 | 78 | 83 | 11% |

| Fedbank Financial Services | 4,470 | 117 | -11.72% | 58 | 65 | 68 | 70 | 6% |

| Krystal Integrated Services | 1,041 | 734 | -5.25% | 9 | 12 | 15 | 15 | 8% |

Indian Renewable Energy Development Agency

Classified as an Infrastructure Finance Company by RBI and granted Mini Ratna Category-I status in June 2015, the company promotes, develops, and finances new and renewable energy projects. Fully owned by the Government of India, it is a public financial institution and a registered Non-deposit NBFC.

In November 2023, the company launched its IPO to enhance its capital base for future requirements and onward lending. Over the last four quarters, its financial margins have consistently ranged from 32% to 35%. The reported consistent profits for past four quarters starting Q2FY24 at ₹285 crore to currently ₹383 crore in Q1FY25

DOMS Industries

The gross margin has remained stable at around 44% for the last four quarters, while the NPM increased from 9.95% to 12.13% in Q1FY25. Recently, the company acquired a 51.77% equity stake in Uniclan Healthcare Private Limited, a key move in our strategy to explore new sectors that enhance our portfolio and focus on children during their formative years. In the past four quarters starting Q2FY24 the profits have jumped from ₹31.7 crore to ₹49 crore in Q1FY25.

The company came up with its IPO in December 2023 to partly finance the cost of establishing a new manufacturing facility to expand its production capabilities.

It currently exports its products to over 50 countries, with more than 4,100 SKUs. It generates 85% of its sales from within India and 15% from international markets.

India Shelter Finance Corporation

Management has given guidance for loan growth of 30%-35% and credit costs of around 40 basis points for the year. Operating leverage is expected to improve, with a potential decrease in opex to AUM ratio by 15-20 basis points annually over the next few years. The company has maintained consisteny in profits for the last four quarters starting Q2FY24 to Q1FY25. The NBFC reported a net profit of ₹83 crore in Q1FY25 as compared to ₹60 crore in Q2FY24.

The company came up with its IPO in December 2023 with a promising objective to meet future capital requirements towards onward lending.

It plans to add 40-42 branches in FY25, having already opened 30 new branches in the current quarter. Expansion includes branches in Rajasthan, Uttar Pradesh, Haryana, Uttarakhand, and Maharashtra.

Fedbank Financial Services

In Q1FY25, the company’s gold business grew by 15% QoQ and 46%YoY, Profit after tax grew by 30% YoY and the company has improved on its cost-to-income ratio from 57.3% to 55.4%. The company is targeting an AUM growth of 25% for the year and initiating insurance agency operations. Over the previous four quarters the profits have grown from ₹57 crore in Q2FY24 to ₹70 crore in Q1FY25.

The company came up with its IPO in November 2023 to augment the company's Tier I capital base to meet the company's future capital requirement.

Krystal Integrated Services

The company was listed in March 2024 and had an objective to repay/prepay, fully or partially, certain borrowings and Funding capital expenditure for the purchase of new machinery.

It is the 8th largest player in the Integrated FMS Market in FY23. The company earns most of its revenue from government contracts. Company consistent OPM of 6% over the last four quarters. Renewal rate for government contracts at 65-70%. Optimistic about maintaining growth momentum. Expecting continued growth in the staffing segment due to organic business growth. In the latest quarter of Q1FY25 the company reported net profit of ₹15 crore as against ₹9 crore in Q2FY24.

About The Author

Next Story