Market News

Kotak Mahindra Mutual Fund introduces the Kotak NIFTY 100 Low Volatility 30 Index Fund; details inside

.png)

4 min read | Updated on May 22, 2024, 18:10 IST

SUMMARY

Kotak Mahindra Mutual Fund launched the Kotak NIFTY 100 Low Volatility 30 Index Fund, aiming to track the NIFTY 100 Low Volatility 30 Index. The fund offers low-volatility large-cap investments and requires a minimum investment of ₹100.

Kotak NIFTY 100 Low Volatility 30 Index Fund

Kotak Mahindra Mutual Fund launched the Kotak NIFTY 100 Low Volatility 30 Index Fund. It is an open-ended index fund that aims to mirror the NIFTY 100 Low Volatility 30 Index returns, subject to tracking errors. While the objective is to track the index performance before expenses, achieving it is not guaranteed. The fund launched today, May 22, 2024, and the new fund offer closes on May 31, 2024. You can invest for as little as ₹100 and increase your investment amount in any increment thereafter.

“The launch of the Kotak Nifty 100 Low Volatility 30 Index Fund is aligned with our commitment to offer products that cater to different risk appetites and investment horizons. Currently, large caps are at reasonable valuations as compared to Midcaps and Small caps. This index fund offers investors an opportunity to invest in a rule-based index that invests in low volatile large-cap companies across different sectors,” said Nilesh Shah, Managing Director of Kotak Mahindra AMC.

“Investors looking to invest in large companies and wanting further lower volatility can now opt for Nifty 100 low volatility 30 index as an investment option. A bouquet of 30 large-cap companies from the Nifty 100 index that constitutes this fund can help investors diversify their portfolio for long-term capital appreciation. We are excited to launch the Kotak Nifty 100 Low Volatility 30 Index Fund NFO,” said Devender Singhal, Executive Vice President & Fund Manager, Kotak Mahindra AMC.

Kotak NIFTY 100 Low Volatility 30 Index Fund

The investment objective of the Kotak NIFTY 100 Low Volatility 30 Index Fund is to provide returns that, before expenses, correspond to the total returns of the securities as represented by the underlying index, subject to tracking errors. However, there is no assurance that the investment objective of the Scheme will be achieved.

Benchmark

The performance of the Kotak NIFTY 100 Low Volatility 30 Index Fund is benchmarked against NIFTY 100 Low Volatility 30 Index (Total Return Index).

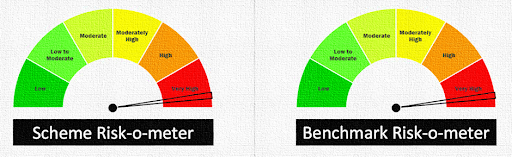

Risk-o-meter:

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Equities covered by the NIFTY 100 Low Volatility 30 Index | Very High | 95% | 100% |

| Money Market | Low to Moderate | 0% | 5% |

Who should invest in this scheme?

This NFO of Kotak NIFTY 100 Low Volatility 30 Index Fund is ideal for investors looking for long-term capital appreciation and return commensurate with the performance of NIFTY 100 Low Volatility 30 Index subject to tracking error.

Peer Schemes

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) |

|---|---|---|---|

| Bandhan Nifty100 Low Volatility 30 Index Fund | 06-10-2022 | 612.53 | 1.02 |

| Motilal Oswal S&P BSE Low Volatility Index Fund | 23-03-2022 | 49.50 | 1.03 |

| UTI S&P BSE Low Volatility Index Fund | 03-03-2022 | 368.54 | 0.91 |

| Nippon India Nifty Alpha Low Volatility 30 Index Fund | 21-08-2022 | 317.59 | 0.87 |

Who Manages the Scheme?

Abhishek Bisen is 45 years old and has a Bachelor of Arts in Business Management and a Master of Business Administration degree in Finance. He graduated from the Executive Program in Advanced Finance offered through IIM Calcutta. He joined this firm in October 2006 where he mostly handles the investments for debt funds.

Devender Singhal, 46 years old, obtained a PGDM in finance and insurance as well as an honours degree in mathematics at New Delhi University. At Kotak Asset Management Company, he has been managing equity funds since August 2015 for which his portfolio contains both Multicap and hybrid strategies. In managing funds, Mr. Singhal has been in practice for 22 years.

Satish Dondapati is 44 years old with an MBA in Finance, and he has accumulated more than 16 years of experience managing Exchange-Traded Funds (ETFs). This new fund provides an attractive option for investors seeking long-term capital appreciation with reduced volatility, making it a suitable addition to diversified portfolios. The fund management team brings extensive experience in equity and debt fund management.

About The Author

Next Story