Market News

From Japan’s interest rate hike to disappointing US big tech earnings, here’s what led the global market meltdown

4 min read | Updated on August 05, 2024, 14:43 IST

SUMMARY

Global equity markets saw a sharp sell-off across the board on Friday, August 3, dampening investor sentiments. An array of factors, including the hike in interest rates by the Bank of Japan and weakness in the US economy, triggered a sell-off in major global indices.

Global equities witnessed selloff across the board led by multiple factors

Equity markets worldwide witnessed a heavy sell-off on on Friday, August 3. The major global indices in the US, Europe and Asia fell over 3%, led by various factors causing tremors in the global economy. The Japanese markets were hit the hardest among its peers, falling nearly 10% in two trading days. Equity markets in the US also fell more than 5% in two trading days, with the tech-heavy Nasdaq losing nearly 6% and the Dow Jones and S&P 500 falling more than 4%.

Below are key reasons for the sharp sell-off in Indian equities

Interest rate hike in Japan

In early July, the Japanese yen hit a historic low or 161.9 against the US dollar, making imports of food and fuel more expensive. This prompted the Bank of Japan to increase the interest rate from 0-0.1% to 0.25% to stop the Japanese yen from sliding further. The hike resulted in a sharp rally in the yen, as it bounced back to 146 against the dollar.

This hike in interest rates impacted the yen carry trade, which benefited from lower interest rates in Japan. Carry trade refers to a strategy wherein investors borrow money in a currency with low interest rates, such as the yen, and reinvest the proceeds in a currency with a higher rate of return. After the Bank of Japan raised interest rates, there was a huge demand for the yen, which led to currency depreciation and lowered the margins on the yen carry trade, thus prompting a sell-off in global equities.

Weakness in the US economy

Some key macroeconomic indicators suggest weakness in the US economy. The latest payroll data for July showed that the US economy added 114,000 jobs against the forecast of 175,000 and revised June estimate of 179,000. Furthermore, the jobless claims in the US economy also increased by 14,000 to 249,000 against the estimate of 236,000 for the week ending July 27.

In addition, the ISM manufacturing PMI for July fell to 46.6 from 48.8 in June. The reading also came below expectations of 48.8, sparking fresh worries about the weakness in the country's manufacturing activity. A PMI reading below 50 is considered to show a contraction in economic activity.

Disappointing earnings from tech giants

The world’s largest tech giants, such as Alphabet, Microsoft and Amazon, witnessed heavy sell-off after their quarterly earnings failed to boost investor sentiments. All the major tech companies saw significant advancements in AI, boosting earnings expectations for these tech giants. However, rising costs in AI advancements are eating into the margins of the companies. According to a Reuters report, Microsoft missed earnings estimates, and Tesla reported its lowest profit margins in more than five years. Google’s parent company, Alphabet, witnessed a slowdown in YouTube advertising revenue.

Chip maker Intel reported a loss of $1.6 billion and suspended dividend payouts. It also announced job cuts for 15,000 of its employees. Following this, shares of Intel fell nearly 40%.

Recession around the corner

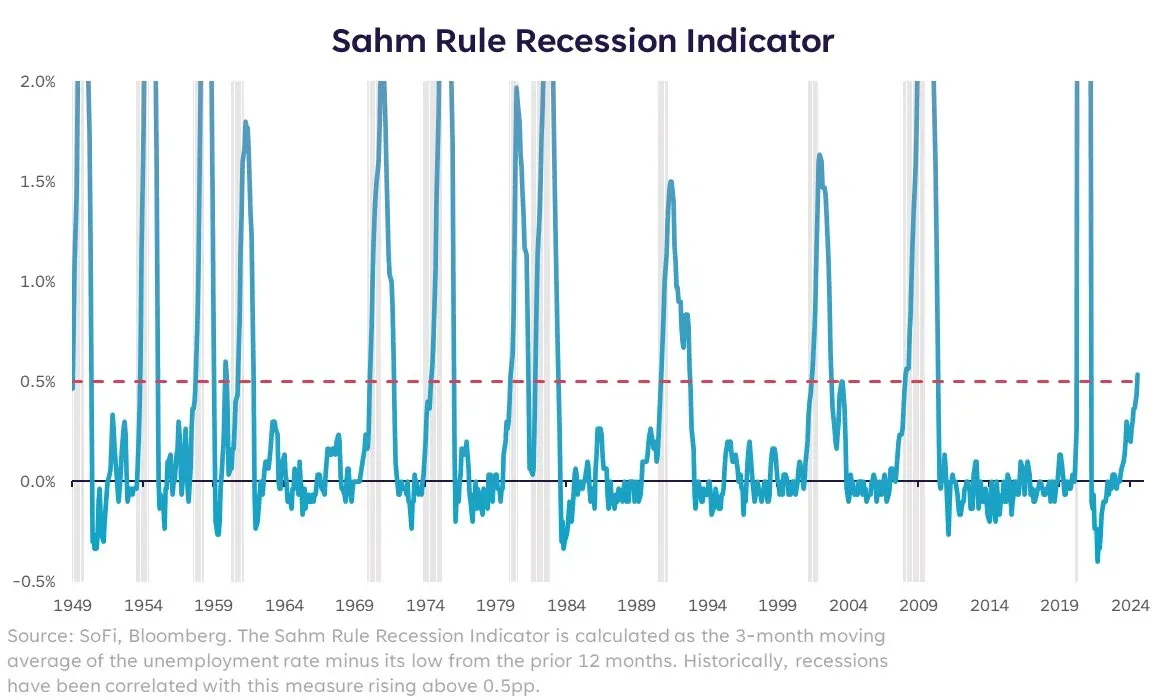

With multiple macroeconomic indicators showing weakness in the US economy, investors and experts around the world are sounding the alarm for an upcoming recession. Sahm's rule, considered a leading indicator of recession, has shown that the US economy is heading for a recession.

The rule states that a recession is underway if the 3-month moving average of the unemployment rate increases by 0.5 percentage points relative to the low of the previous 12 months. The unemployment rate in the United States rose to 4.3% in July of 2024 from 4.1% in the last month, the highest since October 2021, and above market expectations.

Bottomline

Investors around the world are concerned about a potential recession in the United States, which might have a global impact. Following a rapid surge in global markets, particularly in India, valuations appear stretched. Furthermore, the escalating tensions in the Middle East may contribute to investor concerns. As regulators work through these difficult circumstances, global markets could continue to be jittery as investors across the globe look to sell equities.

About The Author

Next Story