Market News

Trade Setup for Dec 23: NIFTY50 ends below 200 EMA — Volatility ahead?

.png)

4 min read | Updated on December 23, 2024, 07:22 IST

SUMMARY

The NIFTY50 index closed below the last three weeks' lows, losing over 4% last week and formed a bearish Marubozu candlestick on the weekly chart. It also breached its critical 200-day EMA support zone, suggesting increased volatility and further weakness ahead.

The SENSEX fell over 1% on the weekly expiry of its options contracts, marking its fifth consecutive day of losses.

Asian markets @ 7 am

- GIFT NIFTY: 23,795 (+0.11%)

- Nikkei 225: 39,065 (+0.94%)

- Hang Seng: 19,843 (+0.62%)

U.S. market update

- Dow Jones: 42,840 (▲1.1%)

- S&P 500: 5,930 (▲1.0%)

- Nasdaq Composite: 19,572 (▲1.0%)

U.S. indices rallied on Friday after cooler-than-expected inflation print of the November eased worries about the past of the interest rates. The Personal Consumption Expenditure (PCE) showed a rise of 2.4% in November, lower-than the street estimates of 2.5%.

Earlier in the week, the U.S. Fed projected fewer rate cuts for the year 2025 than its previous forecast, resulting in a sharp fall and volatility in indices. Despite the Friday’s sharp recovery, all the three major indices ended the week on a negative note.

NIFTY50

- December Futures: 23,625 (▼1.05%)

- Open interest: 4,19,966 (▼2.2%)

After a flat start, the NIFTY50 index came under renewed selling pressure following its initial pullback, extending its losing streak to a fifth consecutive day. During the week, the index fell 5% from its recent peak and slipped below the key support of the 200-day exponential moving average (EMA), indicating weakness.

The technical structure of the index on the daily chart remains bearish with immediate resistance at the 24,200 level. However, it is important to note that the index has dropped below its 200-day EMA after five consecutive days of declines, and is now approaching the important support zone of the November monthly low. In the upcoming sessions, traders should monitor the range of 24,200 and 23,200. The index may remain volatile in this range and a close above or below these levels may provide further directional clues.

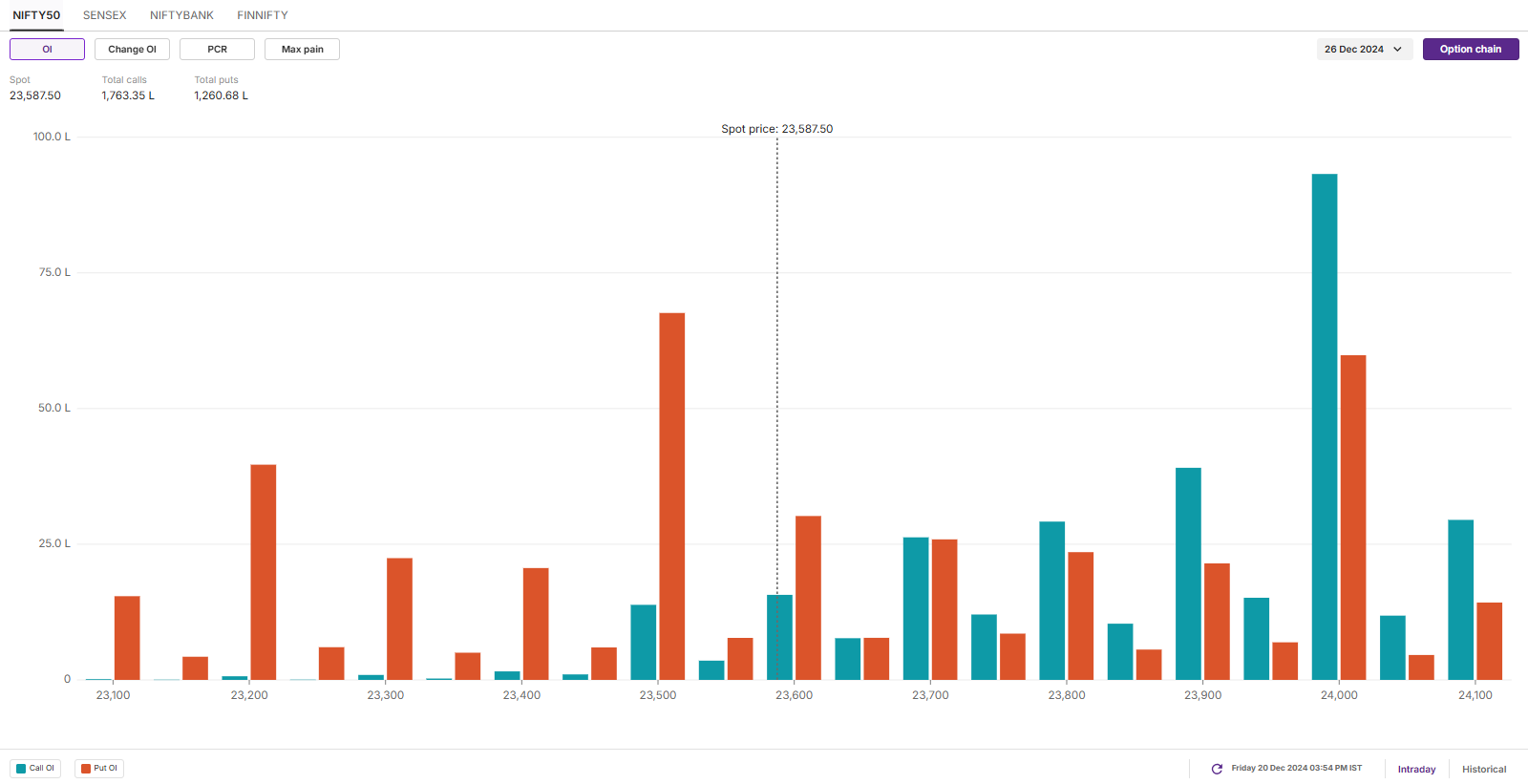

The open interest data of the monthly expiry saw significant call build-up at 24,000 strike, indicating that the index may face resistance around this zone. On the other hand, the put base was established at 23,500 strike, suggesting some support for the index around this zone.

SENSEX

- Max call OI: 79,000

- Max put OI: 79,000

- (Expiry: 27 Dec)

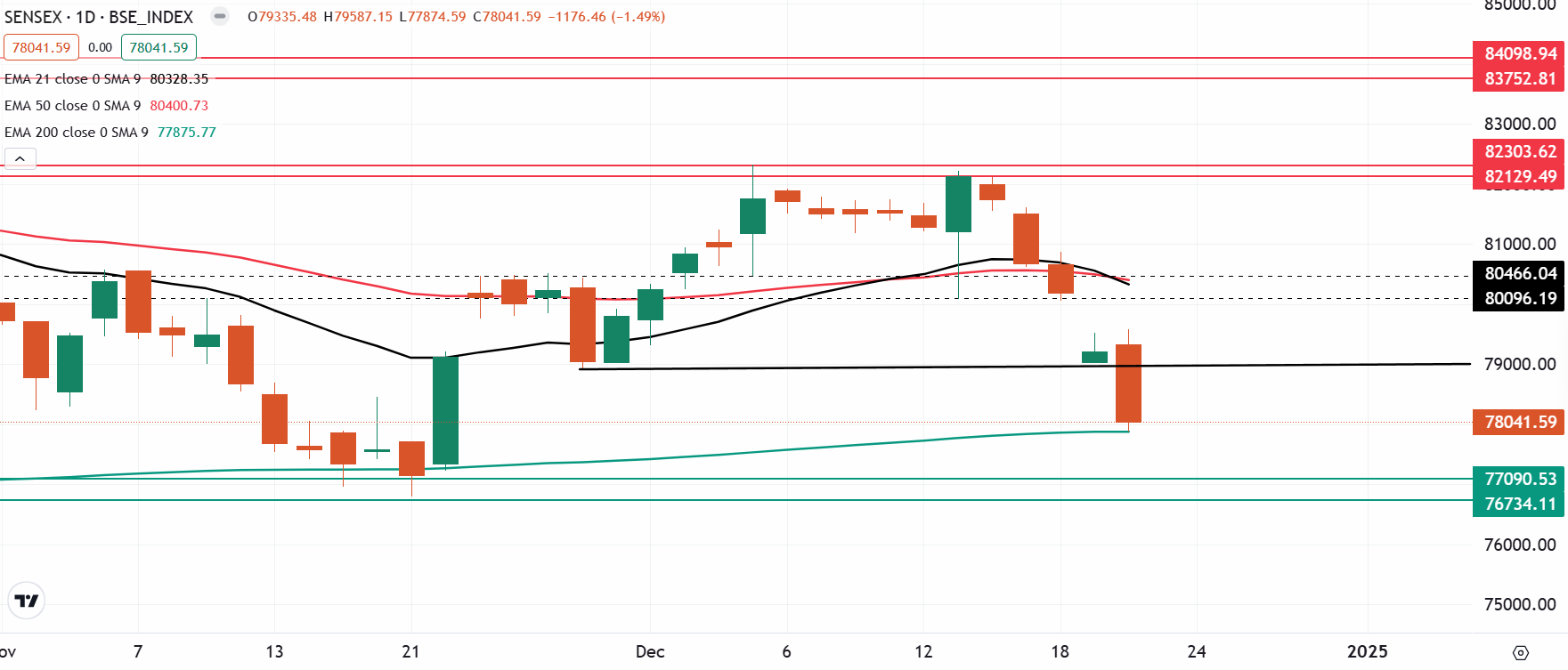

The SENSEX fell over 1% on the weekly expiry of its options contracts, marking its fifth consecutive day of losses. Despite an early pullback, the index breached the critical swing low of 78,900 and tested its 200-day EMA, a key psychological support level.

From a technical perspective, the index structure remains bearish, with immediate resistance near the 80,500 level. Notably, the index has tested the psychologically crucial 200-day EMA. Traders should watch price action closely around this support level. A decisive close below it could signal further downside, while holding above it may lead to volatility and potential consolidation in this zone. Meanwhile, we will closely monitor the open interest data for the 26 December expiry on Monday, to gather directional insights.

FII-DII activity

Stock scanner

- Long build-up: Dr Reddy’s Laboratories

- Short build-up: Siemens, RBL Bank, LTIMindtree, Prestige Estates and Zomato

- Under F&O ban: Bandhan Bank, Granules India, Hindustan Copper, Manappuram Finance, RBL Bank and Steel Authority of India

- Out of F&O ban: NMDC and PVR Inox

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story