Market News

Fed’s historical rate cuts: What 2001, 2007-08 and 2019 tell us about upcoming rate cut in 2024

.png)

4 min read | Updated on September 18, 2024, 13:56 IST

SUMMARY

The Fed is preparing for its first rate cut in four years, raising the question of whether it will trigger a market rally. Historical data suggests that market reactions to rate cuts are unpredictable, with other factors like domestic demand and valuations playing significant roles in influencing market movements.

Theory suggests rate cuts should lift valuations, but history suggests a rate cut alone is not enough to lift valuation

As the U.S. Federal Reserve prepares for its first interest rate cut in over 4 years, all eyes are on the upcoming Federal Open Market Committee (FOMC) meeting. With inflation easing, the labour market cooling, and the 2024 presidential election on the horizon, the Fed is widely expected to cut rates. However, the quantum of the rate cut is crucial for the market.

This move would signal the start of a new rate-cut cycle, driving optimism in global markets. It is particularly crucial in emerging economies like India, where a weaker dollar and lower U.S. bond yields could attract foreign investment into Indian stocks.

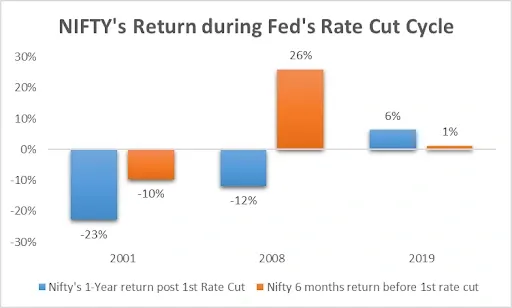

However, historical data suggests that equity markets have not always thrived during past rate-cut cycles. During 2001 and 2007-08 rate cut cycles, equities experienced significant drawdowns, and in 2019 markets remained flat despite the cuts. Factors such as earning slowdowns and weak growth often outweigh the potential benefits of cheaper capital, tempering market enthusiasm.

Historically, the Fed has initiated rate-cut cycles during challenging economic conditions. In 2001, after the dot-com bust, the Fed slashed rates from 6% to 1.75%. During the 2007-08 financial crisis, the Fed cut rates by 2.75%. In 2019, amid a mid-cycle adjustment, the Fed cut rates by 0.75%. (Source - Forbes.com)

(Source - Tradingview)

The market's response to rate cuts has been influenced by factors like domestic demand, macro trends, and valuation levels.

In 2001, rate cuts were ineffective in preventing a market correction, as weak domestic demand led to a 23% drop in the NIFTY50 post-rate cuts. However, in the run-up to rate cuts the NIFTY50 had already declined 10%.

In 2007–08, strong demand initially fueled a rally, but high valuations and the global financial crisis triggered a market sell-off, with NIFTY50 correcting over 12% in a year since the beginning of the rate cut. In the run-up to the rate cut, the NIFTY50 had climbed 26%, six months before the beginning of the cycle.

However, in 2019, the markets saw modest single-digit gains, with NIFTY50 rising 6% over a one-year period following the first rate cut. In the six months prior, it gained only 1%, as the COVID-19 pandemic disrupted economic activities.

Comparison of macro indicators during the rate cut cycles

| Indicators | 2001 | 2007-08 | 2019 | 2024 (September) |

|---|---|---|---|---|

| US Labour Market (Unemployment rate %) | Weak (4.2%) | Weak (4.7%) | Stable (3.8%) | Weak (4.2%) |

| Domestic Demand (Real GDP growth) | Weak (3.6%) | Strong (8%) | Weak (6.5%) | Mixed to Weak (Provisional- 8.2%) |

| Valuations (NIFTY50 P/E) | Low (19x) | Moderate (21x) | High (25x) | High (24x) |

(Source - Economic Survey and Nuvama Research, Note- 2024 data for September considered)

Currently, the U.S. labour market is weakening, domestic demand in emerging markets is mixed, and valuations are high, particularly in India, where the price-to-earning ratio stands at an elevated 24x. These conditions suggest that rate cuts may provide some relief.

As Fed Chairman Jerome Powell indicated in his recent speech at the Fed's annual economic conference, “the time has come to cut its key policy rate”, making clear his intention to prevent further cooling in the labour market.

For the past 14 months, the central bank has maintained interest rates between 5.25% and 5.50% to curb inflation and bring it closer to its 2% target. Despite persistent inflation, it has shown a significant decline. Meanwhile, a cooling job market has further opened the door for the Fed to consider reducing rates.

The Federal Open Market Committee FOMC will meet on September 17-18 to decide monetary policy.

The impact of the upcoming Fed rate cuts on equity markets will depend on three key factors, the state of the U.S. labour market, domestic demand dynamics, and current market valuations.

History shows that rate cuts alone may not be enough to prevent market volatility due to the rising recession risks in the U.S., weak domestic demand, and elevated valuations, caution is warranted. The effectiveness of this cycle will hinge on broader economic conditions.

About The Author

Next Story