Market News

Paytm Q2 Results: Net profit comes in at ₹928 crore on one-time gain from Zomato deal; shares tank 8%

.png)

3 min read | Updated on October 22, 2024, 12:30 IST

SUMMARY

The company's net profit was aided by a one-time gain of ₹1,345 crore, which was due to the sale of the movie ticketing business to Zomato.

Stock list

In the year-ago period, the fintech company reported a loss of ₹291.7 crore.

In the year-ago period, the fintech company reported a loss of ₹291.7 crore.

The company's net profit was aided by a one-time gain of ₹1,345 crore, which was due to the sale of the movie ticketing business to Zomato.

Paytm would have reported a net loss of ₹415 crore, excluding the one-time gain, which would have been higher than the loss it reported during the same quarter last year.

Shares of One 97 Communications after the results announcement declined in trade. The stock slipped as much as 7.74% to ₹669.65 on the BSE.

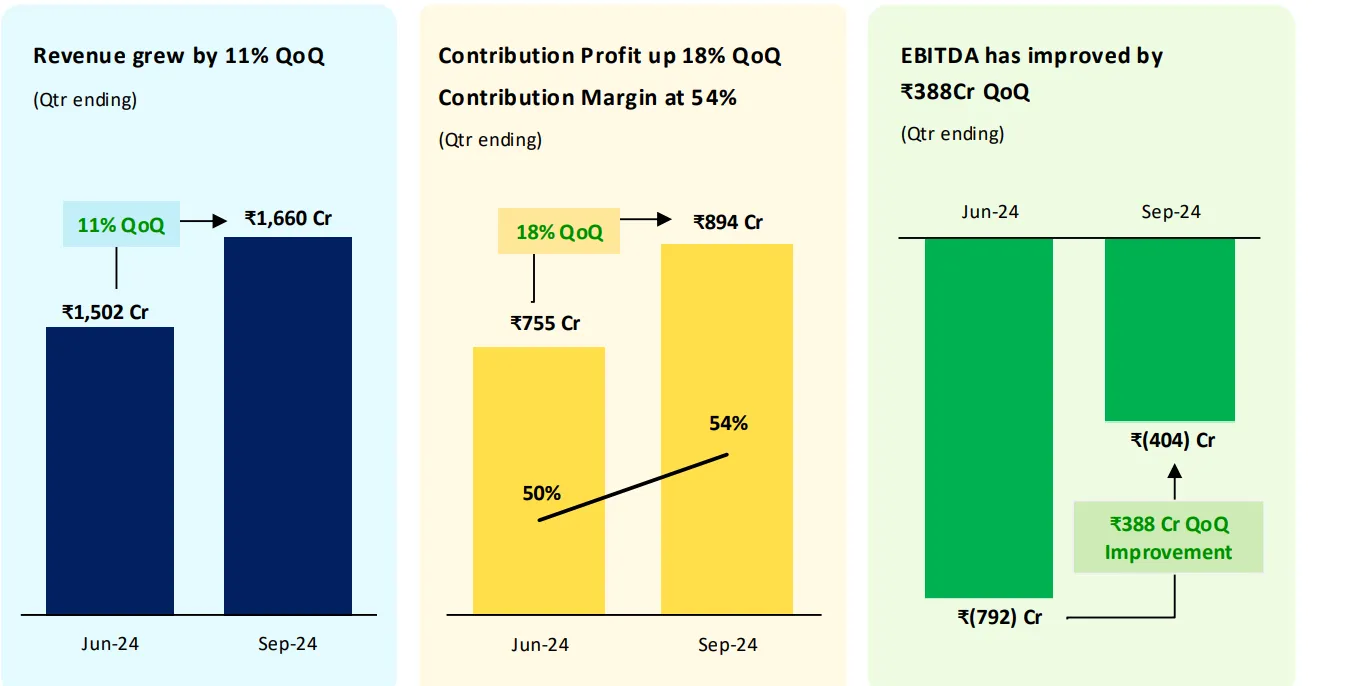

Revenue from operations came in at ₹1659.5 crore, down 34% against ₹2,518.6 crore logged in the September 2023 quarter.

On a sequential basis, the figure grew by 10.5%.

In its earnings release, Paytm said that its core business is to acquire customers (consumers and merchants) for payments and cross-selling financial services. For financial services, the relevant metric is the number of unique payment customers we successfully cross-sell to and revenue earned from them.

"Starting this quarter, we have started disclosing the number of key financial services customers. These are unique consumers and merchants who have availed of Paytm’s and group entities’s financial services offerings, i.e., equity broking, insurance, and credit products, such as merchant and consumer loans distributed through our platform. However, it does not include customers availing mutual fund distribution, Postpaid loans, or any attachment insurance products, as they contribute negligible revenue/profitability," the press release added.

For the next couple of quarters, Paytm said it will continue to report the value of loans disbursed, but over time, the relevant metrics will be the number of key financial services customers (consumer and merchant) and revenue from financial services.

During Q2 FY 2025, 6.0 lakh key financial services customers (consumers and merchants) availed financial services through our platform, versus 5.9 lakh during Q1 FY 2025.

"Low penetration and high engagement of customers on our platform provide opportunity for us to drive cross-sell of financial services. We continue to partner with various financial institutions to enhance and widen our financial service offerings," it further said.

Q2 FY25 Financial Highlights

Update on Zomato deal

During the quarter, "we completed the transaction to sell our entertainment ticketing business to Zomato Limited. The final price, after working capital adjustments, was ₹2,014 crore, leading to gains of ₹1,345 crore, which is reported under the exceptional items in the P&L. This transaction has resulted in further strengthening our balance sheet with a cash balance of ₹9,999 crore," the company said.

About The Author

Next Story