Market News

Silver reclaims ₹89,000, crude oil sustains bullish momentum; check today's trade setup

.png)

4 min read | Updated on December 26, 2024, 18:45 IST

SUMMARY

From the technical standpoint, the crude oil is sustaining previous week’s bullish momentum and is maintaining the flag and pole pattern, highlighted on 19 December in our trade setup blog.

The technical setup and price action of the yellow metal remained range-bound.

Market recap (as of 6:30 pm)

- Gold 5 Feb Futures: ₹76,740/ 10 gram (▲ 0.62%)

- Silver 5 March Futures: ₹89,926/ 1 kg (▲ 0.67%)

- Crude Oil 17 Jan Futures: ₹6,039/ 1 BBL (▲ 0.99%)

Technical structure

A pole and flag pattern is a continuation pattern seen in technical analysis. The sharp price movement (pole) is followed by a consolidation phase (flag), often leading to a breakout in the direction of the initial trend. However, it is important to note that the Futures contract of 17 January is reaching the immediate resistance zone of 6,100 on the daily chart. A close above this will lead to continuation of bullish momentum. On the other hand, a rejection from this zone and a close below 5,850 will invalidate the pattern.

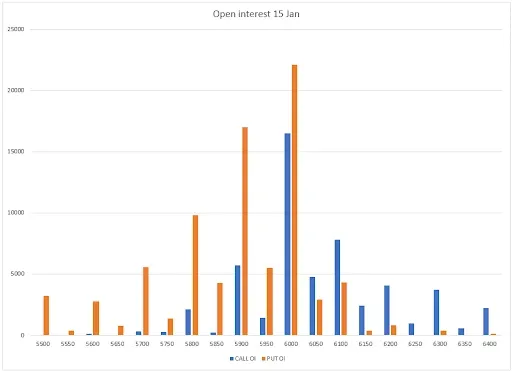

The open interest data for the 15 January expiry saw significant additions of put options at 5,900 and 6,000 strikes, pointing at support for the crude oil around this area. On the flip side, the call base was seen at 6,000 and 6,100, with relatively low volume.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story