Market News

MCX Gold and Silver see profit booking, Crude trades range-bound; check today’s trade setup

.png)

2 min read | Updated on March 20, 2025, 19:05 IST

SUMMARY

MCX Gold faces profit booking, while silver slips below ₹99,700 support. MCX crude oil remains range-bound in today's trading session.

Commodity trade setup Jan 16: Gold and Silver shine bright in lead-up to Donald Trump’s swearing-in

Market recap (as of 7:00 pm)

- Gold 4 April Futures: ₹88,528/ 10 gram (▼ 0.08%)

- Silver 5 May Futures: ₹99,005/ 1 kg (▼ 0.92%)

- Crude Oil 21 April Futures: ₹5,805/ 1 BBL (▼ 0.29%)

Technical structure

The broader trend remains bullish as long as silver holds above the 50-day EMA and the trendline support connecting the December and February lows. A decisive close below these levels could signal weakness. However, bullish momentum will resume if silver reclaims the immediate resistance at ₹1,01,980 on a closing basis.

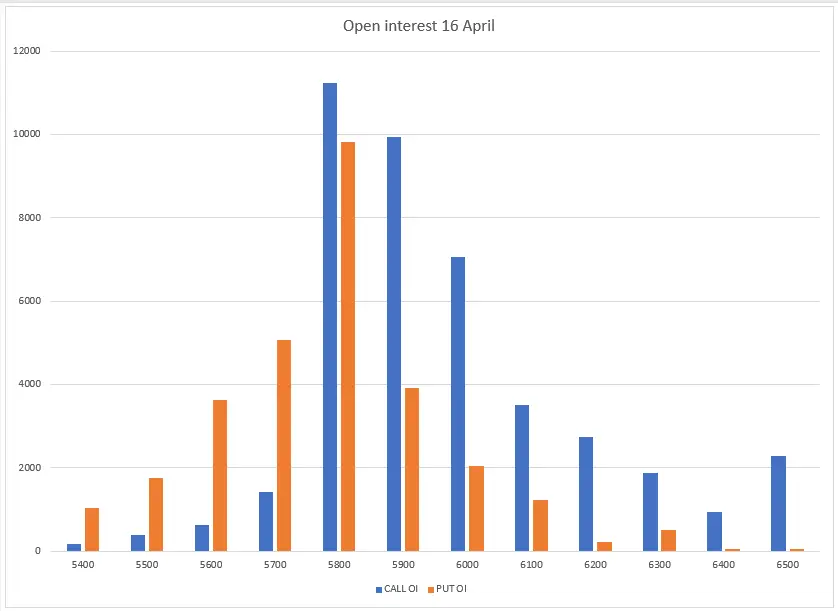

The open interest (OI) data for the April 16 expiry saw significant call and put OI build-up at 5,800 strike, indicating consolidation for the crude around these levels. Additionally, substantial call base was also visible at 5,900 strike, suggesting resistance for crude around these levels.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story