Market recap (as of 7:00 pm)

- Gold 4 April Futures: ₹87,984/ 10 gram (▼ 0.01%)

- Silver 5 May Futures: ₹1,00,390/ 1 kg (▼ 0.35%)

- Crude Oil 19 March Futures: ₹5,862/ 1 BBL (▲ 0.38%)

Gold: The yellow metal traded marginally higher on Monday, with gold April Futures trading at $3,004 per ounce, up 0.10%. Gold prices are trading in a range with a focus on trade tariffs and the US Federal Reserve’s policy meeting. Meanwhile, silver prices traded lower, down 0.65% at $34.21 per troy ounce in the futures market.

Crude Oil: International crude oil futures traded higher today, with Brent Futures trading around $70.97, up 0.60%, while WTI Crude traded 0.58% higher around $67.32. Oil prices traded higher after the US intensified its military operations against Yemen’s Iran-backed Houthi rebels. This attack has raised concerns over potential disruptions in oil supplies through Red Sea region.

Technical structure

Gold: Price of yellow metal on MCX extended the bullish momentum for the fifth day in a row and is trading above Friday’s closing price. Both the short-term and the long-term structure of Gold remains bullish after the breakout of the consolidation on March 12th. Unless the gold slips below the 21-day exponential moving average, the trend may remain bullish.

Silver: After profit-booking on Friday, MCX silver prices remains flat and are consolidating within Friday’s range. It is forming an inside candle on the daily chart after the breakout of the inverse head and shoulder pattern on March 12th. This indicates that the broader and short-term trend of the Silver remains bullish with immediate support around ₹98,300 zone.

Crude oil: Oil prices extended their consolidation for the eighth consecutive day, trading in positive territory. However, the broader trend remains weak as crude hovers below key exponential moving averages (EMAs), such as the 21-day and 50-day, on MCX. For a bullish reversal, crude must reclaim the 21-day EMA and breach the immediate resistance zone at ₹5,946 on a closing basis. Failure to do so may keep the bearish trend intact, with further weakness expected if the ₹5,761 support zone breaks.

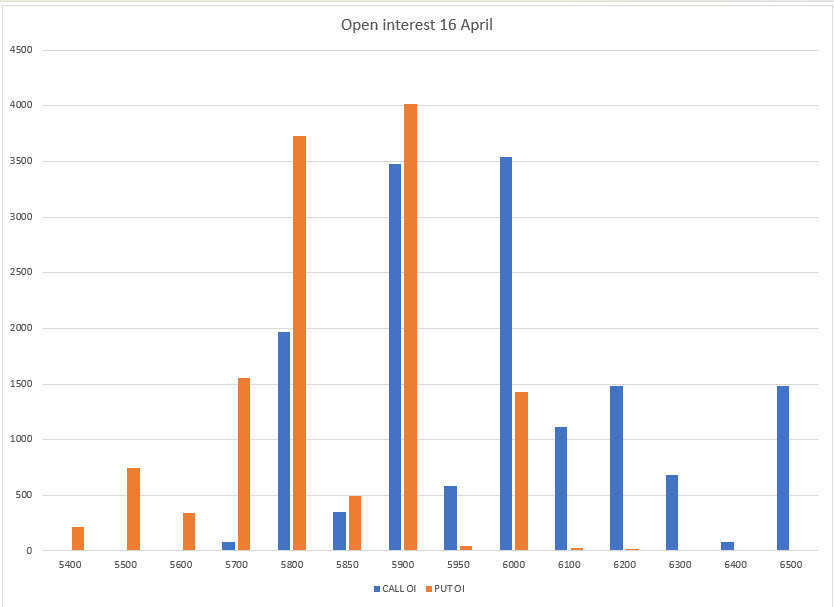

The open interest data for the April 16th expiry saw significant build-up of call and put options at 5,900 strike, indicating consolidation for the crude around this zone.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

.png)