Business News

President Murmu credits reforms for PSU banks' profitability; here's how public lenders performed in Q4FY24

3 min read | Updated on June 27, 2024, 16:29 IST

SUMMARY

President Murmu said that the government brought banking reforms to save the sector from "collapsing" and made laws like the Insolvency and Bankruptcy Code (IBC).

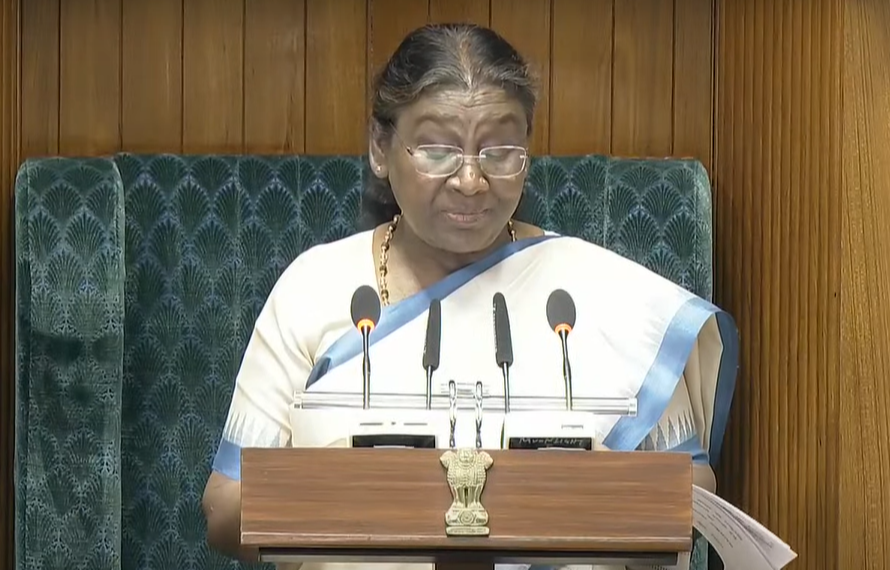

President Droupadi Murmu addressed the joint sitting of Parliament on Thursday

President Droupadi Murmu, addressing the joint sitting of Parliament, on Thursday, June 27, credited the reforms in the last decade for making India's banking sector one of the strongest in the world.

"Our public sector banks are robust and profitable today. Profits of public sector banks have crossed ₹1.4 lakh crore in 2023-24 which is 35% higher than last year. The strength of our banks enables them to expand their credit base and contribute to the economic development of the nation," the President said, adding that non-performing assets (NPAs) of public sector banks are continuously decreasing.

She noted that the State Bank of India (SBI) is earning record profits, and the Life Insurance Corporation of India (LIC) is getting stronger than ever.

SBI, India's largest state-run lender, reported a net of ₹20,698 crore in the January-March quarter, reflecting a 24% increase year-on-year (YoY). Year-to-date (YTD), the stock has rose 31.6%, while in the past year, it has climbed 47.7%.

LIC's net profit rose 2.5% YoY to ₹13,762 crore in Q4 FY24. The state-run insurer also reported improvement in asset quality in the final quarter of FY24. The stock has gained 19.2% YTD and advanced 60.4% in the past year.

President Murmu said that the government brought banking reforms to save the sector from "collapsing" and made laws like the Insolvency and Bankruptcy Code (IBC).

"Today, these reforms have made India's banking sector one of the strongest banking sectors in the world," she added.

Except for UCO Bank and Punjab and Sind Bank, all other public sector banks reported an increase in net profit in the March quarter.

How PSU banks performed in Q4 FY24

| PSU Bank | Q4 Net Profit (₹ crore) | Change (% YoY) |

|---|---|---|

| Canara Bank | 3,757.2 | 18.4 |

| Bank of Baroda | 4,886.4 | 2.3 |

| Punjab National Bank | 3,010 | 160 |

| Indian Bank | 2,247 | 55 |

| Bank of India | 1,439 | 7 |

| Union Bank of India | 3,310.5 | 19 |

| Bank of Maharashtra | 1,218 | 45 |

| Central Bank of India | 807.3 | 41 |

| Indian Overseas Bank | 808 | 24 |

| UCO Bank | 525.7 | -9.5 |

| Punjab and Sind Bank | 139 | -70 |

About The Author

Next Story