Business News

Long-term vision with higher budgetary allocation; a game changer for green energy stocks

.png)

10 min read | Updated on June 19, 2024, 17:22 IST

SUMMARY

Rising power consumption, climate change, and limited natural resources have alarmed governments worldwide. Sustainable development and achieving net-zero carbon emissions have become critical goals, driven by events like COP23. As a result, governments are increasingly supporting green energy initiatives to address these challenges.

Stock list

Long-term vision with higher budgetary allocation; a game changer for green energy stocks

The government's interest in the green energy sector has brought skin in the game for stocks operating in this particular sector. Energy companies for decades struggled with strained balance sheets as the sector demanded heavy infrastructure and to monetise from it businesses required a long gestation period.

However, over the period companies have managed to reduce debt and with government encouragement, the demand for sustainability has surged. The green energy stocks have moved significantly higher over the years.

Overview

India is the 3rd largest energy-consuming country in the world. India stands 4th globally in renewable energy installed capacity, 4th in wind power capacity and 5th in solar power capacity. The country has set an enhanced target at the COP26 of 500 GW of non-fossil fuel-based energy by 2030. This has been a key pledge under the government’s Panchamrit goals. This is the world’s largest expansion plan in renewable energy.

The installed solar energy capacity has increased by 30 times in the last 9 years and stands at 82.63 GW as of April 2024. India’s solar energy potential is estimated to be 748 GW as estimated by the National Institute of Solar Energy (NISE). The installed Renewable energy capacity (including large hydro) has increased by around 128% since 2014. Up to 100% FDI is allowed under the automatic route for renewable energy generation and distribution projects subject to provisions of The Electricity Act 2003.

As of April 2024, Renewable energy sources, including large hydropower, have a combined installed capacity of 191.67 GW.

The following is the installed capacity for Renewables

| Energy | Capacity |

|---|---|

| Wind Power | 46.16GW |

| Solar Power | 82.63GW |

| Biomass | 10.35GW |

| Small Hydropower | 5GW |

| Large Hydropower | 46.92GW |

| Waste to energy | 0.59GW |

| (Source- investindia.gov.in) |

India has set a target to reduce the carbon intensity of the nation’s economy by less than 45% by the end of the decade, achieve 50% cumulative electric power installed by 2030 from renewables, and achieve net-zero carbon emissions by 2070. The country aims for 500 GW of renewable energy installed capacity by 2030.

India wants to produce 5 million tonnes of green hydrogen by 2030. This will be supported by 125 GW of renewable energy capacity.

Budgetary Allocations

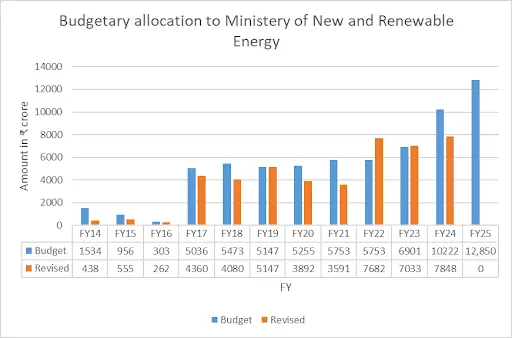

The Ministry of New and Renewable Energy in FY24 and FY25 saw substantial increases of 48.12% and 25.71%, respectively from preceding years in budget allocation.

Below table summarizes budgetary allocation to the Ministry of New and Renewable Energy from FY14 till FY25.

Below table summarizes budgetary allocation to various schemes under green energy in the FY25 budget

| Schemes | **Revised 2023-2024 ** | Estimates 2024-25 | % Change |

|---|---|---|---|

| Kisan Urja Suraksha evam Utthaan Mahabhiyan | 1,100 | 1,496 | 36.00% |

| Solar Power (Grid) | 4,757 | 10,000 | 110.22% |

| Wind Power (Grid) | 916 | 930 | 1.53% |

| National Green Hydrogen Mission | 100 | 600 | 500.00% |

| Green Energy Corridor | 434 | 600 | 38.25% |

| Reform Linked Distribution Scheme | 10,400 | 14,500 | 39.42% |

| Strengthening of power systems | 2,562 | 501 | -80.44% |

| Power System Development Fund | 900 | 1,200 | 33.33% |

| Faster Adoption and Manufacturing of Hybrid and Electric Vehicles in India (FAME India) | 4,807 | 2,671 | -44.44% |

| Nuclear Power Projects | 1,791 | 2,228 | 24.40% |

| Electrification Projects | 8,361 | 6,500 | -22.26% |

| ( Figures in ₹ crore) (Source - Notes on Demands for Grants, Union Budget 2024-2025) |

To recall last year’s announcement, the budget allocated ₹35,000 crore for priority investments in energy transition and Net Zero. Of this amount, ₹30,000 crore was designated to provide capital support to oil marketing companies for undertaking projects for energy transition, energy security and achieving Net Zero emissions by 2070.

The government announced the Pradhanmantri Suryodaya Yojana in January 2024 for rooftop solar installations in 10 million households.

Viability gap funding has also been announced for the initial addition of up to 1 GW in offshore wind energy capacity. The Union Government introduced the country’s first-ever tender last year to allocate sites for offshore wind energy projects. While the country has an installed wind capacity of 43.7 GW, it is currently limited to land-based wind projects.

The budget for the National Green Hydrogen Mission to develop green hydrogen has been increased to Rs 600 crore in the upcoming financial year from ₹100 crore estimated in FY 2023-24.

| Investment in PSUs through IEBR ( Figures in ₹ crore) | _Revised 2023-2024 _ | _Estimates 2024-25 _ |

|---|---|---|

| Indian Renewable Energy Development Agency | 20,496.59 | 25,914.39 |

| Solar Energy Corporation of India | 858.63 | 585 |

| _(Source - Notes on Demands for Grants, Union Budget 2024-2025) _ |

Green Energy vs Renewable Energy

Though ‘green energy’ and ‘renewable energy’ are often used interchangeably, one essential difference exists between them. While green energy sources are considered renewable, not all renewable energy sources are considered green. For example, solar power is a green and renewable energy; burning wood is renewable because you can grow more trees, but it is not green, as it pollutes the atmosphere. Green energy is a subset of renewable energy.

Green energy stocks

Green energy stocks are companies involved in developing alternative technologies with renewable resources that emit little to no pollution. The most prevalent sources of green energy include sunlight, wind, and heat. They can also include low-impact hydroelectric sources and specific forms of biomass. Companies that work towards creating no carbon emissions with these resources and reducing the use of fossil fuels are considered green energy companies.

Top performing Green (Renewable) energy stocks

| Stock Name | Market Cap (₹ Crore) | Share Price on June 14,2024 | 5Yrs Return |

|---|---|---|---|

| Adani Green Energy Ltd | 2,85,917.86 | 1,805.00 | 4275.76% |

| Suzlon | 67,257.49 | 49.44 | 1082.78% |

| WAA Solar Ltd | 245.44 | 185 | 969.36% |

| Tata Power | 1,43,310.98 | 448.5 | 587.36% |

| SJVN Ltd | 53,091.53 | 135.1 | 448.07% |

| (Source- NSE) |

Adani Green Energy Ltd

Suzlon Energy Ltd

WAA Solar Ltd

Tata Power Ltd

SJVN Ltd

Below are the other Green stocks which have outperformed in the last 5 years

| Stock Name | Market Cap (₹ Crore) | Share Price on June 14,2024 | 5Yrs Return |

|---|---|---|---|

| BF Utilities Ltd | 3,459.21 | 918.35 | 410.48% |

| Orient Green Power Company Ltd | 2,084.04 | 21.25 | 401.18% |

| NHPC Ltd | 1,02,911.38 | 102.45 | 306.55% |

| Energy Development Company Ltd | 107.73 | 22.68 | 284.41% |

| KPI Green Energy Ltd | 40,543.13 | 1,478.90 | - |

| IREDA | 48,137.87 | 179.1 | - |

| _(Source- NSE) *KPI Green Energy and IREDA are yet to complete 5 years on the Indian bourses _ |

Expectations from the upcoming full budget in July 2024

India’s ambitious target of 500 GW renewable energy capacity by 2030 and becoming energy self-reliant after that needs a booster dose from the upcoming full-fledged budget. However, February’s interim budget was no short for the renewable sector in any way. The hike in capital allocation to the sector highlighted the strategic vision of the government.

Industry expectations regarding capital expenditure have been met in the interim budget and the status quo on the same is expected to be maintained. Apart from that industry would look for inducement in R&D and transmission capabilities through schemes like PLI, and fiscal incentives in the form of tax relaxation including tax holidays for new setups are anticipated.

The outlook for the green energy sector in India remains positive, driven by an ambitious target of net carbon zero by 2070, technological advancement and growing energy demand with a focus on sustainability.

However technical feasibility like integrating renewable energy into the existing grid infrastructure poses challenges related to intermittency and stability. The green energy sector in India has shown robust financial performance and growth potential. With strong government support, increasing investments, and technological advancements, the sector is well-positioned to play a critical role in India's energy future and economic development.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story