Business News

Are India’s exports under threat from Trump’s reciprocal tariffs?

8 min read | Updated on March 18, 2025, 18:23 IST

SUMMARY

US President Donald Trump's reciprocal tariffs are changing the game of global trade. What potential implications can reciprocal tariffs have on India's exports to the US, India’s biggest trade partner? How will it impact the Indian economy and trade relations between India and the US? Which sectors will be hit the hardest? Find out all the answers in the article below.

Are India’s exports under threat with Trump’s reciprocal tariffs? | Image: Shutterstock

US President Donald Trump’s reciprocal tariffs are reshaping the global trade landscape. Starting April 2, 2025, the US will impose reciprocal tariffs on countries that levy higher duties on American goods, including India. This announcement has created uncertainty among key trading partners of the US and sparked discussions about its potential economic impact.

But what does this mean for Indian businesses, trade relations, and the economy? Let’s understand.

Current status of India and US trade relations

India-US economic relations year-on-year (value in US$ million)

| Trade activities | FY 2019-20 | FY 2020-21 | FY 2021-22 | FY 2022-23 | FY 2023-24 |

|---|---|---|---|---|---|

| India’s exports to the US | 53,088.77 | 51,623.14 | 76,167.01 | 78,542.60 | 77,515.03 |

| Growth (%) | -2.76 | 47.54 | 3.12 | -1.31 | |

| India’s imports from the US | 35,819.87 | 28,888.10 | 43,314.07 | 50,863.87 | 42,195.49 |

| Growth (%) | -19.35 | 49.94 | 17.43 | -17.04 | |

| Total trade | 88,908.65 | 80,511.24 | 119,481.08 | 129,406.47 | 119,710.52 |

| Growth (%) | -9.44 | 48.40 | 8.31 | -7.49 |

Source: Department of Commerce, Ministry of Commerce and Industry, GoI

Source: Department of Commerce

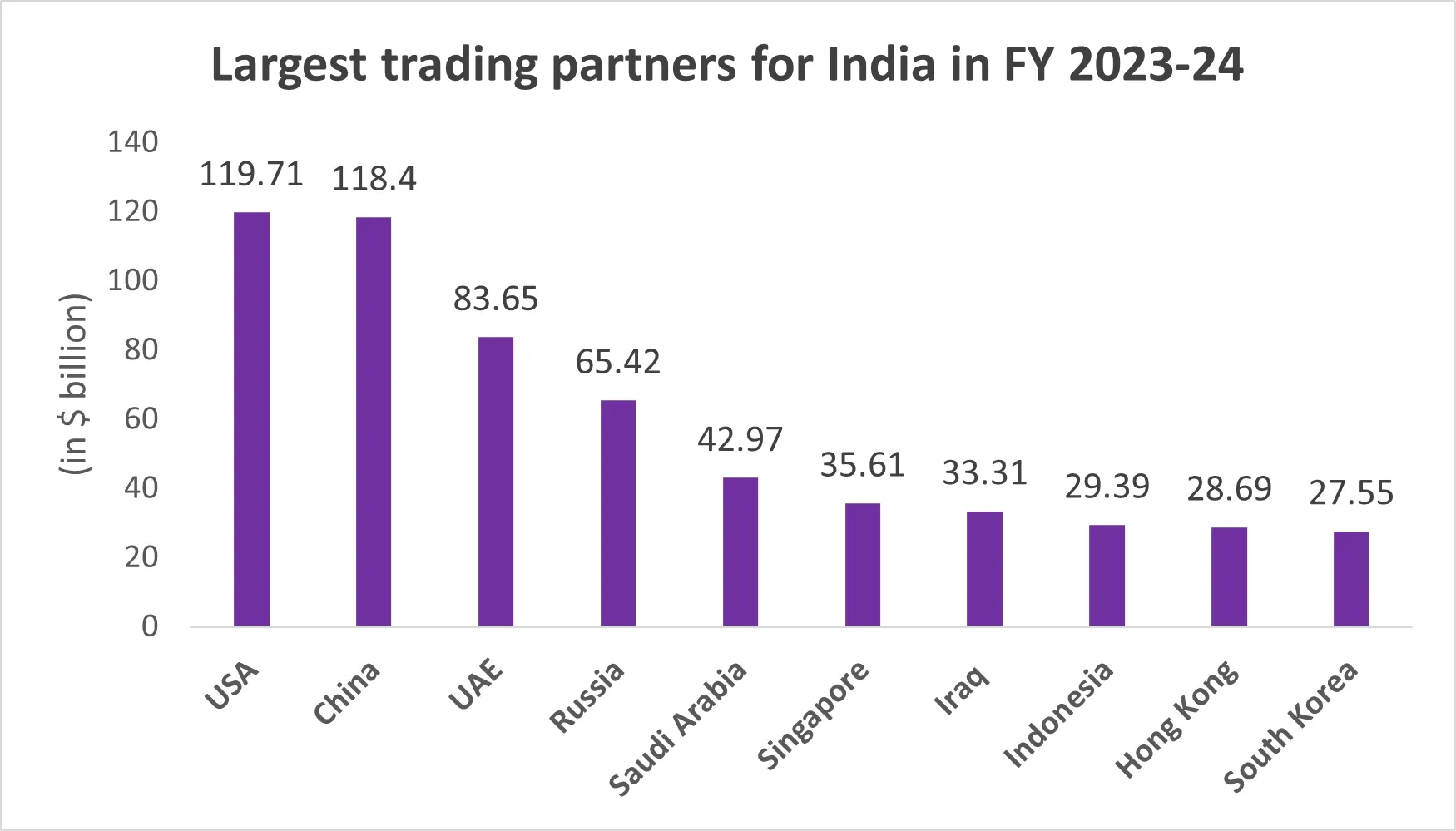

Hence, it is clear that India is more reliant on the US for trade.

Source: India’s Ministry of Commerce and Industry

Source: US Census Bureau

But now, things have taken a U-turn.

Trump’s criticism of India’s high tariffs on US goods, calling them “unfair” to the US and imposing reciprocal tariffs has raised some concerns for India.

For context, India’s tariff rates, while aligned with its protective economic strategy, are significantly higher than those of the US, especially in key sectors such as agriculture, textiles, automobiles and pharmaceuticals. India imposes a weighted average tariff of 8.5% (adjusted for the reduction in the recent budget) on US imports, whereas the US maintains a much lower average of 3%.

Although this abrupt realisation of high tariffs could be one factor, the main motive behind Trump's reciprocal tariffs decision is to narrow the growing US trade deficit gap with India and to boost tariff revenues to make up for reduced corporate tax income.

What will be the impact of Trump’s reciprocal tariff on India?

This is a debatable subject at the moment.

- A research report by Morgan Stanley states the direct impact of reciprocal tariff hikes will likely be manageable for India; however, the indirect impact through trade uncertainty weighing on business confidence is more worrisome.

- According to Citi Research, the reciprocal tariffs imposed by the US could lead to annual losses of $7 billion for India.

- A report by Nomura states India is among the least vulnerable Asian countries in this trade war.

- According to SBI Research, the impact of US tariffs on Indian exports to the US would likely be limited to just 3% to 3.5%.

While experts have different views on the potential impact of reciprocal tariffs on India, one thing is certain.

India will face a relatively smaller impact due to its diversified export portfolio and growing trade relationships with other regions such as Europe and the Middle East. India has strategic partnerships and free trade agreements with countries like the UAE, Australia, and the European Union. Moreover, India is also a member of forums like the Regional Comprehensive Economic Partnership (RCEP) and BRICS. These strong global partnerships are expected to cushion the impact of US tariffs on India.

There is another interesting point here.

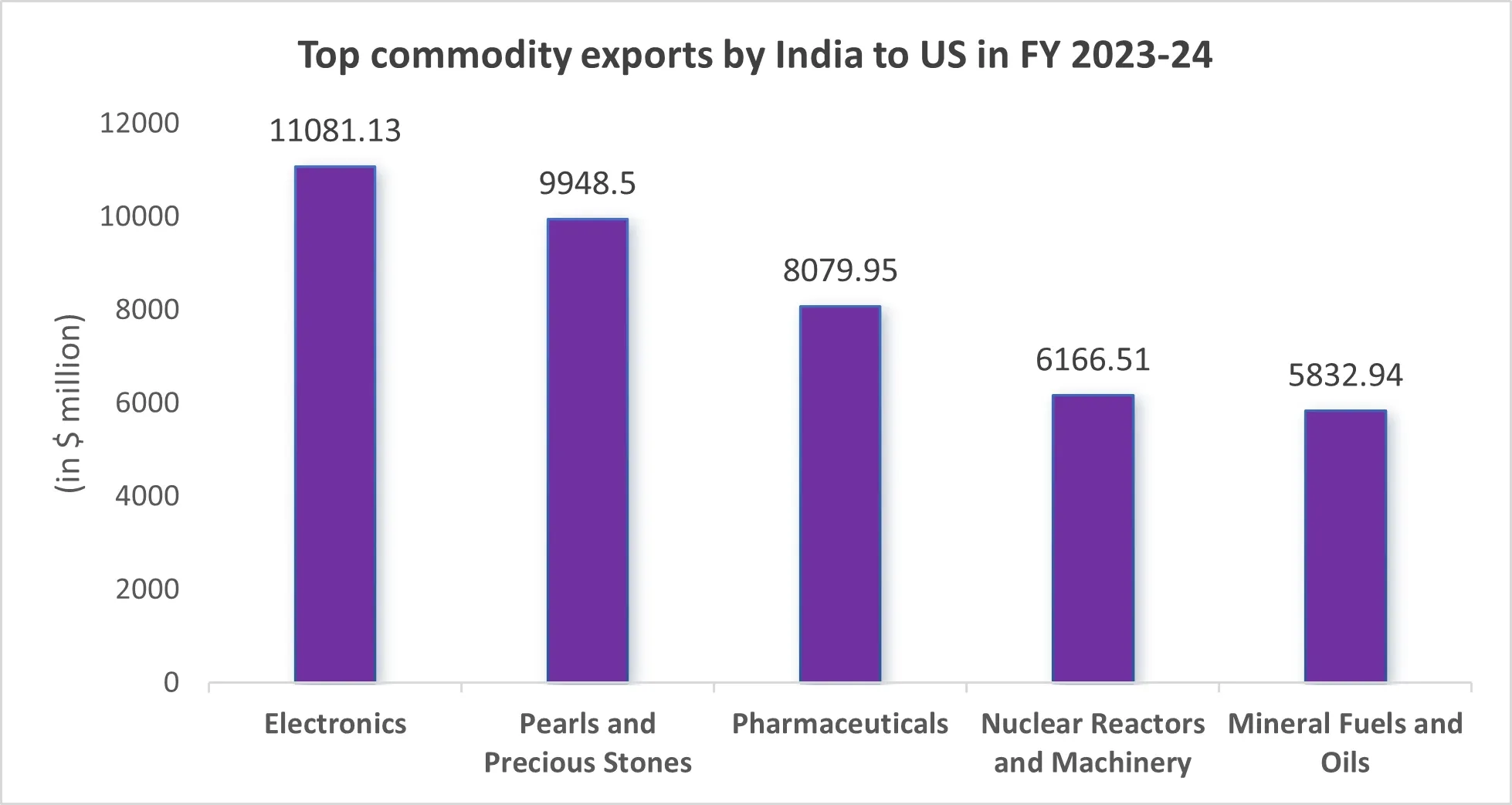

With Trump imposing 25% tariffs on Mexico and Canada (its top two trade partners) and 20% on China, India could benefit from these strained trade relationships by exporting more technology, electronics and jewellery to the US. But this will be possible only if India expands its supply capability to export to the world and becomes globally competitive in the products that the US currently relies on its key trading partners.

While experts believe that Trump’s reciprocal tariff plan may turn out to be more of “white noise” for India’s exports, few sectors could bear the heat of the tariff war.

Sectors that may be impacted

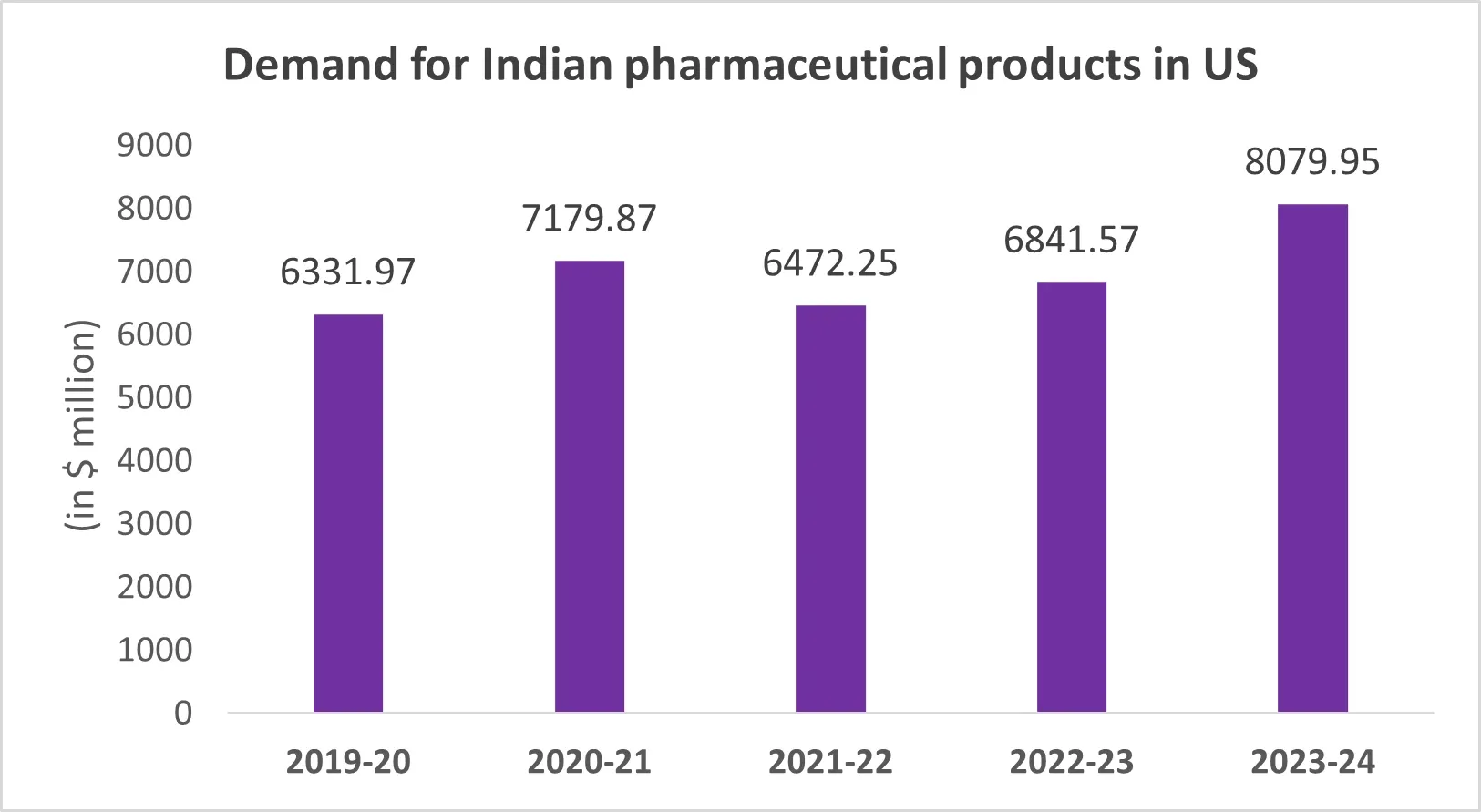

- Pharma

There is a massive demand for Indian drugs in the US market. As many as 4 out of 10 prescriptions filled in the US in 2022 are supplied by Indian companies.

Source: Ministry of Commerce and Industry

Currently, there is no import duty on Indian pharmaceuticals in the US. However, India levies around 10% import duty on American drugs.

If the US imposes tariffs on pharma products, it will increase the export cost for many pharma companies. A sudden price surge might reduce the demand of Indian medicines in the US, leading to losses for Indian pharmaceutical companies.

- Agriculture

Given the wide tariff gap of nearly 40% between India and US in the agriculture sector, if the US decides to impose reciprocal tariffs on a wider array of agricultural goods, India’s food and farm exports, including shrimp, dairy, and processed foods, could see substantial disruptions.

While the trade volumes in this sector are relatively low, the tariff differences could lead to the sector facing import duties of up to 38.2%.

- Specialty chemicals

India is one of the biggest suppliers of agrochemicals, dyes, and fluorochemicals to US manufacturers. Currently, organic and miscellaneous chemicals face a 10% tariff in India, while the US average tariff for similar products is around 3%.

If a 7% tariff is imposed on Indian specialty chemicals exported to the US, it would significantly dent exporters’ earnings and they could see a drop of up to 12% in EBITDA as per Citi Research estimates.

- Gems and jewellery

India is a major exporter of gems and jewellery, with the US importing $8.5 billion worth in 2024. However, a significant tariff gap remains a concern. While the US imposes a 2.1% duty, India levies around 15.4% on imports in this sector. With reciprocal tariffs coming into effect, the gems and jewellery industry is likely to face major setbacks.

Other key sectors that could come under pressure due to reciprocal tariff hikes are electrical, industrial machinery, fuels, textiles, iron & steel, and automobiles.

But as they say, every coin has two sides, can this cloud also have a silver lining? Let’s find out.

The positive impact of Trump’s tariffs on the Indian economy

According to former RBI Deputy Governor Viral Acharya, Trump’s tariff policy is expected to boost India’s economy, as the government aims to reduce trade barriers to counter the tariff threat.

It will also encourage Indian businesses to position themselves as global leaders. Small, medium and large enterprises can lower their production costs with the support of the Indian government, making tariffs less impactful.

Additionally, the potential migration of companies from China to India, driven by lower tariffs, could significantly benefit India. It could boost manufacturing and create opportunities for Indian manufacturers and exporters.

But here’s the thing. A lot of these positive impacts depend on the Indian government’s response to the tariff war.

India’s efforts to ease trade tensions

To mitigate trade tensions, India and the US are collaborating towards a mutually beneficial trade agreement. Both nations have set an ambitious goal under “Mission 500” to double bilateral trade to $500 billion by 2030. A key component of this effort will be negotiations for a multi-sector bilateral trade agreement by 2025, focusing on reducing tariff and non-tariff barriers, improving market access, and strengthening supply chain integration.

India is making efforts to strengthen trade ties. We saw the measures introduced in the 2025 Union Budget to ease trade tensions. Furthermore, India has already slashed tariffs on several items. For instance, tariffs on high-end motorcycles have been lowered from 50% to 30%, while those on bourbon whiskey have been cut from 150% to 100%. In addition, India has pledged to reassess other tariffs, expand energy imports, and increase defence equipment purchases from the US.

Looking ahead, all eyes are now on the Indian government’s response to the “Trump Card” as it will decide the country’s economic growth and sustainability.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story