Business News

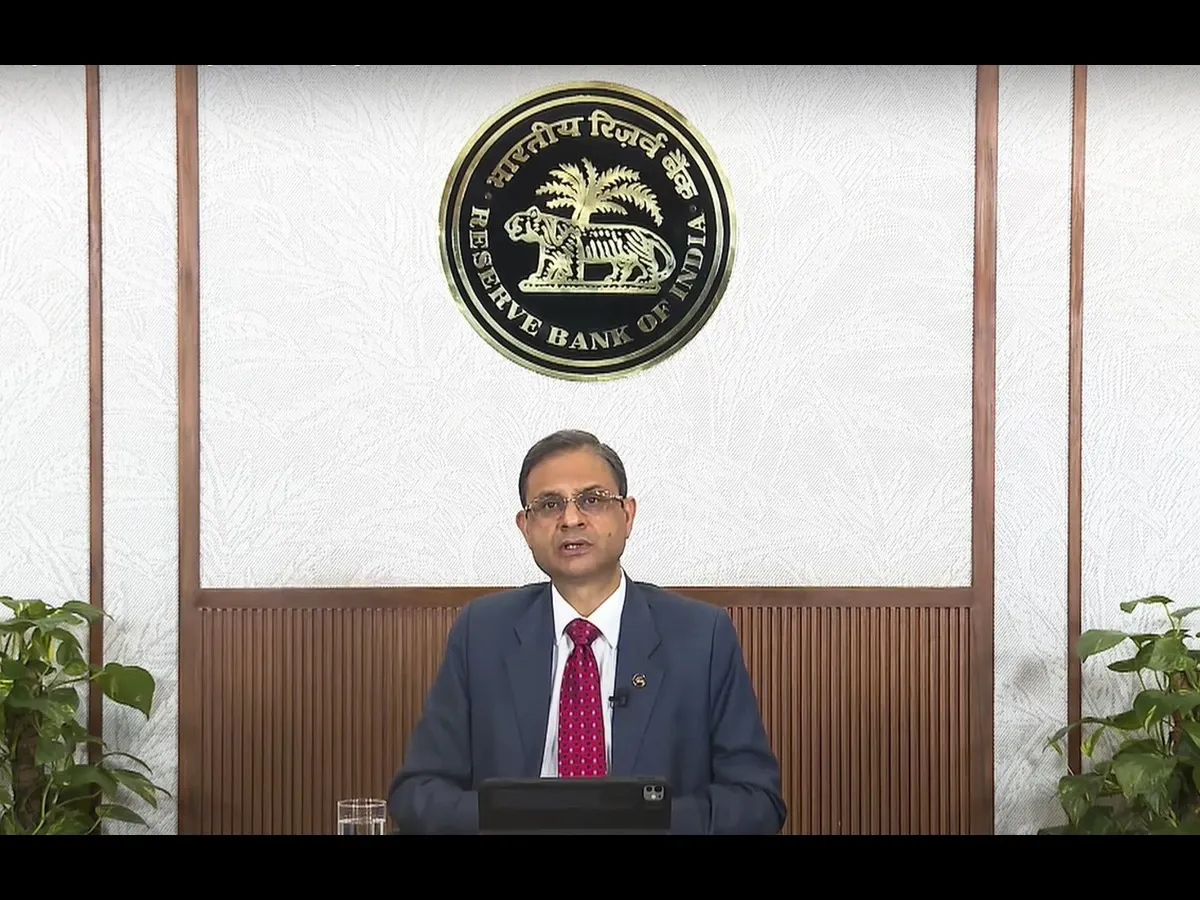

RBI to monitor rapidly evolving global situation, remain 'agile and proactive' in policy actions: RBI Governor

.png)

3 min read | Updated on April 21, 2025, 09:41 IST

SUMMARY

“ In view of the rapidly evolving situation, especially on the global front, we are continuously monitoring and assessing the economic outlook. We will be agile and proactive in our actions on the policy front, as always”, said RBI governor Sanjay Malhotra.

Tariff war induced global uncertainty is expected to shape global trade and economic policies across the globe.

Amid the ongoing tariff war, Reserve Bank of India (RBI) Governor Sanjay Malhotra has said that the central bank will continuously monitor the rapidly evolving global situation and remain 'agile and proactive' in its policy actions. Observing that the Indian economy and the financial markets have demonstrated remarkable resilience, Malhotra cautioned that ‘they are not immune to the vagaries of an uncertain and volatile global environment’.

He said ‘In view of the rapidly evolving situation, especially on the global front, we are continuously monitoring and assessing the economic outlook. We will be agile and proactive in our actions on the policy front, as always. He said the growth-inflation balance has improved significantly, and there has been a decisive improvement in headline inflation, which is projected to remain aligned to the target of 4 per cent in FY26. However, global uncertainties and weather disturbances pose risks to the inflation outlook.

He added ‘Even though we have projected a somewhat lower real GDP growth for FY26 at 6.5 per cent, India is still the fastest growing economy. Yet, it is much below what we aspire for. We have reduced repo rates twice and provided sufficient liquidity. On the Indian financial markets, the Governor said all market segments, including FX, G-sec, and Money Markets, have largely remained stable.

He noted that while the rupee came under a bit of pressure a few months ago, it has fared better thereafter and regained some lost ground. Equity markets experienced a significant correction, as capital outflows accelerated, a trend seen in most emerging markets. The government securities market has, however, remained rock-steady throughout the year.

He further said the gross market borrowings of the central and state governments, totalling Rs 24.7 lakh crore in FY 2024-25, sailed through smoothly. The cost of borrowing for the central government came down by 28 basis points to 6.96 per cent in FY25, from 7.24 per cent in FY24. The secondary market in g-secs continued to be deep and active, partly aided by India's inclusion in global bond indices. In India, Malhotra said markets have evolved within a regulated framework, adapting to changing regulatory philosophies and approaches.

He also emphasised that the foreign exchange markets are reasonably liquid with narrow bid-ask spreads and there is growing transparency in this market. The Reserve Bank has recently announced that access to FX Retail will also be provided through the Bharat Connect platform. In the first phase, a pilot to facilitate purchase of US dollars by individuals is planned. Subsequently, its scope will be expanded based on the experience gained.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story