Whether the Market is Up or Down, Consider the Moneyness

Option traders tend to thrive on market volatility. This makes sense because if a trader is placing a directional bet on the movement of an index or stock, the trader can only make a profit if that index or stock moves enough to cover the cost of buying the option. One of the great things about options trading is that you can “choose your own adventure”. As a trader, you can decide if you want to accept a reduced max gain to increase your odds of making a profit or maybe exchange a potential higher loss for greater upside.

If the markets are moving less, then a good way to improve your chances of profitability is to lower the break-even point. A way to do this is to look towards in-the-money (ITM) contracts instead of at-the-money (ATM) or out-of-the-money (OTM) contracts. The drawback of in-the-money contracts is that there is a larger cash outlay compared to at-the-money or out-of-the-money contracts.

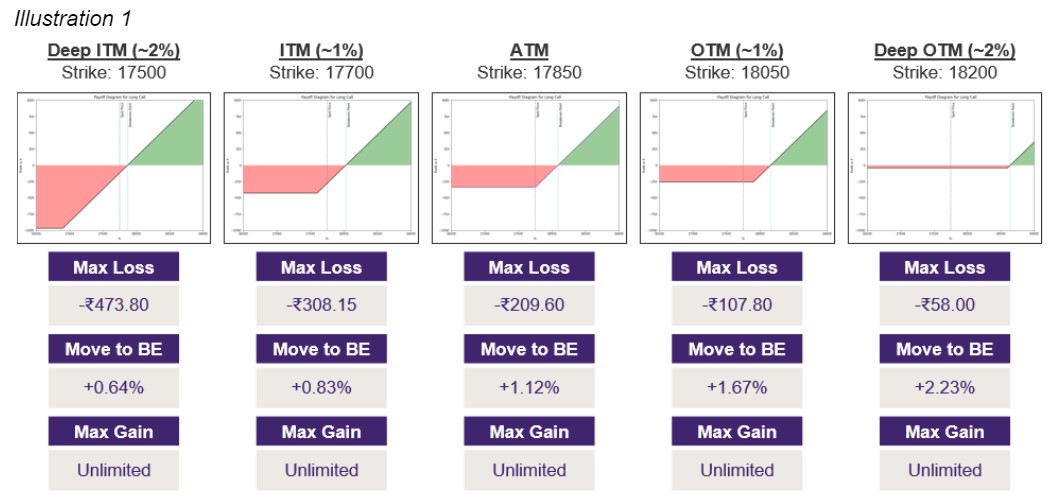

Let’s look through a quick example. Illustration 1 has 5 different contracts for the Nifty 50 with a 19 Jan 23 expiration date. The prices listed are as of market close on 6 Jan. Comparing the 2% ITM (in-the-money) contract with the 2% OTM (out-of-the-money) contract, you can see that the price to purchase the ITM contract is over 8X that of the OTM contract. The benefit to the 2% ITM contract is that the break-even is a move of +0.64% over the two weeks. By comparison, the Nifty would need to move +2.23% for the 2% OTM to break-even. Since +0.64% is a smaller price move than +2.23%, the likelihood of the ITM contract breaking even is greater than the likelihood of the OTM contract breaking even.

Let’s assume the Nifty closes 2.5% higher to 18305 on expiration. This leads to a profit of 331.20 for the ~2% ITM contract. The calculation for this is:

- Nifty close on expiration (18305) – Strike Price (17500) – Option Cost (473.80)

We can contrast this with the ~2% OTM contract that would have a profit of 47.94. The calculation for this is:

- Nifty close on expiration (18305) – Strike Price (18200) – Option Cost (58.00)

In our above scenario, the ROI for the 2% ITM contract is 82% (331.20 / 473.80) and the ROI for the 2% OTM contract is 81% (47.00 / 58.00). The ROI for the out-of-the-money contract beats out the ROI of the in-the-money contract. However, trader success isn’t only defined by return on investment. Traders also need to consider the likelihood of entering into a winning trade as well as the winning percentage. Moneyness allows traders to calibrate how much they want to gain with how often they can potentially win.