Benchmark indices post gains amid global volatility

The Indian stock markets had a decent but volatile run during the holiday-shortened week that ended on November 17. After welcoming Samvat 2080 on a positive note on Sunday with an hour-long Diwali Muhurat Trading Session, the broader market indices managed to post weekly gains, with two consecutive days of gains and two days of losses along with a trading holiday on Tuesday.

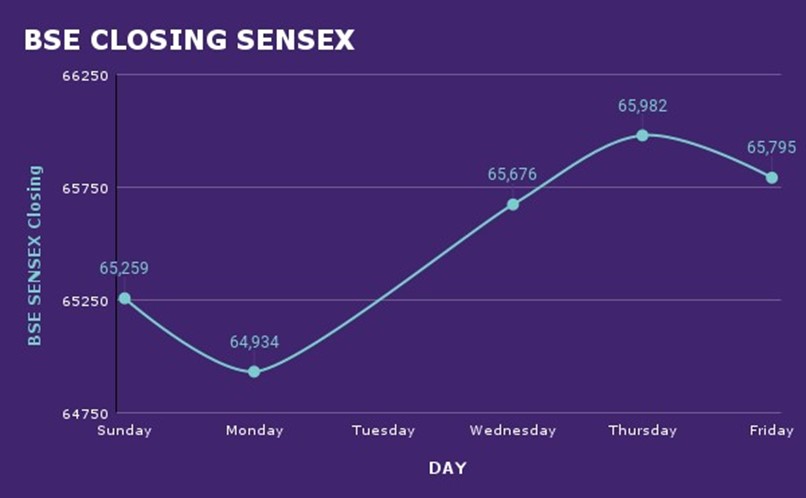

After the end of trading hours on Friday, the benchmark NIFTY 50 index was up 1.6% for the week, while the BSE Sensex ended 1.4% higher. Among the sectoral indices IT, auto, FMCG, metal and pharma sectors posted gains whereas the banks and financial services stocks logged losses this week.

Let’s take a detailed look at the key highlights of the Indian stock markets during the week that went by.

Positive inflation cues

This week, the US CPI (consumer price index) inflation came in at a softer-than-expected 3.2%, fuelling hopes that the US Federal Reserve may start cutting rates within the first half of the next year. As a result, US bond yields plunged as traders anticipated that policy rates had peaked.

The CPI inflation data for India was also released on November 13, indicating that inflation slowed to a 5-month low of 4.87% in October 2023 (provisional). Retail inflation had stood at 5.02% year-on-year in September. The benign inflation scenario, both globally and domestically, proved to be a double booster for the Indian stocks.

IT stocks

The expectations that the Fed was done hiking rates also triggered fresh buying in the Indian IT companies that usually have a strong base of US clients**.** Separately, shares of India’s largest IT services exporter Tata Consultancy Services Ltd (TCS) were in focus after the company finalised November 25 as the record date for its Rs 17,000 crore share buyback plan.

Consequently, the NIFTY IT index surged over 5% during the week, with shares of Tech Mahindra Ltd leading the pack with 5.5% gains. Stocks of TCS and Infosys Ltd jumped 5% each during the week, while those of L&T Infotech Ltd and HCL Technologies Ltd rose 4.7% and 4.2%, respectively.

Banking stocks

Stocks of banking and finance companies took a major hit on Friday after the Reserve Bank of India (RBI) made consumer lending costlier for lenders.

RBI raised the risk weights for lenders and non-bank financial companies (NBFCs) by 25 percentage points to 125% on retail loans compared to 100% earlier. Risk weights for loans are essentially the capital that banks need to set aside for every loan.

This move may prompt banks and NBFCs to increase interest rates on personal loans and credit cards, thereby adversely affecting growth in these categories.

Shares of SBI were down 3.7% on Friday, while those of SBI Cards and Payment Services Ltd slipped 5%. RBL Bank Ltd crashed over 7.7% on the last day of the week, while others like Axis Bank Ltd were down 3.3%, ICICI Bank fell 1.6% and Bajaj Finance dropped 1.9%.

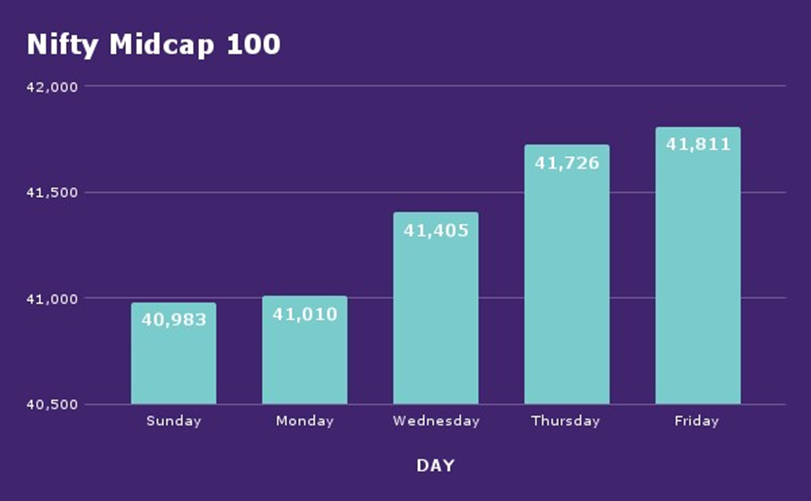

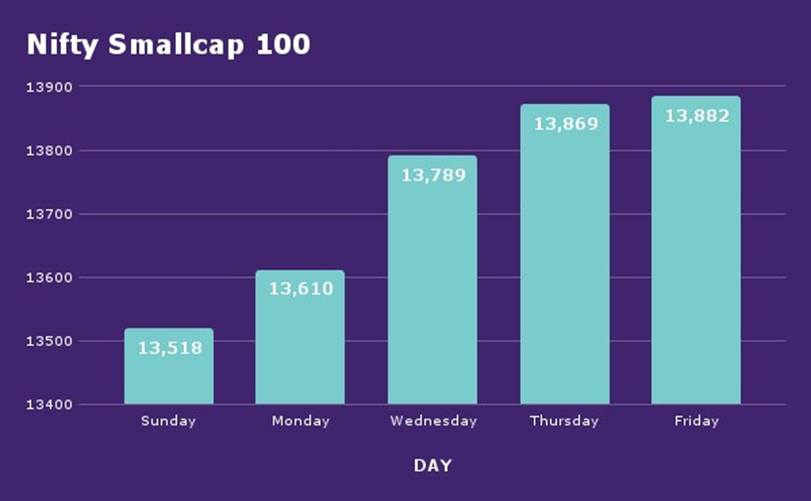

Small caps, midcaps shine

The small cap and midcap indices outperformed key broader benchmark indices this week, hitting fresh highs.

The NIFTY Smallcap 100 surged 3.9% during the week, while the NIFTY Midcap 100 rose 2.6%. Notably, this is the second consecutive week when the smallcap and midcap stocks delivered strong returns to investors.

Global markets rally

Global Stocks rose this week, providing support to the Indian equity markets, on hopes that central banks across the world would now pause on the aggressive interest-rate increases.

Europe’s Stoxx Europe 600 Index jumped 2.8% this week, S&P 500 gained 2.1%, while the FTSE 100 was up 1.6%. Meanwhile, Hong Kong’s Hang Seng Index inched up 1.5% this week, Japan’s Nikkei 225 rose over 3% and Australia’s ASX 200 climbed 1% during the period.