Tega Industries IPO – All You Need to Know

Incorporated in 1976, Tega Industries (Tega) manufactures components of mining equipment. These components are used across different stages of mineral ore processing.

Tega has six manufacturing sites: three in India and the other three strategically located in Chile, South Africa, and Australia.

Offer details

-

Start date: 1 December 2021

-

End date: 3 December 2021

-

Price band: ₹443–₹453 per share

-

Minimum investment: ₹14,949

-

IPO size: ₹619 crore

Business highlights

-

Globally, Tega is the second-largest producer of polymer-based mill liners. It’s global market share rose from 3% in 2018 to 5% in 2020.

-

Apart from mill liners, it also makes other components such as conveyor belts, pump parts and chutes used in mineral ore processing.

-

As on June ‘21, its order book stood at ₹316 crore, which is about 40% of its FY21 revenue.

Financials

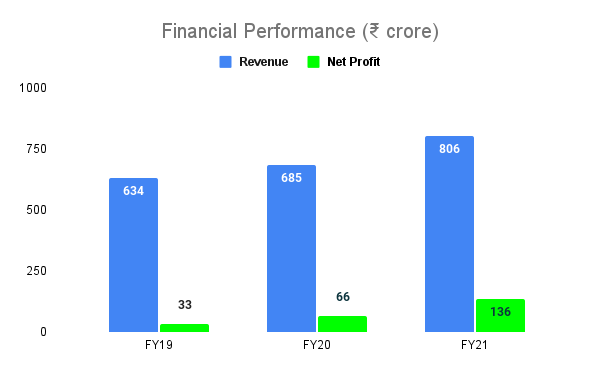

Revenue: 13%; Net profit: 103% (FY19-21 CAGR)

**Strengths**

**Strengths**

-

High repeat revenue of about 75% due to replacement demand.

-

60% of revenue comes from gold and copper ore processing sites.

-

These metals have different demand cycles and hence provide stability to the revenue.

-

High client diversification with top 10 customers accounting for less than 30% of total revenue.

-

Tega is one of the most efficient players globally with operating margins of around 28% and return on capital employed of about 24% in FY21.

Risks

-

Business presence in over 70 countries exposes it to currency fluctuations and geo-political risks.

-

Failure to manage its vast production and distribution network could hamper business growth.

-

Loss of a long-term marquee customer(s) may result in loss of business in an industry, which has high entry barriers.

Opportunities

-

Gold and copper ore processing is expected to grow at 6% CAGR to $3 billion over the next 10 years.

-

Strategically located manufacturing sites are positioned in key mining belts to leverage the growth of its clients.

-

Interestingly, declining grades of copper ore require more processing material. This is expected to boost demand for Tega’s products.