Star Health IPO: All you need to know

Introduction

Established in 2006, Chennai-based Star Health and Allied Insurance (Star Health) offers coverage for health, personal accident and overseas travel. It is India’s largest private health insurer and commanded a market share of 15.8% in fiscal 2021.

Offer Details

-

IPO Size: ₹7,249 crore

-

Fresh issue: ₹2,000 crore

-

Offer for sale: ₹5,249 crore

-

Price band: ₹870-₹900 per share

-

Face Value: ₹10 per share

IPO Timeline

-

Start Date: 30 November 2021

-

End Date: 2 December 2021

-

Tentative Allotment Date: 7 December 2021

-

Tentative Refund Credit: 8 December 2021

-

Tentative Share Credit in Demat: 9 December 2021

-

Expected Listing Date: 10 December 2021

Registrar Information (RTA)

-

Registrar to the Offer: KFin Technologies Private Limited

-

Contact Person: Jayashree Sethuraman, Company Secretary and Compliance Officer

-

Contact: +91 44 2828 8800

-

Email: investors@starhealth.in

Key Highlights

-

The Indian health insurance market continues to be underpenetrated with health insurance penetration of only 0.3% of GDP compared to a global average of about 2% of GDP. Further, outside of government plans, only 10% of the population has health insurance policies.

-

After starting in 2006, Star Health has emerged as the leading insurer with 15.8% market share in FY21 and has ranked first in the retail health insurance market over the last three years.

-

Star Health has strategically focused on retail health insurance and derives nearly 90% of its gross written premium (GWP) or premium from this segment. It had insured 2 crore lives in FY21.

-

It received about 80% of the business from individual insurance agents and has about over 5 lakh agents in its network. Apart from this, it also sells policies directly online through its website, brokers and web aggregators.

-

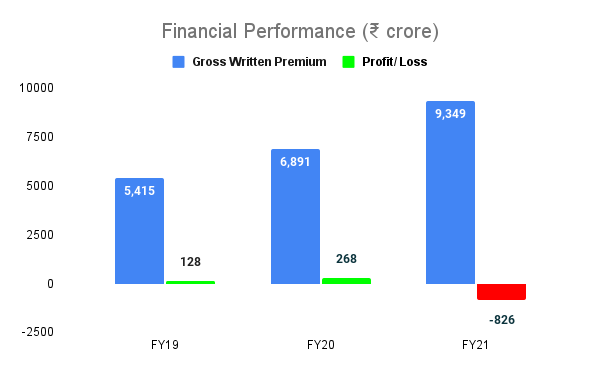

In FY21, the company had a GWP of ₹9,348 crore. Its retail health GWP was three times higher than the next highest retail health insurance player

-

HDFC Ergo.

-

Its retail business premium has grown at a CAGR of 31% between FY18 and FY21, which is highest among the top five players in the segment.

-

As per industry reports, India’s total gross direct premium for health insurers is expected to grow at 19% CAGR between FY21 and FY25.

-

The growth is expected to be driven by economic growth, rising disposable incomes and increasing awareness about getting insured especially after the pandemic.

-

While the opportunity for insurance companies in India is large, the business also carries risks of sudden spike in claims. For example due to the pandemic, Star Health’s overall gross paid claims amounted to a total of over ₹3,300 crore during the 18 months (FY21 and first half of FY22).

Financial Information

Here’s a look at the company’s financial status:

Strengths

-

In FY21, the company had a 15.8% overall health insurance market share and a 31.3% retail health insurance market share. The strong brand recognition puts the company in a position to continue its growth and strategically increase market share in the retail health insurance market

-

The company offers the highest number of retail products (17 products) among its peers, signalling its focus on product innovation.

-

In India, health insurance is largely an assisted product and customers require help for policy selection and claim processing. Star Health has the largest individual agent network, of around 5 lakh agents, among its peers.

-

Star Health had an overall claim ratio at around 65% between FY18-20, which remained under control till the pandemic struck. It rose to 94% in FY21. The claims ratio is the percentage of claims costs incurred in relation to the premiums earned.

-

The company has a backing of strong promoters viz. Safecrop India Investments LLP, WestBridge AIF I and Mr. Rakesh Jhunjhunwala

Risks

-

Outbreaks of epidemic or pandemic in future could significantly affect Star Health’s business. It suffered a loss of ₹825 crore in FY21 due to a surge in pandemic-related claims.

-

An insurer's business is to a large extent driven by the company's brand, business reputation and market perception. Any kind of negative publicity could harm the company’s reputation and in turn affect its business prospects.

-

Failure to keep pace with rapidly changing technology in the health insurance industry can affect the company’s growth and market share.

-

Nearly 80% of Star Health’s business is generated from the retail health insurance segment. Any adverse trends such a preference towards government or group health insurance plans could impact the business.

-

Inability to grow or develop a network of agents in a cost-effective manner in future.

-

In the past, the company has failed to meet its solvency ratio requirement. If it fails to meet the requirement in the future, the company could face regulatory action. As of 30 September 2021, its solvency ratio was 1.52x versus IRDAI prescribed level of 1.50x.

Opportunities

-

The health insurance penetration in India is low at just 0.3% of GDP versus a global average of around 2% of GDP.

-

Further, the health insurance density or the per capita premium in India is significantly low and stood at $5 in 2019 compared to $20 in Russia and $66 in China. This indicates room for rise in premium rates.

-

According to CRISIL research, the gross direct premium of health insurers is expected to grow at 18% CAGR between FY21-FY25E, indicating strong growth prospects for the industry and companies with leading positions.

-

Of this, retail health insurance is expected to grow at 23% CAGR. Star Health has strategically positioned itself in this area and derives nearly 80% of the business from this segment.