Sigachi Industries IPO: All you need to know

Incorporated in 1989, Sigachi Industries Limited is one of the largest manufacturers of Microcrystalline Cellulose (MCC) in India. MCC is primarily widely used as an excipient (carrier or supporting material) for finished dosages in the pharmaceutical industry. Here’s all you need to know about this IPO.

IPO Details

-

IPO size: ₹125 crore

-

Fresh issue: ₹125 crore

-

Offer for sale: Nil

-

Price Band: ₹161-₹163 per share

-

Lot size: 90 shares

-

Cost per lot: ₹14,670

-

Issue opens: 1 Nov 2021

-

Issue closes: 3 Nov 2021

-

Basis of allotment date: 10 Nov 2021

-

Initiation of refunds: 11 Nov 2021

-

**Credit of shares to demat account:**12 Nov 2021

-

Expected listing date: 15 Nov 2021

-

Registrar: BigShare Services Private Limited

-

Contact: Shreya Mitra, +91 040 4011 4874/75/76

-

E-mail: cs@sigachi.com

Key highlights

-

Hyderabad-based Sigachi is a leading manufacturer of high quality and consistent Microcrystalline Cellulose Powder

-

Its products find application in pharmaceutical, supplement and food industries.

-

Sigachi exports its products to 41 countries including the US, Denmark, U.K., etc. The share of exports in the total revenues has been growing and in fiscal ‘21, exports contributed nearly 73% of the total revenues.

-

The company plans to use net proceeds of this issue to primarily enhance its production capacity of MCC

-

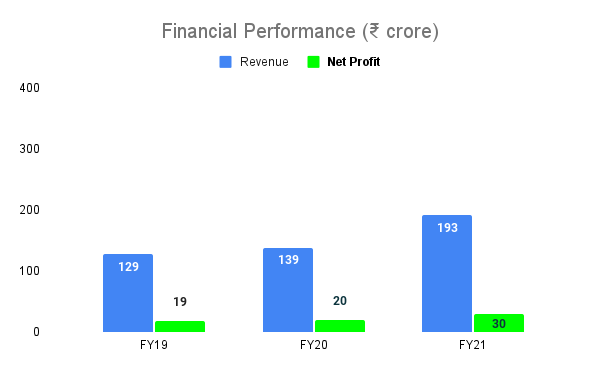

Between FY19 and FY21, the company’s revenues and net profit have seen steady growth and have grown 22% and 26%, respectively.

Reasons for going public

-

Expansion of production facilities for microcrystalline cellulose at Dahej and Jhagadia in Gujarat

-

To manufacture Croscarmellose Sodium at Kurnool in Andhra Pradesh

-

General corporate purposes

Company Fundamentals

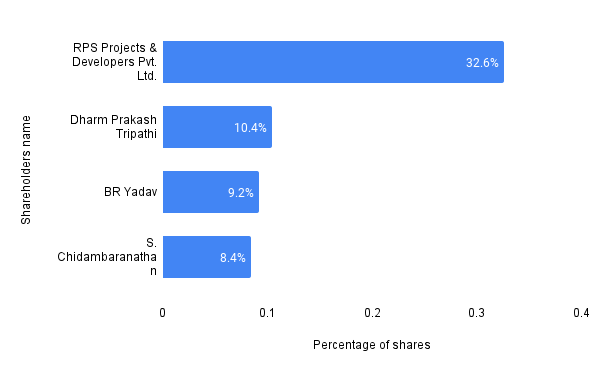

Top shareholders of the company are:

Company Financials

Here’s a look at the company’s financial status:

Company Overview

Hyderabad-based Sigachi Industries manufactures microcrystalline cellulose (MCC), which is used as excipient (binders, fillers) in pharmaceutical, supplement and food industries. The company has three manufacturing locations in India and is one of the leading MCC makers in India.

Industry outlook

The global market for MCC is expected to grow at a CAGR of 7.2% between 2020-2025 and reach $1.4 billion (about ₹10,500 crore) by 2025. The growth is expected to be driven by the rising demand for packaged food and rising demand for pharmaceutical, cosmetic and personal care products. Europe is currently the largest market for MCC and accounts for nearly one third of the market share. India is a relatively smaller market with a size of about ₹300 crore. Sigachi derives more than 70% of its revenues from exports.

Competitive strengths

-

Well-experienced and highly skilled management team with a strong background in the excipient and pharmaceutical industry

-

A long-standing market presence and the superior quality of products with outstanding quality control and quality assurance team

-

Extend services to multiple sectors, including but not limited to pharmaceuticals, nutraceuticals, food and cosmetics.

Risks

-

Reliance on the demand from the pharmaceutical industry for a significant portion of the revenue

-

No long-term agreements with suppliers of raw materials

-

Dependence on few customers for significant portion of the revenue

-

Instances of delays or defaults in customer payments could increase working capital investment

-

Depleting forest reserves may affect raw material availability

-

mainly wood pulp