Sapphire Foods IPO: All you need to know

Incorporated in 2009, Sapphire Foods India is one of the Yum Brands’ largest franchisee operators in the Indian subcontinent. It operates KFC, Pizza Hut outlets and Taco Bell.

As of June 2021, it owned and operated 209 KFC restaurants in India and the Maldives, 239 Pizza Hut restaurants in India, Sri Lanka and the Maldives, and 2 Taco Bell restaurants in Sri Lanka.

Here is everything you should know about the Sapphire Foods India Limited IPO:

Offer details

-

IPO size: ₹2,073 crore

-

Fresh issue: NA

-

Offer for sale: ₹2,073 crore

-

Price Band: ₹1,120-₹1,180 per share

-

Lot size: 12 shares

-

Cost per lot: ₹14,160

-

Issue opens: 9 Nov 2021

-

Issue closes: 11 Nov 2021

-

**Basis of allotment date:**16 Nov 2021

-

Initiation of refunds: 17 Nov 2021

-

**Credit of shares to demat account:**18 Nov 2021

-

Expected listing date: 22 Nov 2021

-

Registrar: Link Intime India Private Ltd

-

Contact: Sachin Tukaram Dudam, Tel.: +91 22 6752 2343

-

E-mail: investor@sapphirefoods.in

Shares of the company will list on BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

Key highlights:

-

Incorporated on November 10, 2009. Sapphire Foods is YUM’s largest franchisee operator in the Indian subcontinent.

-

The company has been associated with the Yum since 2015 and has non-exclusive rights to operate KFC, Pizza Hut and Taco Bell

-

It has presence in India, Srilanka and the Maldives

-

The company has warehouses across five cities in India to service its restaurants

-

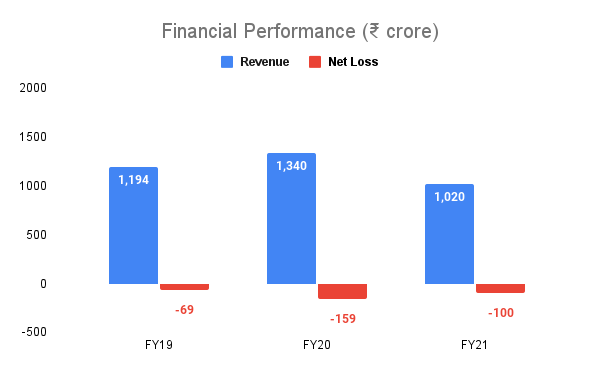

Over the last three financial years, the company has suffered losses

Company’s reasons for going public

-

Enhancing company brand name among existing and potential customers

-

Creation of a public market for the company’s shares

-

Carry out offer of sale for the selling shareholders

Company fundamentals

Here is some key fundamental information about the company:

Financial information

Overview of business

Sapphire Foods has risen to the top of the food franchise chain. Sapphire Foods has a pan-Asia presence, including India, Sri Lanka, and the Maldives. The store count has gone up from 376 in March 2020 to 450 in June 2021.

Strengths

-

India’s leading Quick Service Restaurant (QSR) with a substantial market presence online and offline.

-

Made significant investments in operations and has a well-defined process

-

Built scalable new restaurant economic model for expansion

-

Strong net worth and limited reliance on capital borrowing

-

Strong management team with more than two decades of experience in the food sector

Opportunities

-

Conversion from unorganised food services to the brands

-

Fast-paced expansion to capitalise on growth opportunities

-

Leveraging omnichannel strategy

-

Exploring opportunities to acquire high quality and scalable QSR and food brands

Threats

-

Intense competition from domestic and global food chain giants, such as Jubilant Food Works Ltd, Westlife Development Ltd, and Burger King India Ltd

-

Change in healthcare and local/national government regulations

Risks

-

The company has suffered losses over the last three financial years and could run the risk of losses in the future

-

It may incur additional debt in the future

-

Changing and dynamic national and international food and restaurant regulations/practices

-

The exposed risk to chicken-related diseases like the bird flu can impact the supply and consumption of chicken and lead to losses.