Option strategy: Bear put spread

Bear Put Spread is an options trading strategy which is deployed when a trader’s view is moderately bearish on a stock or an index. The strategy takes advantage of a decline in the price of the underlying asset before the expiration of the contract.

Bear Put Spread setup📊

The strategy includes buying a put option and selling a put option at a lower strike price of the same underlying asset and the same expiry.

Similar to the Bull Call Spread, the Bear Put Spread is also a net debit strategy. Meaning that after paying and receiving the premium for both the put options, the strategy starts with a net payout from the pocket. Simply put, the premium paid will be more than the premium received.

**Jargon alert!**📢

How to deploy the Bear Put Spread?

Buy ATM put option

Sell OTM put option (Lower strike)

*Of the same expiry

Buy ATM put option

Sell OTM put option (Lower strike)

*Of the same expiry

1) Lower strike:

Aka out-of-the-money (OTM) strike. In put options, it is the strike which is lower than the current market price of the stock or an index.

Aka out-of-the-money (OTM) strike. In put options, it is the strike which is lower than the current market price of the stock or an index.

2) ATM strike:

ATM AKA at-the-money strike. It is the strike which is the same or closest to the current price of the stock or an index.

ATM AKA at-the-money strike. It is the strike which is the same or closest to the current price of the stock or an index.

Bear Put Spread example📉

Assume that NIFTY 50 is currently at 17,500. You believe that the index will fall around 300 points or more than 1.5% from its current levels to 17,200 mark in upcoming weeks. Based on this view, this is how this strategy will pan out:

You buy a put option of 17,500 strike by paying a premium of ₹120.

(ATM strike)

Similarly, you sell a put option of 17,200 strike and receive a premium of ₹65.

(This is the lower strike)

Similarly, you sell a put option of 17,200 strike and receive a premium of ₹65.

(This is the lower strike)

- Do note, selection of strikes should be done as per the view and time to expiry.

As we are aware, the Bear Put Spread is a net debit strategy so the premium paid from the pocket to deploy this strategy will be ₹55 (₹120

- ₹65). We arrived at this value by subtracting the premium of the ATM strike price from the premium received from the lower strike price.

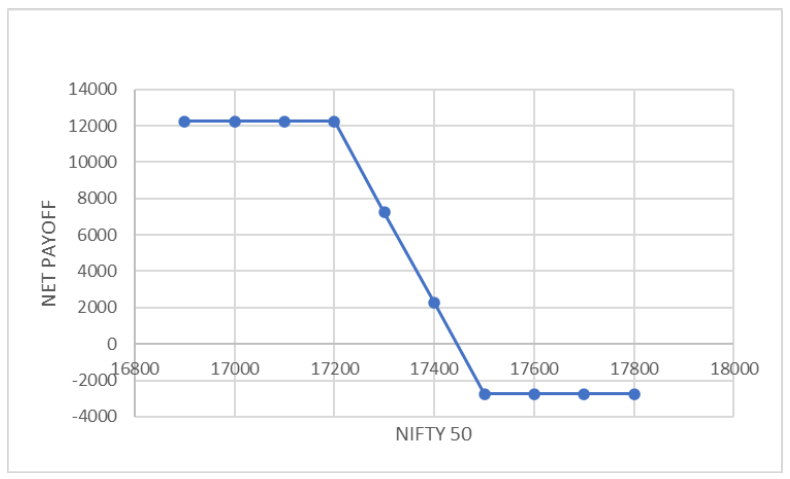

Bear Put Spread payoff diagram

As you can see in the payoff graph above, the Bear Put Spread strategy clearly outlines the risk and reward once the trade is deployed. To understand this better, let’s deep dive into the maximum gain and maximum loss potential of this strategy.

Good to knowBreak even poin t🚦

The point at which strategy makes no profit or loss.

To calculate the break even point of this strategy, subtract the net premium paid from the ATM put option strike i.e 17,500-55=17,445. Simply put, if the NIFTY 50 closes below 17,445 at expiry, the strategy will make profit. In case it closes at 17,445, then the strategy will neither make a profit nor make a loss.

Note: Deploying a Bear Put Spread strategy can give you a higher probability of success if the breakeven is closer to the current market price of the underlying.

- Maximum profit

Maximum profit for this strategy is limited to the width of the spread minus the premium paid. Meaning, to calculate the width of the spread we have to subtract the ATM put option strike from the lower put option strike. Here’s how it works:

a) Width of the spread is 300 points (17,500-17,200)

b) Net premium paid is ₹55.

c) Maximum profit turns out to be ₹245 (300–55), that is ₹12,250 [(245*50 lot size)]. It is to be noted that the lot size of an options contract for the NIFTY 50 index is 50.

b) Net premium paid is ₹55.

c) Maximum profit turns out to be ₹245 (300–55), that is ₹12,250 [(245*50 lot size)]. It is to be noted that the lot size of an options contract for the NIFTY 50 index is 50.

- Maximum loss

As we all know by now, a Bear Put Spread is a net debit strategy, and to enter this trade we paid a net premium of ₹55. So the total risk for this trade is limited to the amount of premium paid from the pocket i.e ₹2,750 [(55*50 lot size)]. It is important to note here that the strategy will make a loss if the NIFTY 50 closes above the breakeven point i.e 17,445 at expiry.

Deploying a Bear Put Spread strategyWhat works in favour

By selling the put option at a lower strike, the risk of the strategy gets capped to a certain extent.

For example, if we buy the 17,500 put option the maximum loss will be ₹6,000 (Net premium paid for ATM strike * lot size= 120*50). However, by deploying a Bear Put Spread strategy the net loss is capped at ₹2,750 which is 54% less in comparison to the naked option buying.

-

By deploying a Bear Put Spread strategy, the breakeven point moves closer to the current market price in comparison to naked option buying. It improves the probability of success and, as mentioned above, reduces the potential loss as compared to buying naked options.

-

The strategy benefits from a gradual rise in implied volatility (IV). Simply put, the strategy is initiated when the IV is low and is expected to rise in the near future.A trader can also select the strikes which can help them in moving the breakeven point closer to the current market price. For example, if you sell a 17,300 put option instead of a 17,200 -you will receive a higher premium. Meaning, the net outflow from the pocket will be lower

-

which will, in turn, bring the breakeven point closer to the underlying.

How? Let’s take a look.

17,300 strike premium received= ₹80 (Lower strike)

17,500 strike premium paid= ₹120 (ATM strike)

Net premium paid=₹40 (120-80)

New breakeven=17,460 (17,500-40)

17,500 strike premium paid= ₹120 (ATM strike)

Net premium paid=₹40 (120-80)

New breakeven=17,460 (17,500-40)

What works against

-

Time decay or Theta will hurt the strategy and will decrease every day until the ATM or buy contract expires. However, since the strategy involves both buy and sell strikes, the impact of time decay on both contracts may offset each other to a certain extent.

-

The margin required to deploy this strategy is slightly higher than buying a naked put option.

-

Profit of the trade gets capped by selling a lower strike put option.

-

The strategy is ideally not initiated when the implied volatility is high and is expected to decline. Meaning, once the trade is initiated, a crush in IV can lead to fall in option premiums.

We hope this strategy was simple and easy to understand. You can try spotting it on the option chain on Upstox and see if you are able to identify levels.

Want a pre-curated Bear Put Spread strategy? Upstox has introduced Ready-made Option Strategies, a safer way to trade in NIFTY 50 and BANK NIFTY options. Click here to know more.