Nifty closes in on 21,000, Adani stocks surge in bull run

-

Strong vehicle registrations in November aided rally in auto and metal shares

-

A correction in US bond yields and easing inflation worries led to increased buying in banking shares

-

The RBI kept the policy rates unchanged for a fifth time in a row in its policy review on Friday, December 8.

-

Combined market cap of Adani group stocks touched ₹15 lakh crore mark for the first time since February 2023.Equities market witnessed FIIs inflow of an estimated ₹17,000 crore.

Hello there, we are here again to recap another exciting week in the stock markets that saw new peaks.

The markets continued the record-breaking run for a second week. This was fuelled by state poll results as well as the outperformance of Adani group shares.

Sensex and Nifty recorded their biggest single-day gains in more than 18 months and a seven-day non-stop winning run in this eventful week. While Sensex breached the 69,000 level for the first time, Nifty was headed to scale a new milestone of 21,000. Broader indices also joined the party with Nifty Banking scaling its new lifetime high. IT shares were also back in demand after easing worries over the US recession.

The Nifty surpassed the 21,000 mark for the first time after hitting 21,006 in the morning trade on Friday, December 8. The Sensex touched a high of 69,893 intraday. While the Nifty closed at 20,969.4, up 0.33%, Sensex closed at 69,825.60, 0.44% higher.

This week, the market witnessed the biggest weekly gain, since July 22, with both benchmark indices gaining nearly 3.5% each.

What stoked the market rally?

It was the BJP’s win in three Hindi heartland states – Rajasthan, Madhya Pradesh and Chhattisgarh – in the assembly polls that triggered buying across the sectors.

Market participants took the BJP's impressive win over the weekend as a sign of policy continuity.

Strong vehicle registrations in November also sparked interest in auto and metal shares. A correction in US bond yields and easing inflation worries stoked buying in banking shares which contributed the most to the market rally.

The RBI kept the policy rates unchanged for a fifth time in a row in its bimonthly monetary policy review. It essentially indicates the bank regulator’s measures to maintain price stability.

The diminishing US recession fears also brought IT shares back on the investors’ radar.

Adani Group stocks rally in a bullish market

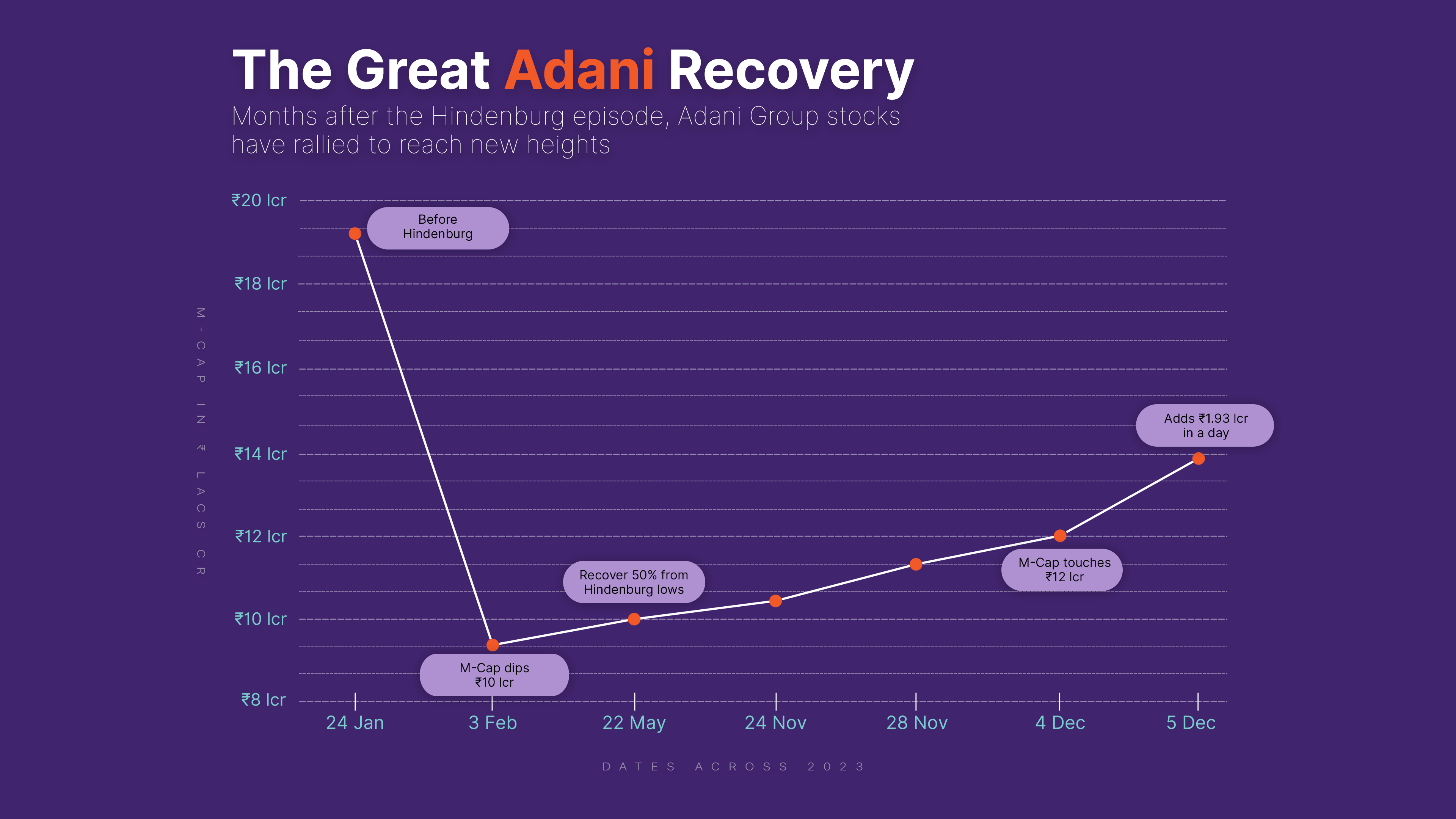

After a boost following the Supreme Court order on the SEBI probe last week, Adani Group shares continued to rally this week driven by a favourable US government agency report. The combined market valuation of Adani Group shares touched the ₹15 lakh crore mark for the first time since February this year. The group shares were beaten after a damning Hindenburg Research report on January 24. The meltdown caused a sharp $100 billion (around (₹8.4 lakh crore) loss in market valuation from a peak of around ₹19 lakh crore before January 24.

Interestingly, Adani Total Gas doubled the investor wealth in the past one month by rising over 113%.

FIIs reverse strategy for Indian markets

A significant boost to Indian markets this week was the return of foreign funds, with FIIs injecting an estimated ₹17,000 crore into the cash segment of the equities market. This influx was supported by both receding inflation and falling yields in both the US and Indian markets, encouraging FIIs to re-enter the market. IT and banking were their favourites picks this week.

Paytm shares

Shares of One97 Communications, the parent entity of digital payment app Paytm, tumbled around 20% this week to hit their lower circuit limit. The stock tanked to more than 7-month low of ₹650.45 on Thursday after Paytm announced plans to reduce small ticket loans amid regulatory changes.

The decision raised fears that the cut down in ‘Buy Now, Pay Later’ (BNPL) loans may impact significantly overall loan distributions through the platform.

What lies ahead

Nifty's ascent towards the 21,000 mark, fuelled by buying in heavyweights, has sparked concerns about overbought Indian markets. While a temporary consolidation may occur due to valuation worries, the RBI's upward revision of the 2023-24 real GDP growth projection is expected to have a positive impact, potentially mitigating the downside risks.