MobiKwik IPO: All you need to know

Founded in 2009, One MobiKwik Systems Limited, popularly known as MobiKwik, is one of the largest fintech companies in India. Headquartered in Gurgaon, India, MobiKwik offers digital wallet (MobiKwik Wallet) and buy now, pay later (MobiKwik Zip) services. The platforms support peer-to-peer payments and digital wallets to bank payments. Presently, the platform has more than 12 crore registered users and over 30 lakh e-commerce, retail and biller partners.

The company is seeing strong growth, especially during the pandemic, which has amplified the demand for contactless and digital payments. In FY20, the net revenue of the company grew 133%. In March 2020, it recorded net revenue of ₹38 crore—the highest ever in a month.

MobiKwik has filed its draft red herring prospectus (DHRP) for its initial public offering (IPO) with the Securities Exchange Board of India (SEBI).

Here is everything you should know about the MobiKwik IPO:

Offer details

-

IPO size: ₹1,900 crore

-

Fresh issue: ₹1,500 crore

-

Offer for sale: ₹400 crore

-

Dates: Not announced

-

Price band: Not announced

-

Lot size: Not announced

The shares will be listed at BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). MobiKwik is targeting a valuation of nearly $1 billion with the IPO.

Investor category-wise break-up

| QIB | NIB | Retail |

| --

| --

- | --

- | --

- |

| 75% | 15% | 10% |

The price band, face value, issue size, market lot, and opening and closing date of the IPO has not been disclosed yet but can launch in September 2021. The lead managers of the stock issue are ICICI Securities, BNP Paribas, IIFL Securities, Credit Suisse Securities India and Jefferies India.

The price band, face value, issue size, market lot, and opening and closing date of the IPO has not been disclosed yet but can launch in September 2021.

Reasons for going public and objective of the IPO

The company is launching the IPO to raise funds and use 40% of the net proceeds from the IPO towards funding its organic growth initiatives. MobiKwik aims to:

-

Acquire customers and merchants to make MobiKwik wallets ubiquitous in India

-

Investment in data sciences to strengthen their platform

-

Deploy advanced technology to improve their existing offerings, including the MobiKwik Wallet, MobiKwik Zip and Zaakpay (the payment gateway by MobiKwik)

-

Leverage machine learning techniques and use lending partners to increase the usage of BNPL in India.

The public issue will also allow existing shareholders to sell part of their stake in the company. The offer for sale comprises shares of seven existing shareholders, including Cisco Systems, Sequoia Capital India, American Express, Bajaj Finance Limited, Tree Line Asia Master Fund, and the company promoters—Bipin Preet Singh and Upasana Taku.

Company fundamentals

Before investing in the IPO, it is advisable to understand the company fundamentals:

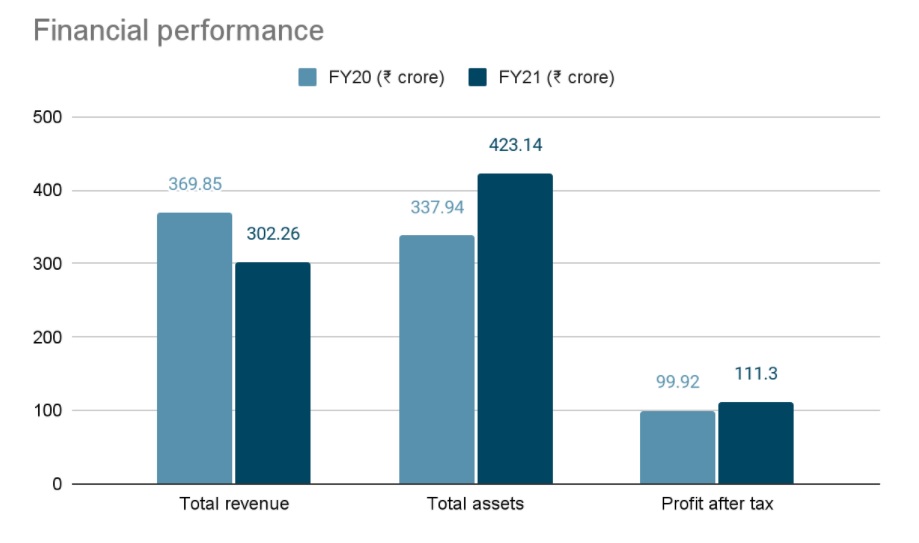

Financials

Overview of business

MobiKwik, a platform that started as a digital wallet, has transformed into a large fintech company. The company has expanded horizontally to include multiple financial services, such as digital payment solutions, EMI payment options, insurance policy covers, small-ticket loans, credit and gold loans. As per reports, the company is also expanding to offer mutual funds and other financial products to retail and institutional investors.

As per the MobiKwik website, the company records over a million transactions each day across digital wallets and services, such as mobile recharge and utility bill payment.

Industry outlook

Even though there are multiple giants in the digital payments space (such as Paytm, PhonePe, and Google Pay), MobiKwik’s competitive advantage is its ability to use data science, machine learning and advanced technology to introduce financial services products and then cross-sell, creating demand for all products.

Strengths

The management at MobiKwik believes the three factors that have led to the rise of the company are:

-

Ability to cross-sell

-

Usage of data science and technology

-

Efficient management of risk

Opportunities

-

The digital payments in India are rising fast, and MobiKwik has been an enabler in the growth of this industry.

-

The consumer payments market in India is still underpenetrated as less than half of Indians pay digitally.

-

The pandemic has led to a surge in digital payment and the digitisation of the consumer economy.

Threats

-

Intense competition in the fintech space from domestic and global tech giants, like Paytm, PhonePe and Google Pay.

-

The risk of market volatility due to inflation can cause an overall economic slowdown.

-

Change in legal and compliance rules for digital payments can impact MobiKwik and other fintech players negatively.

-

The financial needs and net proceeds usage as suggested by MobiKwik have not been assessed by any bank, financial institution, or other independent body.

Risk factors

-

The pandemic can negatively affect the company and its operations.

-

Inability to acquire, retain and expand clients or vendor connections could cause a decline in business and operations.

-

Data breaches, cyberattacks can substantially and negatively affect the brand name.

-

Significant and growing competitiveness in the fintech space.

MobiKwik is expected to benefit from the boom in the fintech industry. However, with its competitors like PayTM also launching its IPO, the competition is about to heat up.