Markets stay resilient, NIFTY IT Index takes a hit

-

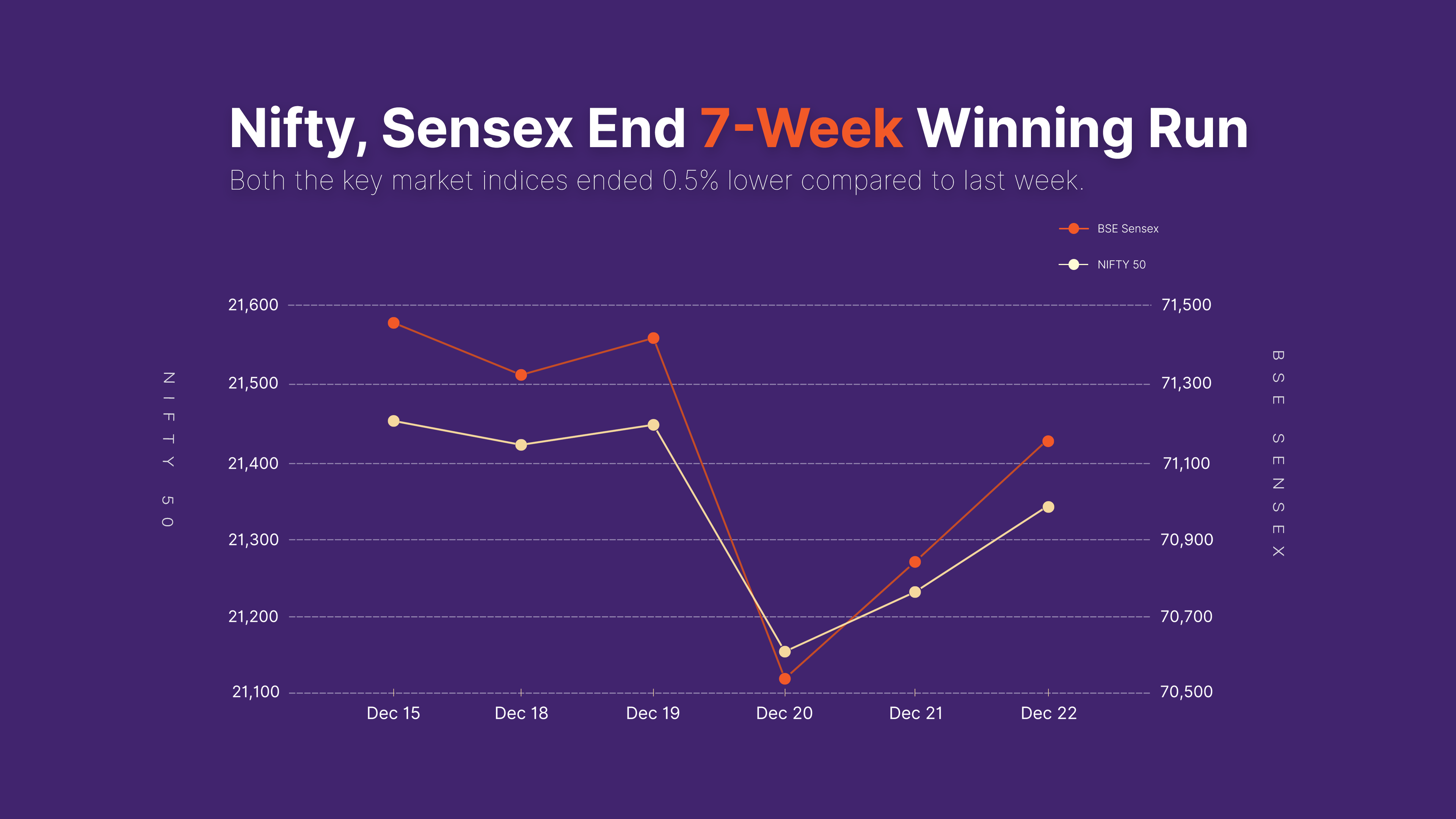

Benchmark indices marginally lower in a week that saw sharp volatility.

-

The NIFTY IT Index lost nearly 2% on December 20.LIC stock rallied almost 5% in the last two sessions of the week.

The holiday season is here and so are we with a recap of the week.

The equity markets, like most of us, were expected to take it easy this Christmas season but key indices remained resilient.

Both the NIFTY50 and the SENSEX closed marginally lower as compared to the previous week, amid volatility.

A blip during the middle of the week triggered fears of consolidation when the Sensex crashed over 900 points in a single session on Wednesday, with no clear reason in sight. Despite the subdued move in key benchmark indices, the mood changed pretty quickly, and the remaining two sessions of the week posted smart recovery.

This was surprising, given the fact that foreign investors have been selling this week and there have been concerns about the new Covid-19 variant. The momentum from the Federal Reserve rate cut expectations was still kicking and helped the markets stay resilient.

IT stocks take a hit

Almost all major sectoral indices moved within a range of 1% from the levels they touched the previous week. The one index that took a bit of a hit was the NIFTY IT Index which lost nearly 2%.

The fall could have been much more though, considering that US-based IT services provider Accenture reported quite a subdued first-quarter performance.

Domestic investors usually take cues from Accenture earnings while setting their expectations from Indian IT companies like Tata Consultancy Services, Infosys or Wipro. Unfortunately, Accenture didn’t paint a rosy picture this time around.

The US-based company, which follows the September-August fiscal, issued one of its weakest revenue growth guidance for the financial year 2024.

For Q1, Accenture reported year-on-year (YoY) growth of 1% near the upper end of -2% to 2% growth guidance range. Accenture also said that it expected the revenue to grow in the range of 2% to 5% in FY24 but saw second-quarter growth in the range of -2% to 2%.

Surprisingly, the weak commentary and poor growth guidance did not significantly impact the stock performance of Indian IT companies. Most of the weekly decline in the shares of IT firms came during the first half of the week before Accenture came out with its results. The second half was more about consolidation despite all the negative market buzz around these stocks.

LIC stock rallies to end on a high

Another major newsmaker this week was the state-run insurer LIC. The stock rallied almost 5% in the last two sessions of the week after the government granted a one-time exemption to the insurer from the 25% minimum public shareholding norm.

LIC was listed on BSE and NSE in May 2022, which means that it had to meet the 25% minimum public shareholding rule by 2027, as per the current guidelines. The company has now received an extension of 10 years and would need to meet the requirement by May 2032. The government currently holds a 96.5% stake in LIC, which only leaves 3.5% with the public.

Interestingly, shares of LIC have jumped almost 18% in December so far, making it one of the best months for the stock.

Adani Group’s green energy push

Adani Green Energy has also been in the news this week after reports emerged that Gautam Adani and his family were planning to invest $1 billion into the renewable arm of the parent group.

The move is reportedly a part of the Adani group’s aim to reach the target of 45 gigawatts of green energy capacity by 2030.

No wonder, the stock jumped over 4% in the last two sessions of the week, though it remained flat on a full-week basis.

DOMS and ISFC IPOs list at premium

The IPO space kept buzzing this week as well. It was fuelled by renewed optimism after the successful listing of DOMS Industries and India Shelter Finance Corporation this week.

DOMS Industries made a strong debut on the exchange, listing at a premium of over 77%. The IPO of the stationery and art products manufacturer was subscribed over 93 times.

Meanwhile, India Shelter Finance Corporation listed at a premium of over 25% at ₹620 per share compared to the issue price of ₹493 per share.

The strong debut made investors rush to the public issues open for subscription. The Happy Forgings IPO was subscribed 82 times, while the RBZ Jewellers offer was subscribed almost 17 times on the final day of bidding.

The week ahead

The coming week would see the listing of stocks like Muthoot Microfin, Motisons Jewellers and Suraj Estate – the IPOs of all of which had garnered huge subscription numbers.

Amid these new listings, the markets would bid a happy goodbye to 2023 – a year that has turned out to be one of the best for equities in recent history. It remains to be seen though how much of this optimism would spill over 2024.

Till then, stay tuned.