What is Margin Trading Facility (MTF)?

When an investor can take a higher value position with only a fraction of the total transaction value, this smaller amount is called a margin. Hence, Margin Trading Facility is when the trader increases their buying capacity of shares and securities by paying only a small amount - the margin. Hence, it is simply a leveraged position in the market. Margin can be in the form of Cash/Collateral as may be decided by the Upstox. The rest of the amount is paid by the broker. A nominal interest rate is charged on this as this acts as a loan.

What are the advantages of Margin Trading Facility?

Some of the key advantages of Margin Trading Facility are:

Brokers provide the liquidity by filling the gap of funds that the investor is unable to put up himself due to the lack of sufficient cash balance. Hence, investors can look at short term price movement opportunities.

It helps you improve the return percentage on the capital deployed. This improvement of ROE is due to trading only in margins, hence, you are paying only 25% of the costs, which means if the price moves up 5%, your ROE gain is 20%.

You will never have to miss out on lucrative purchasing options in equity shares as through MTF, your broker provides you with the required liquidity while you pay only a minimal amount. Hence, you can now capitalise on all your opportunities in the stock market.

The loan that is MTF is used only to appreciate assets like equity and this creates wealth for you in the long run, hence, making the loan also a lucrative option.

How to activate your MTF account?

Activating your MTF account is very simple. This facility can be traded in through your existing trading account. Simply sign the MTF agreement and you may start utilising the balance available in your wallet for MTF purpose. An equity & demat account is a necessity. Read through the agreement as you need to understand the terms and conditions attached to MTF before you avail it, to make sure you understand how it works. You can simply do all of this through your Upstox account.

How does Margin Trading Facility work?

Margin Trading Facility is a special feature that allows you to buy shares worth more than their purchasing capital. How it works is, you put in only a fraction of the amount required. This is called Margin. This can be paid in both cash/existing holdings in your demat account by pledging them as collateral, as may be decided by Upstox. The rest of the amount required is put in by the broker. For example, let us say you have Rs. 1 Lakh. Based on this amount, the broker may let you borrow from him, through MTF an amount of Rs. 2 Lakhs. Hence, you can now buy shares worth Rs. 3 Lakhs. You will have to pay a nominal interest rate on the Rs. 2 Lakh borrowed by you, but you can gain huge advantages in the market as the returns you earn on this amount is higher than what you may earn on Rs. 1 Lakh. All of this is done under the SEBI regulations for the same.

What are the risks involved in Margin Trading Facility?

Some of the risks involved are:

Magnified Losses: Just like the margin amount lets investors magnify the profits, in the case of losses, the losses are also magnified. You may end up losing more than you have invested as the loss calculated will be on the total amount put into buying the shares, which includes your minimum amount plus the amount offered to you by your broker. While borrowing from brokers may be simple, the binding of the borrowed amount is the same as banks.

Minimum Margin Balance: A minimum balance has to be maintained continuously in your trading account at all times. If, due to any reason, this amount falls below the required amount, you will be forced to sell some or all of the assets and securities to maintain the amount. It is a binding amount.

Liquidation: You must follow through the terms and conditions of the agreement signed by you for availing the MTF. Brokers have the right to initiate action against you if you fail to do so. If you fail to meet the minimum margin call, brokers can liquidate your assets to recover the sum.

What is MTF pledge?

One of the most important steps in availing an MTF is completing the pledge request. It is a mandatory process that was introduced by SEBI. Upon buying shares under Margin Trading Facility, you have to pledge all the shares you want to buy to continue to hold the position. This has to compulsorily be done before 9 PM on the same day as availing it. In the case you fail to authorise your pledge, the shares are squared off on the T + 7 day. To pledge, avail and sign the agreement through your trading account. An email / SMS confirmation will be sent to you along with a link that will redirect you to the CDSL website. Enter your PAN / Demat account details here and select the stocks you want to pledge. AN OTP will be sent to you which will help you complete the process.

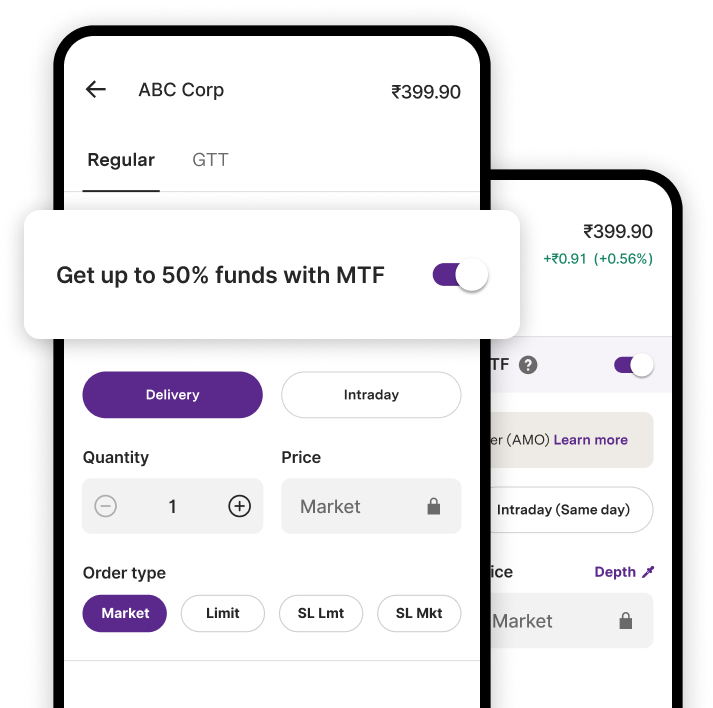

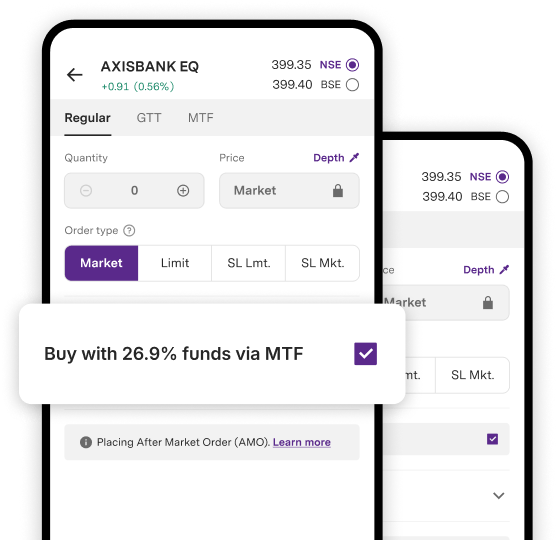

What are the easy steps to avail Margin Trading Facility (MTF)?

To avail this facility, here are some easy steps:

Step 1: Log on to your Upstox account.

Step 2: Select the stock that you want to purchase.

Step 3: Enter the quantity, select product type as margin and click confirm buy.

Step 4: Authorise your MTF pledge request by 9 PM on the same day.

Step 5: Once it is approved, check your email / SMS for all communication. Click on the CDSL link you receive and enter your PAN / Demat account details and that's it! An OTP will be sent to you to complete the process.

How can Margin Trading Facility benefit investors?

Margin Trading Facility can benefit investors by:

It is beneficial for those looking for price movement in the short term but do not have the sufficient cash balance.

It improves the return percentage.

It enhances the buying power of the investors.

It is regulated by SEBI.

Important things to know about MTF

With MTF you can borrow funds from us to buy Stocks and hold them for up to 365 days for a small interest per day.

Limits & Charges:- MTF is applicable only on selected stocks.

- Interest of ₹20/day for every slab of ₹40,000 borrowed will be charged. E.g. If you borrow ₹70,000 via MTF, interest will be ₹40/day (₹20/day for the first slab of ₹40,000 + ₹20/day for the second slab of ₹30,000).

- Brokerage charges of 0.1% or ₹20/order (whichever is lower) will be applicable.

- One-time pledging and un-pledging charges of ₹20/Stock will be applicable.

Repayment Terms:- To repay the borrowed amount, you just need to exit your stocks within 365 days.

- Any incurred profits and losses will be yours.

- If you wish to own the stocks after 365 days, you can convert them into Demat Holdings. To do this, you need to email us and ensure you have sufficient funds in your account to repay the borrowed amount.

- You can also refer to MTF T&C here —Terms and Conditions of Margin Trading Facility.

₹1,50,000

₹1,50,000

STEP

STEP

STEP

STEP

STEP

STEP

STEP

STEP