Latent View Analytics IPO: All you need to know

Latent View Analytics is among the leading pure-play data analytics services companies in India. Its IPO opens for subscription between 10 and 12 November.

Offer detailsIPO Size:₹600 crore

Fresh Issue:₹474 crore O ffer for sale:**₹126 crore P rice band: ₹**190-197 per share L ot size:**76 shares Cost per lot:₹14,972

Fresh Issue:₹474 crore O ffer for sale:**₹126 crore P rice band: ₹**190-197 per share L ot size:**76 shares Cost per lot:₹14,972

IPO TimelineStart Date: 10 Nov 2021

End Date: 12 Nov 2021

Tentative Allotment Date: 17 Nov 2021

Tentative Refund Credit: 18 Nov 2021

**Tentative Share Credit in Demat:**22 Nov 2021

Expected Listing Date: 23 Nov 2021

End Date: 12 Nov 2021

Tentative Allotment Date: 17 Nov 2021

Tentative Refund Credit: 18 Nov 2021

**Tentative Share Credit in Demat:**22 Nov 2021

Expected Listing Date: 23 Nov 2021

Registrar Information (RTA)

Registrar Name – Link Intime India Private Limited

Contact – Kesavan VR

Email

Contact – Kesavan VR

- investorcare@latentview.com

Contact Number - +91 044 4344 1700

Key Highlights

-

Latent View Analytics is primarily engaged in the business of providing data analytics services.

-

Its services primarily range from data and analytics consulting, advanced predictive analytics, data engineering and digital solutions.

-

Incorporated in 2006, the company has over the years expanded its service to clients across the US, Europe, and Asia through subsidiaries in the US, Netherlands, Germany, United Kingdom and Singapore.

-

It is now a trusted partner to several Fortune 500 companies and has worked with more than 30 Fortune 500 companies in the previous three fiscal years.

-

It has 46 active clients from various industries such as technology, consumer packaged goods, retail, etc. Renowned global companies such as Adobe, Uber, 7-Eleven, etc. are some of its clients.

Company Information

Latent View Analytics was incorporated in 2006. It is primarily engaged in data and analytics consulting, advanced predictive analytics, data engineering and digital solutions. The company classifies its business into four areas: Consulting services, Data Engineering, Business Analytics and Digital Solutions. The company has long-lasting relationships with many Fortune 500 companies, handling their digital challenges and analytics.

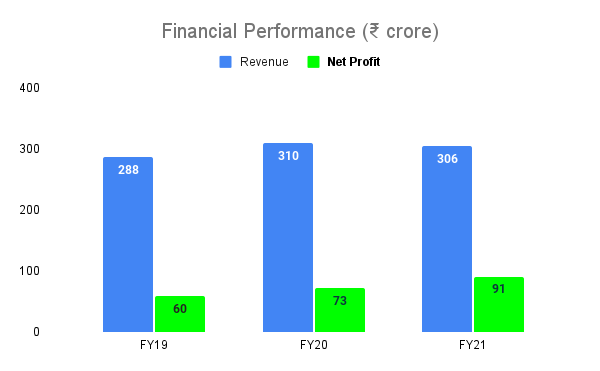

Below is the consolidated financial information of the company for the last three years:

Strengths

-

Provides in-depth expertise across customer analytics, marketing analytics, supply chain solutions, finance and risk analytics and HR analytics

-

Worked with 30 Fortune 500 companies over the last three years indicates marquee clientele

-

Diversified client base across size, industry and geography

-

Strong ties with top 5 clients for an average of 6+ years

-

Strong financial performance with steady profit growth over the last three years.

-

Presence in a variety of industries including BFSI, CPG & Retail, Tech and Industrials indicates client-industry diversification

-

The business model is supported by stable and recurring revenue

Opportunities

-

Covid-19 accelerated the need for digital adoption across industries. As companies invest more in their digital and analytical capabilities, the total investment in digital tech is estimated to double from pre-pandemic levels to $2.4 trillion in 2024.

-

The global Enterprise Data Management (EDM) spending has been forecasted to grow from $64 billion in 2020 to $92 billion by 2024, an approximate CAGR of 10%. EDM is at the core of Latent View’s data analytics endeavours.

-

Exploring new geographies such as Canada and APAC countries.

-

The global predictive analytics market is expected to grow from $46 billion in 2020 to approximately $111 billion in 2024 at a CAGR of 25%.

Risks

-

Concentrated client portfolio – about 54% of revenues came from the top 5 clients in FY21

-

Significant (over 90% in FY21) came from clients located in the US

-

Exchange rate fluctuations could affect financial performance

-

Outstanding tax litigation to the extent of ₹30 lakhs

-

Facing intense competition in key markets

-

Sales cycle is often long and unpredictable