IPO Alert: Krsnaa Diagnostic opens on 4 August 2021

The pandemic may be on the verge of receding, but the importance of healthcare is here to stay. Diagnostic companies, which were at the forefront last year, are likely to see strong growth in the backdrop of this trend. In such a scenario, Krsnaa Diagnostic is hitting the capital markets this week. We bring you all the key details about the IPO.

Key details

-

IPO size: ₹1,213 crore

-

Fresh issue: ₹400 crore

-

Price band: ₹933–₹954 per share

-

Lot size: 15 shares

-

Cost per lot: 14,310

-

Issue opens: 4 August 2021

-

Issue closes: 6 August 2021

-

Basis of allotment date: 11 August 2021

-

Initiation of refunds: 12 August 2021

-

Credit of shares to demat account: 13 August 2021

-

Expected listing date: 17 August 2021

About Krsnaa Diagnostic

Incorporated in 2010, Pune-based Krsnaa Diagnostic provides a range of technology enabled diagnostic services such as imaging (including radiology), clinical laboratory tests, pathology and tele-radiology to public and private hospitals, medical colleges and community health centres across India. These services and tests are used for prediction, early detection, diagnostic screening, confirmation or monitoring of diseases.

The company runs one of India’s largest tele-radiology reporting hubs which is located in Pune. This hub processes large volumes of X-rays, CT and MRI scans, allowing it to serve patients in remote locations where diagnostic facilities are limited. Since its inception, the diagnostic company has catered to 23 million patients.

Krsnaa Diagnostic primarily focuses on the public private partnership (PPP) diagnostic segment, which contributes 67% of the total revenue. It usually enters into long-term PPP agreements which provide predictability of revenue.

The company has opened 1,797 diagnostic centres in partnership with public agencies. Besides this, it is also increasing its collaboration with private healthcare players. This segment currently contributes around 33% of the revenue.

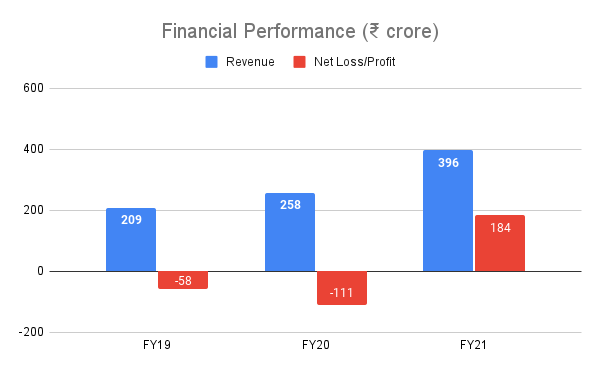

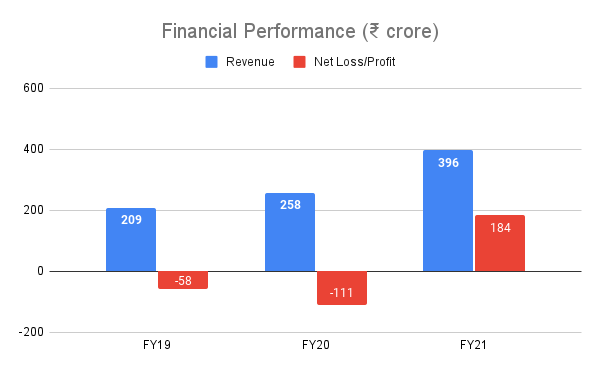

After making losses in FY19 and FY20, the company posted a profit of ₹184 crore in FY21. Meanwhile, between FY19 and FY21, the company’s revenue has grown at a CAGR of 37.5%.

About the issue

The IPO size is ₹1,213 crore. Of this, the fresh issue of ₹400 crore will be used for establishing diagnostics centres at Punjab, Karnataka, Himachal Pradesh and Maharashtra as well as repaying a portion of the debt. The remaining ₹813 crore is an offer for sale.

IPO allocation quota

| QIB | NIB | Retail |

| --

| --

- | --

- | --

- |

| 75% | 15% | 10% |