IPO Alert: CarTrade Tech opens on 9 August 2021

Are you planning to buy a car? You must have surely visited online portals to research about models and finance options. CarTrade Tech operates some of most popular auto marketplaces in India. It is launching its IPO and you can ride along. We bring you all the key details about this latest public issue.

Key details

-

IPO size: ₹2,999 crore

-

Fresh issue: NA

-

Price band: ₹1,585–₹1,618 per share

-

Lot size: 9 shares

-

Cost per lot: ₹14,562

-

Issue opens: 9 August 2021

-

Issue closes: 11 August 2021

-

Basis of allotment date: 17 August 2021

-

Initiation of refunds: 18 August 2021

-

Credit of shares to demat account: 20 August 2021

-

Expected listing date: 23 August 2021

About CarTrade Tech

Incorporated in 2000, CarTrade Tech is a multichannel auto platform, which operates brand names such as CarWale, CarTrade, Shriram Automall, BikeWale, CarTrade Exchange, Adroit Auto and AutoBiz. Through these brands, it connects automobile customers, dealerships, manufacturers and other businesses.

These brands offer a variety of solutions from buying and selling to the financing of new and pre-owned cars, two-wheelers as well as commercial vehicles, farm and construction equipment.

The company’s two platforms—CarWale and BikeWale—are the most popular online auto portals in comparison to their peers. In Q1FY22, these two platforms combined with CarTrade, witnessed on average 27.1 million unique visitors per month, with 88.1% being organic visitors (not arriving via paid marketing channels).

CarTrade Tech has a strong digital focus. It uses new technologies such as machine learning and artificial intelligence to enhance customer experience and drive more traffic onto its platforms.

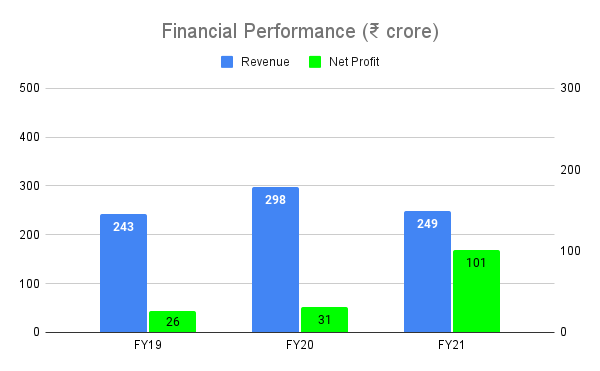

Also, the company has an asset-light model and operates 114 auto malls, a majority of which are rented or leased. Between FY19 and FY21, its net profit has grown at a CAGR of 97.4%.

About the issue

The entire IPO of ₹2,999 crore is an offer for sale. Hence, the company will not receive any of the IPO proceeds. Institutional Investors such as Highdell Investment, Macritchie Investment Pte, CMDB II and Springfield Venture International will be selling a part of their stake.

IPO allocation quota

| QIB | NIB | Retail |

| --

| --

- | --

- | --

- |

| 50% | 15% | 35% |